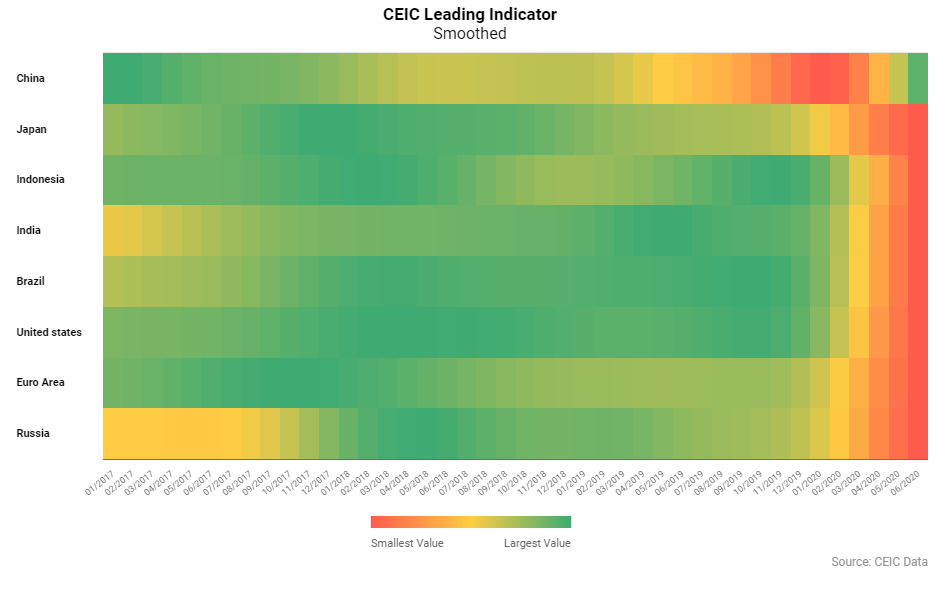

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labor market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions - Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

While the COVID-19 pandemic is far from over, the global economy is starting to adapt to the current conditions according to the CEIC Leading Indicator data for June. All of the eight covered regions registered an uptick, signalling that the business cycle might have turned to acceleration.

The upward trend continued for a fourth month in a row in China, as the non-smoothed indicator reached 111.5, its highest value since March 2017. The rebound among the economies expected to suffer the deepest contractions - Brazil, the Euro Area and the US - has been significant in June and they all passed the value of 70, considerably above the lower bound of 50. Russia and the other Asian economies covered by the CEIC Leading Indicator also performed strongly, with Indonesia, the only country on a continuous downward path since the start of pandemic, accelerating for the first time since the end of 2019.

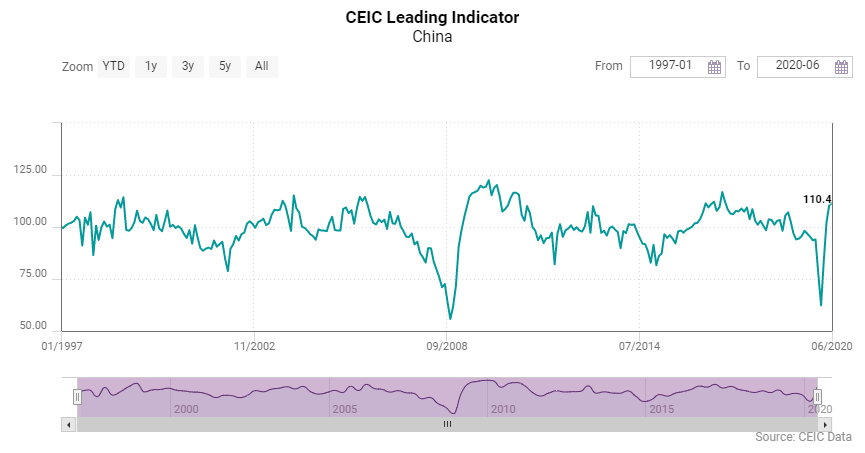

China: Slight Moderation but Still Strong Growth

Among the major economies China was the first to be severely hit by the COVID-19 outbreak and also the first to recover. Since the trough in February 2020, when the CEIC Leading Indicator fell to 62.3 the lowest value since the 2008-2009 financial crisis, the indicator has been growing continuously and in June the figure reached 111.5, the highest reading since March 2017. Nevertheless, there has been a considerable moderation of the growth pace as lower base effects from the poor performance in January and February, when the COVID-19 hit China the hardest, are starting to fade. As a result, the CEIC Leading Indicator grew by a mere 1.1 points m/m in June, compared to a growth of 8.2 points m/m in May and 20 points m m in April.

