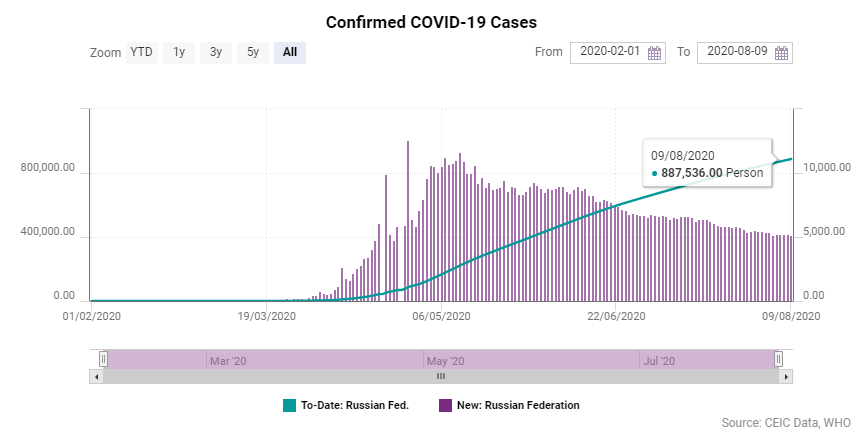

The COVID-19 outbreak reached Russia with a slight delay compared to Europe and Asia. Most countries around the globehad already started testing and reporting positive cases by the end of February 2020 but not Russia.

At the beginning of March 2020 the situation in the country was still under control according to official government declarations. However, things escalated quickly and by the end of March the number of COVID-19 cases was rising at an alarming pace. The crisis got even worse in April as the number of daily new cases in Russia went from a still manageable less than 1,000 to over 12,000 at the end of the month. As of end-July Russia has reported a total of 839,981 COVID-19 cases. The number of COVID-19 deaths exceeded 11,000 between mid-March and mid-July 2020, making Russia the fourth most affected country after the US, Brazil and India.

The city of Moscow has been the most affected by the disease with a total count of 230,029 infected people as of July 13, followed by the Moscow region with 60,688 people and St. Petersburg city with 27.861. Out of the eight main districts in Russia (Central Federal District, Far East Federal District, North Caucasian Federal District, North-Western Federal District, Siberian Federal District, Southern Federal District, Ural Federal District, Volga Region Federal District), the one that has been hit the most is the Central Federal District, which includes both Moscow city and Moscow region.

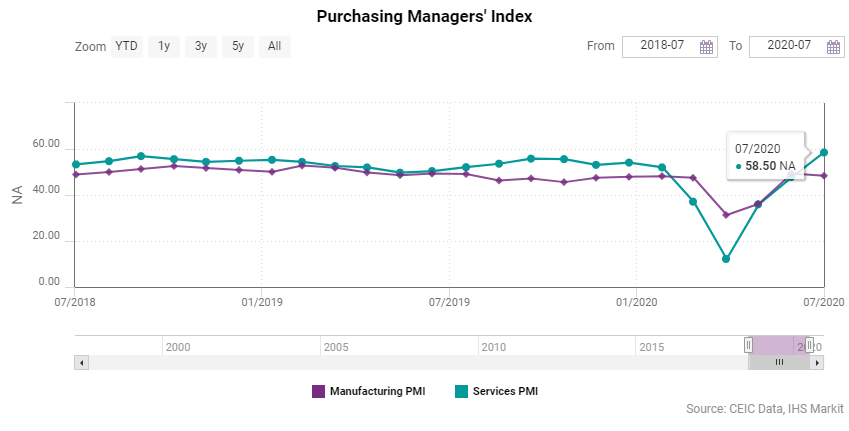

The pandemic is taking its toll on Russia's economy too. The GDP in the first quarter of the year fell to USD 382tn from USD 467.9tn in Q4 2019. According to the Bank of Russia, the GDP is expected to decrease by 4% -6% in 2020 and the recovery from that drop might extend past 2021 and continue in 2022. The economic activity in the country has also dropped considerably. Services and manufacturing were the most affected sectors, as both external and domestic demand for goods and services decreased and businesses activity slowed down. Services PMI fell from 52 in February to 37.1 in March and plummeted further to 12.2 in April. Manufacturing PMI declined from 48.2 in February to 47.5 in March and 31.3 in April. Domestic consumption and retail sales have also been declining since February 2020. The monthly unemployment rate reached an eight-year high of 6.

Healthcare Response

The Russian authorities responded to the COVID-19 outbreak with a number of actions and restrictions imposed on citizens. While the official crisis was declared at a later stage, Russia was fairly quick in creating a special COVID-19 taskforce on January 27. By mid-March, the situation had dictated new rules and on March 18 and 19 the government imposed a nation- wide restriction on all foreign nationals entering the country and declared a state of high alert. All schools went on a three-week long vacation from March 23 until April 12 and on March 27 the country declared a week-long national "work holiday". Public events and gatherings were soon banned, national landmarks, libraries, theaters, recreational centers and night clubs were closed, followed by restaurants, cafes, bars and shops except for grocery stores and pharmacies.

