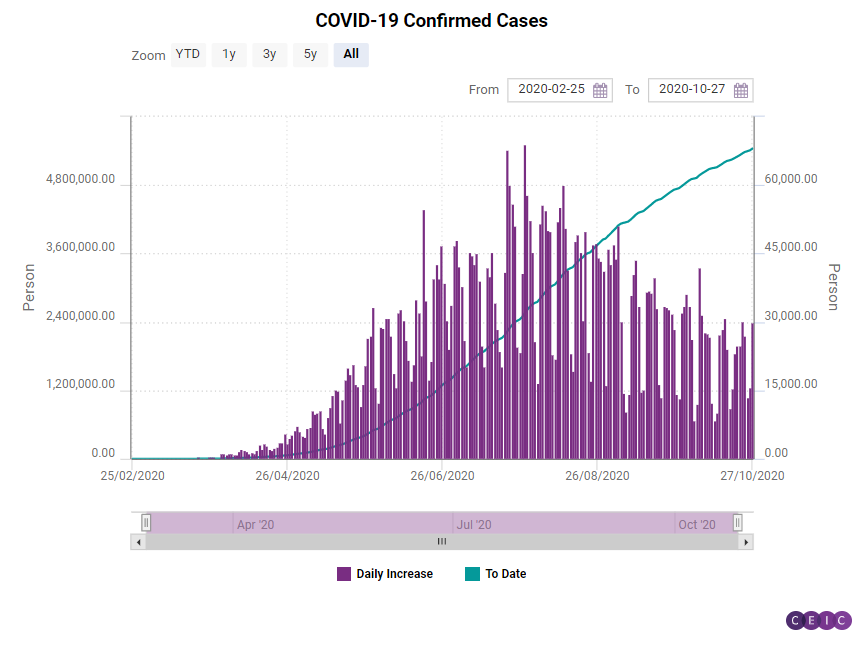

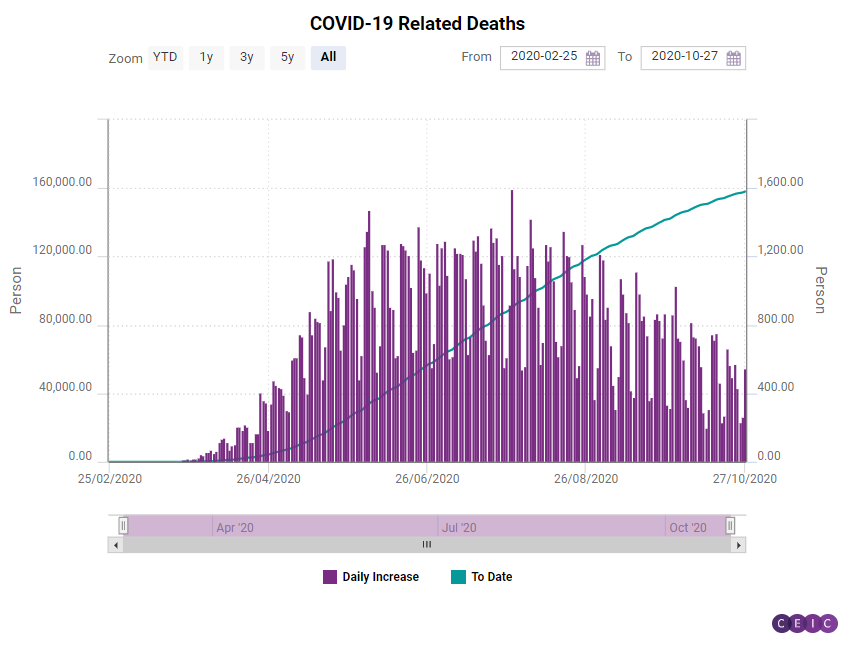

Brazil is among the countries that have suffered the most from the COVID-19 pandemic. As of the beginning of October 2020, the country had the second-highest COVID-19 related death count worldwide with over 150,000 deceased people, preceded only by the U.S.