Automobile production in China continues its rebound, growing by 17.9% y/y in June and moving closer to pre-pandemic levels. Money supply M2 has also been increasing consistently in the past three months, at a steady pace of 11.1% y/y each month, according to People's Bank of China data. Floor space sold in China grew more modestly, by 2.1% y/y compared to a strong 9.7% y/y in the previous month, and its aggregate performance in H1 2020 is still below the same period of 2019. NBS 'manufacturing PMI reached 50.9% in June, staying above the 50% neutral value for four months in a row, displaying the returning confidence in China's manufacturing sector.

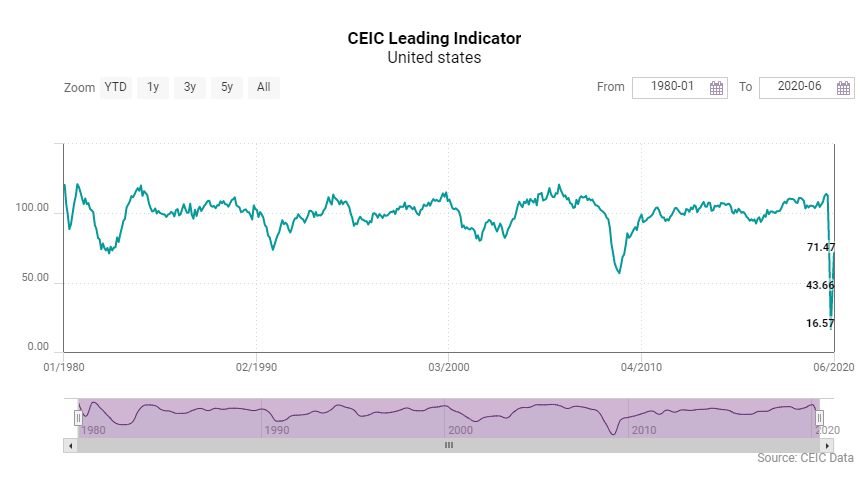

US, Euro Area and Brazil: Picking Up the Pace

While the May rebound in the performance of the CEIC Leading Indicator for the US, the Euro Area and Brazil was very moderate, June data revealed a much stronger revival.

The solidly performing US CEIC Leading Indicator dropped significantly in the months of March and April 2020 when the COVID-19 pandemic started to take its toll. The April value of 16.6 remains the lowest on record. What followed in May was a recovery of the stock market, improving labor market indicators and a weak revival in the housing and automotive markets. June data revealed that the housing market is approaching its pre-crisis levels, consumer confidence is improving and the purchasing managers' index jumped to its highest value since April 2019. The automotive sector is still recovering rather slowly, similar to the labor market.

The CEIC Leading Indicator for the Euro Area suffered very much like the US one since the start of the pandemic, albeit to a lesser degree. The outbreak of the COVID-19 pandemic and the surge in the number of confirmed cases and deaths in the Western European countries, followed by a large-scale lockdown, caused a decline of the CEIC Leading Indicator to 87.3 in March and 40.6 in April, but in May it strengthened to 58.7, supported by an improvement in the labor market, rising economic sentiment and strong performance of the stock markets. The same economic fundamentals played a role in the further rise of the indicator in June, as it reached 76.5, a rebound of almost 20 points m/m.

The CEIC Leading Indicator for Brazil soared to 76.43 in June, after registering a record low of 28.75 in April and a modest uptick of 39.05 in May. Despite the improvement, the value is still lower than the neutral point of 100, which means that the country's economy is expected to operate below the long term trend in the coming 6 to 9 months. The positive performance in June was supported by some key variables. Motor vehicle sales jumped to 135,130 units in June, compared to 56,266 in May, as many factories resumed operations in the period. The manufacturing sector had better prospects in June, revealed by a partial rebound of the industry's confidence indicator. In construction, expectations to purchase raw materials approached the neutral value of 50 points in June, rising to 44.2, compared to 35.3 in May. The equity market index reached 95.