When the number of infected people started growing exponentially, the healthcare system pushed for more tests to ensure accurate monitoring of the situation in the country. The number of tests per day went from barely over 2,000 in March to more than 200,000 in mid-May. In order to combat the spread of the disease, apart from mass testing Russia also relied on isolating patients at designated medical facilities or at their homes, depending on conditions and symptoms. In order to facilitate faster progress, the government allocated a larger budget to the state health insurance fund in Russia, focusing on Moscow where the number of infected people was the highest. The government started providing RUB 200,000 (around USD 2,500) per COVID-19 patient to help hospitals cover care and medications costs.

Fiscal and Monetary Response

Services sector activities, especially the tourism and travel, aviation, sports, culture and recreation segments, heavy machine industries, and oil production and trade bore the brunt of the COVID-19 outbreak. These were also the main focus points for government aid. Even though Russia was more prepared to accommodate the sudden changes around the globe and the unprecedented collapse in the price of oil than other oil-producing countries, the drastic fall in oil demand and prices still had a negative impact on the Russian economy.

In response to that, the Russian government has set a series of fiscal policies to aid the affected industries by means of tax holidays for companies which answer to specific conditions such as strategic importance of the industry the company operates in, reduced earnings of more than 10%, sustained losses due to the COVID-19 crisis and the accompanying restrictions.

The tax relief is to be requested as a more limited aid for a period of three months to one year or tax deferral in periodic instalments which can continue from three to five years, depending on the company and its specific situation. As of April 1, the government has reduced the social security contribution payments of small and medium-sized enterprises (SMEs) for salaries above the minimum wage. If the SMEs operate in a sector or industry more affected by the crisis or have strategic importance to the country, they can also apply for a delay of their income tax payment for business conducted in 2019 and during Q1 2020 for no more than six months. As for any income from business conducted during Q2 2020, the tax delay can be extended to no more than four months. SMEs can delay their social security contributions payments under a scheme similar to that for tax payments. SMEs can also be exempt from paying tax on any subsidies received during the pandemic.

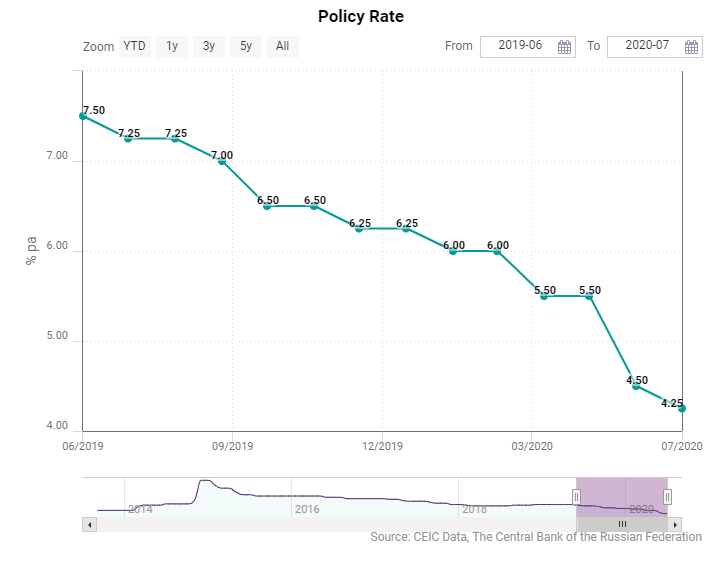

On June 19, as part of the country's response to the COVID-19 crisis, the Bank of Russia cut the key rate by 100 bp to a record low of 4.5% on the back of an expected drop in inflation, whose current target is set at 4%. The rate cut aims to limit risks and keep the inflation rate close to the target one. The central bank does not exclude further rate cuts in case continuous efforts are needed to balance and maintain the inflation rate.

Outlook

According to the latest forecast by the Bank of Russia, as of July 24, the 2020 GDP might contract by between 4.5% and 5.5% which would be an 11-year low. Subsequently, a moderate recovery might follow in 2021 and 2022 with GDP growth of 3.5% -4.5% and 2.5% -3.5%, respectively. A full blown recovery by 2021 is highly unlikely but the economic situation and the low consumer sentiment are expected to slowly improve. Should this scenario play out, household consumption will gradually recover and grow by 3% y / y in 2021.

The economic and fiscal outlook depends mainly on the allocation of resources to mitigate the COVID-19 crisis and address the sudden and unprecedented drop in oil prices worldwide. Currently, the government spending on the containment and management of the COVID-19 situation is expected to reach around 2.8% -2.9% of GDP, which is significantly less than what other countries and regions around the globe have planned on spending. The Euro Area, for instance, will spend between 10% and 20% of its GDP in the form of a fiscal package to manage the crisis. The plummeting international oil prices spell trouble for Russia's federal budget.

The main concerns for the Russian economy come from a prolonged pandemic and inability to manage the crisis. The recent announcement of the Russian government that the Center for Clinical Research on Medications at Sechenov University has developed a COVID-19 vaccine and completed its human trials might make a difference but it is still early for excessive optimism. Even with the rapid speed of medical research and work on the development of a vaccine, it is still possible that an extended crisis could trigger an escalation of already present financial sector weaknesses and cause an even bigger y / y drop in GDP.

Sign in to read the full data analysis on Global Commodity Prices here. Alternatively, download our free, comprehensive, Economic Snapshot Reports here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)