Brazil now has the third-highest infected count after the U.S. and India with over 5mn cases registered. In response to the crisis the Brazilian local governments have taken multiple measures to address health risks but also to tackle the economic impact of the pandemic. Economic support measures can roughly be split into three main pillars. The first one is focused on providing liquidity support for financial institutions, making sure that they have enough operational resources and ability to respond to the market's liquidity needs. The second involves a capital relief scheme aiming to provide more comfort for financial institutions in Brazil to sustain their credit flow amid a time of crisis by adjusting the general capital requirements. Finally, the third pillar contains all other measures such as providing additional loans to back up real estate purchases.

As a more direct response to the crisis and the accompanying spike in unemployment and decrease in household income, soon after the start of the pandemic, at the end of March, the Brazilian Central Bank announced that it will prepare a financial package worth BRL 1.2tn (USD 233.81 bn) in an effort to keep the financial system in the country stable throughout the COVID-19 pandemic. Around half of the funds were meant to be absorbed by banks in Brazil through loans. The government also started distributing significant amounts of money, currently totalling over USD 7bn, among the general population in an attempt to minimize poverty and inequality.

Unemployment and Poverty

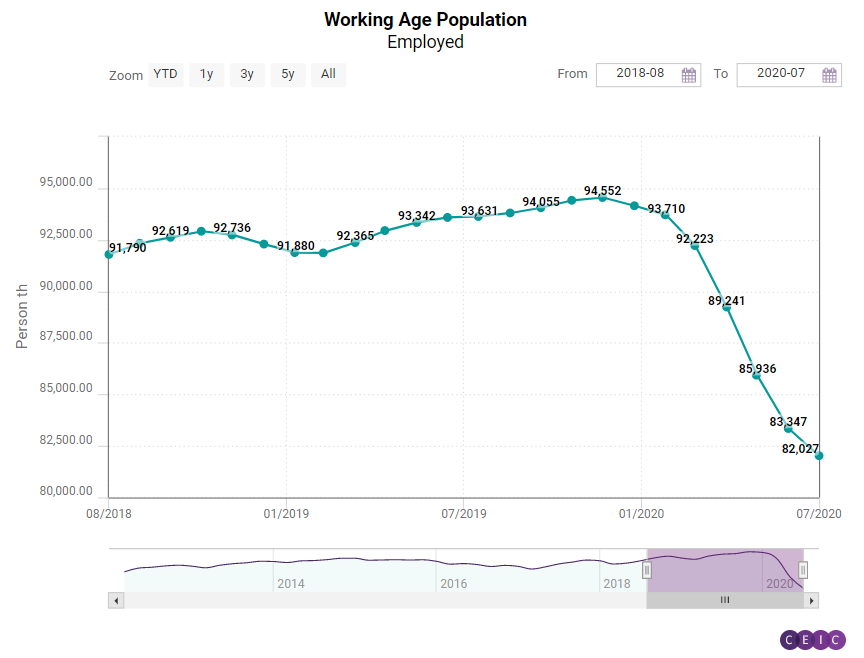

According to the latest data released in late June 2020 by the Brazilian Institute of Geography and Statistics, almost 8mn people in Brazil have lost their jobs and consequently their income due to the COVID-19 crisis since March 2020. The number of employed people in Brazil went down to 82mn in July 2020 from almost 100mn in March 2020. Many people who lost their jobs were previously engaged in the informal sector, mostly working on short- to mid-term temporary working commitments. Among the newly unemployed are also almost 1mn people previously in formal employment.

