The Chinese economy is facing perhaps the most challenging year since the start of the pandemic.

Back in 2020 when COVID first hit, China rebounded quickly and became the only major economy to record positive GDP growth. In 2021, the recovery maintained its strong momentum with GDP expanding by 8.1% y/y. But the unexpected threat to China’s growth prospects turned out to be the Omicron variant. In early March, when the government set the 5.5% growth target for this year, no one expected China's major cities Shenzhen, Shanghai and Beijing to go through full-scale or partial lockdowns in the following months.

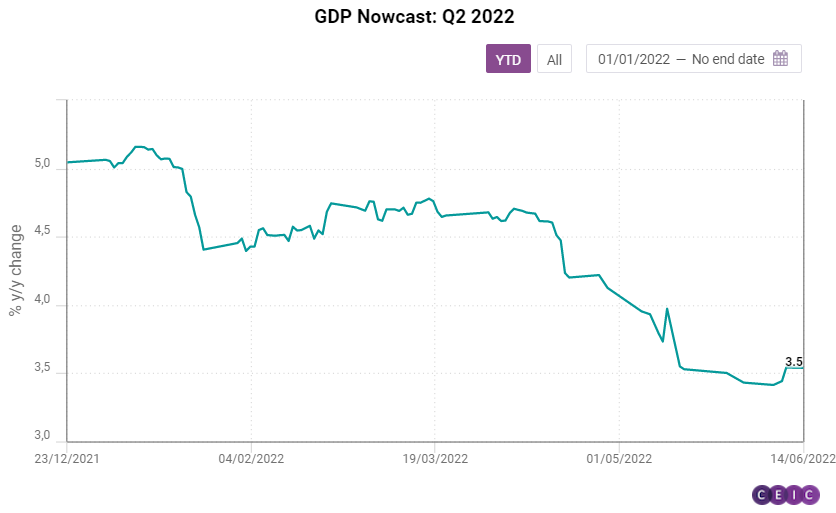

In fact, we at CEIC, have been cutting the GDP Nowcast for Q2 and Q3 very frequently in the past two months. In our model, we have selected 23 monthly economic performance indicators. On March, 14 out of the 23 indicators performed below our expectations, reducing the GDP Nowcast for Q2 by 0.48 pp. In April, the slowdown of the economy became more prominent. Seventeen out of the 23 indicators did not reach our projected value, thus dragging down the GDP Nowcast by as much as 1.04 pp. As of June 7, we estimate that China's economy will only grow by 3.41% y/y in the second quarter, which obviously is far below the 5.5% growth target for the whole year.

In the past, China has always managed to achieve its growth target. We believe that this will continue to be the case for this year. But how? Sluggish domestic consumption and slowing down export growth cannot be relied on. Investment, especially infrastructure investment, once again comes to the spotlight. Back in 2020, when the economy was first hit, investment's share in GDP growth reached as high as 81.5%. In 2021, the share sharply decreased to 13.7%. We expect investment's share in GDP growth to surge again this year and even exceed 81.5%.

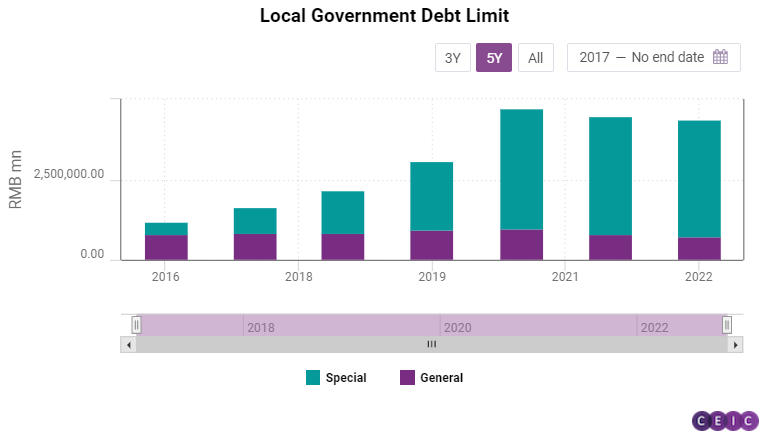

Talking about infrastructure investment, the most important source of funding is local government bond issuance, especially the local government special bonds (LGSB). This insight aims to introduce the scale, process, and directions of this year's issuance as well as to break down provincial data to better understand regional discrepancies.

LGSB is a relatively new concept. It first appeared in 2015 with an annual quota of only RMB 100bn. The scale of LGSB quickly exploded and surpassed that of the general bond. In 2018, the quota of LGSB reached RMB 1.35tn, surpassing RMB 1tn for the first time. It then reached its peak of RMB 3.75tn in 2020. In both 2021 and this year, the quota is RMB 3.65tn. As a comparison, the quota of this year's local government general bond stands only at RMB 720bn, accounting for only 16.5% of the whole new local government bond issuance. Since the repayment of the general bonds relies on the general fiscal revenue of the local governments, this trend also implies that local governments face increasing fiscal constraints.

The most prominent feature of this year's LGSB issuance is its accelerated pace. From January to April, China issued RMB 1.4tn in LGSB, up by 130% y/y and accounting for nearly 40% of the annual quota. In stark contrast, at the end of April 2021, the LGSB issuance only amounted to 6% of the whole year's quota and it was only at the end of July that the issuance reached 37% of the quota. Even in 2020, when China also struggled with downward pressure on the economy, from January to April LGSB issuance made up only 30% of the annual quota, much less than the 40% of this year. As per the government's most recent request, the LGSB issuance will further accelerate in May and June 2022, hitting RMB 1tn each month on average. This accelerated pace is the best evidence of the government's resolution to boost the economy through massive investment.

With the much-accelerated issuance pace, it is important to examine where the funding goes in order to have a better understanding of the priorities of the stimulus. As we mentioned before, LGSB has become one of the most important sources of infrastructure building in China in recent years. In fact, a breakdown of the funding shows that in April nearly 60% went to infrastructure projects including transportation infrastructure, municipal construction and industrial park infrastructure, and government subsidized housing projects. Among them, municipal construction and industrial park infrastructure attracted the most funds, accounting for 26.7% of the whole, followed by 18% for transportation infrastructure and 14.3% for government subsidized housing. If we use the above 60% to estimate the whole year's funding allocations, roughly RMB 2.6tn in local government bond funding will be directed to infrastructure projects.

Two trends are likely to emerge. The first one is more investment in new infrastructure and new energy projects, as mentioned in the newly released 33 government stimulus measures. In the past year, the percentage of funding that went to the energy and urban and rural cold chain logistics infrastructure was between 0%-2% in every month, an insignificant share compared with other infrastructure projects. We are expecting this share to grow in 2022. Second, as the commercial real estate market continues to experience hardships, we believe the government will speed up investment in government subsidized housing projects so as to mitigate the real estate sector's drag down effect on the economy.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about our CEIC China Premium Database -the premier source for everything you need to know about the Chinese economy, housing an unprecedented wealth of information revealing the drivers of the market.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)