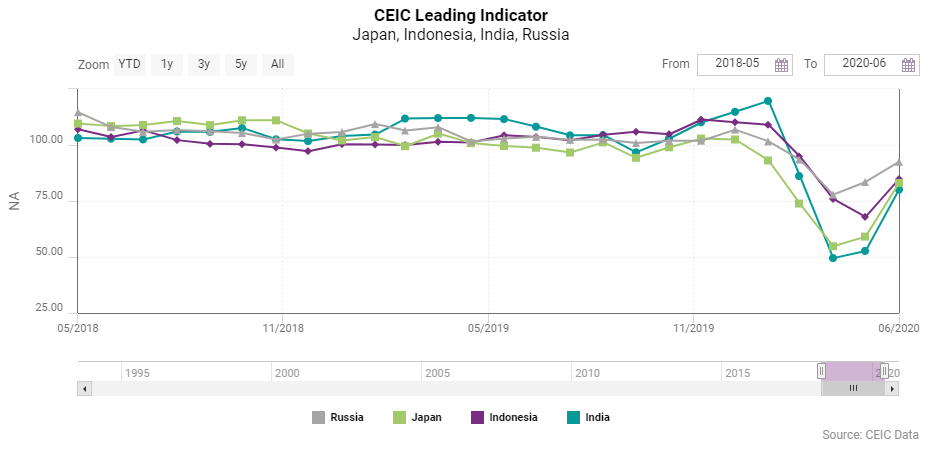

Japan, India, Indonesia and Russia: Still on the Right Path

Russia and the three Asian economies covered by the CEIC Leading Indicator showed more resilience to the COVID-19 crisis in the early months of the pandemic, and June data continues to suggest that this group is still on the right path to recovery. Japan was among the earliest impacted economies by the COVID-19 pandemic as the CEIC Leading Indicator for this country decreased to 93.1 in February and in the following two months the indicator deteriorated further to reach a trough of 54.8 in April. As with the Western Economies, stock market performance and improving business and consumer sentiment managed to support the Japanese economy in May and the CEIC Leading Indicator recorded its first uptick since the end of 2019, to 59.1. The same factors played a role in the strong rebound of the indicator in June, as it jumped by 24 points m/m to 83.1.

After a substantial decline for two consecutive months in March and April 2020, India's CEIC Leading Indicator went up to 52.7 in May and improved further to 80.1 in June. This development implies a steady revival of economic activity, which is also synchronous with the easing of the harsh lockdown measures. The positive performance can be attributed to an increase in consumption and industrial activity, mapped by vehicle sales, electricity generation, and steel production. The decline in automobile sales was less severe in June, at 57.7% y/y compared to 90.3% in May. Electricity generation and steel production also slowed down their drop in June, declining by 27.2% y/y and 11.8% y/y, respectively. Money supply (M2) remained on an upward trend as economic activity increased. Wholesale food inflation, which had been decreasing since January 2020.

Indonesia was the only region covered by the CEIC Leading Indicator which did not experience a rebound in May but generally the Indonesian economy appeared to be less severely affected by the COVID-19 pandemic since the beginning of the crisis. The May performance of the CEIC Leading Indicator, when it reached its lowest value since the 2008-2009 financial crisis at 67.9, was driven by a decline in exports, cement consumption, vehicle sales and continuously low palm oil prices. A rebound to 84.8 was observed in June, as a result of an increase in palm oil price, rising non-oil exports and a more competitive rupiah.

According to the CEIC Leading Indicator for Russia, the country's economy also managed to sustain an acceptable pace in the early months of 2020, despite the double hit of the oil price war with Saudi Arabia and the large amount of COVID-19 cases. The non-smoothed indicator fell below the long term trend of 100 in March, and saw its poorest performance in April, at 77.8. In May the indicator started picking up again, reaching 83.5 and in June it returned to a value close to March, at 92.5. Rising crude oil prices supported the critically important oil sector of Russia, while manufacturing production tendencies improved dramatically. Sales of new vehicles were also accelerating at a faster pace than among most global economies.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register her

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)