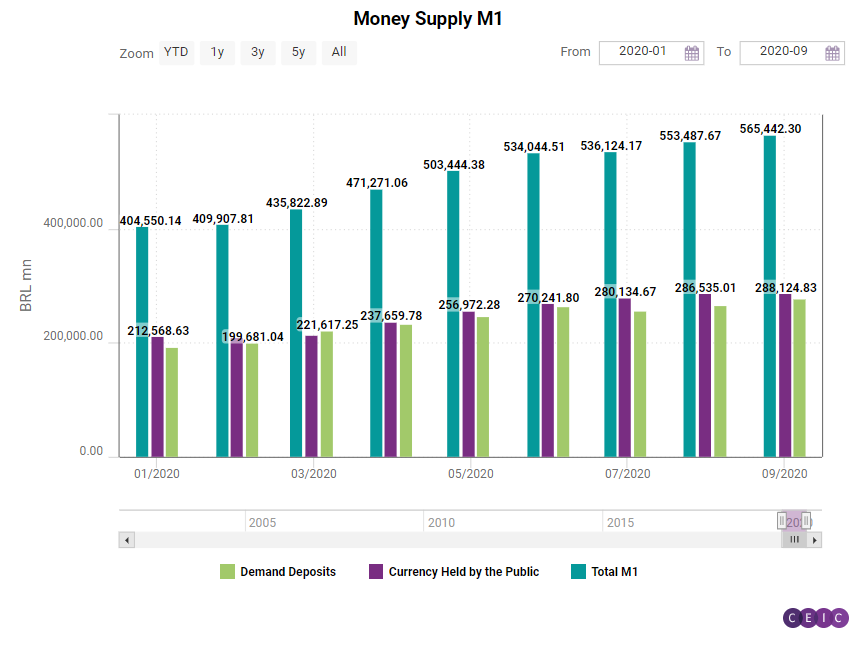

The loss of jobs and income, combined with the ongoing fear of infection has triggered a drastic increase in time and savings deposits. Evidently, people have started to hoard money in preparation for darker times, essentially taking them off circulation and creating a necessity for an increase in the printing of cash to meet the growing demand. At this point, the phenomenon is not an isolated case in Brazil and has been registered in other major economies such as India, Mexico and Russia, which are also witnessing a significant increase in demand for physical currency since the beginning of the crisis. Another big example is the US, where the Federal Reserve, responsible for controlling the money supply, has increased its order for dollar printing by over 1bn notes, currently printing almost 30mn banknotes per day.

Economic Outlook with More Hard Cash

What the Brazilian government soon realized was that this ongoing trend of cash hoarding meant a significant decrease of the money in circulation and a corresponding increase in the demand for cash currency, which could raise serious concerns for the financial stability in the country. Since the beginning of the crisis in March 2020 until the end of July 2020, the total M1 money supply in Brazil had increased from almost BRL 436bn to BRL 536bn, while the currency held by the public grew from BRL 214bn to BRL 280bn. With that in mind, the government had to find a way to quickly introduce new measures in order to mitigate the risk. Thus, in August 2020 the country issued 450mn new banknotes with a denomination of BRL 200.

The most recent data on M1 money supply for August 2020 does not show a significant slowdown of the increase in cash savings by the public. Ultimately, according to the Federal Rural University of Rio de Janeiro, the income transfer programme and the fresh cash injection may have the expected effect in the long run and have an overall positive effect on the economic stability in Brazil. The first signs of recovery are already evident. There has been a significant recovery in the retail sales since the beginning of the crisis. Ever since the dramatic drop of 17.5% y/y in April 2020, retail sales have slowly been recovering. They grew by almost 1% y/y in June and accelerated in July and August to 5% y/y and almost 8% y/y, respectively.

Even with all the positives and the long-term perspective in mind, at the beginning of June, the government was already facing a serious dilemma – whether to continue the financial aid programme, decreasing it in value by half, or to discontinue it altogether. In the end, the decision made by the Ministry of Economy in June was to extend the financial aid programme by another two extra instalments but set payments to BRL 300 instead of the previous BRL 600. Although this cut might slow down the positive effect of the programme, the already accumulated savings are expected to, at some point, get back in circulation as people are will inevitably start spending again once the COVID-19 situation settles down. That in mind, perhaps the initial shock of the decrease of cash in circulation might end up as an opportunity for prosperity after the crisis passes.

Sign in to read the full data analysis here. Alternatively, download the latest, comprehensive analysis of Brazil's economy with the CEIC Brazil Economy in a Snapshot Q3 2020 Report.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)