Investment has long been the main driver of economic growth in China.

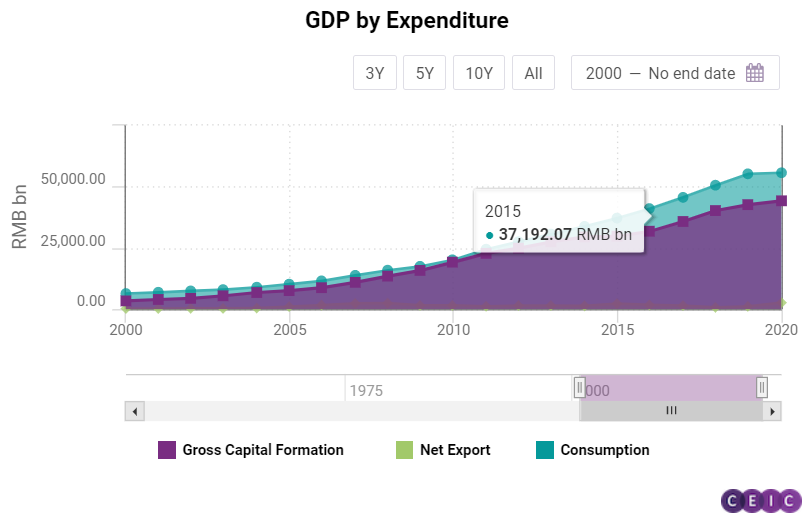

Based on the expenditure method of GDP accounting, gross capital formation has constantly accounted for more than 40% of the total GDP since 2000 and peaked at 47% in 2010 and 2011, right after the 2007-2008 financial crisis. Back then, the Chinese government put forward an RMB 4tn stimulus package to pull the economy out of the recession and it was invested mostly in infrastructure and social welfare, which had far-reaching consequences for the structure of the Chinese economy. Later on, as the supply-side reform and the crackdown on the shadow banking sector phased in, the share of gross capital formation declined to around 43% and consumption gradually picked up.

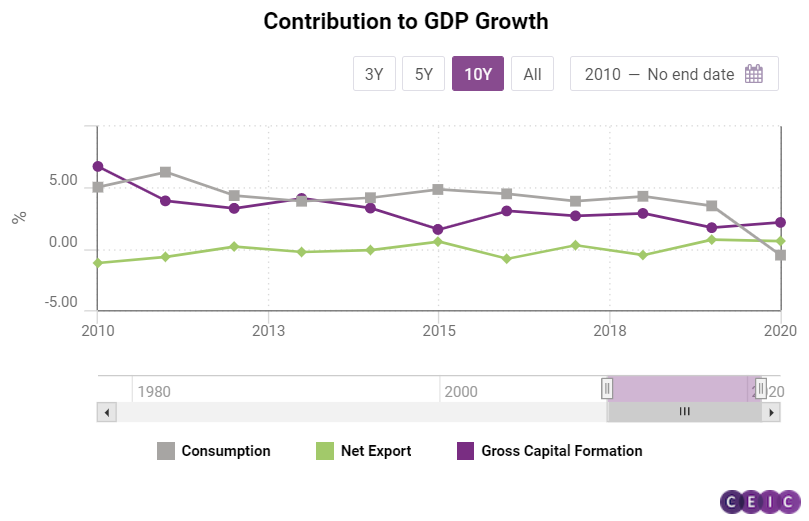

Much like the fiscal policy, investment growth, especially government-led investment growth, is counter-cyclical and aims to stabilize the economy when consumption or exports are depressed. For instance, in 2020 when the pandemic hit the global economy, the contribution of gross capital formation to GDP growth ticked up to 2.16% from 1.73% in 2019 while those of final consumption expenditure and net exports both shrank. As the Chinese economy grows, however, the incremental capital-output ratio, which is the marginal amount of investment capital necessary to generate the next unit of production, has also risen steadily due to decreasing returns to scale.

As such, it is increasingly costly for China to shore up its economy using investment, especially considering its huge side effects. China's recently announced dual circulation strategy is focused on the supply side. It will entail heavy investment in the so-called "new infrastructure" involving several key fields, such as 5G, internet of things, industrial internet, cloud computing, blockchain, data centres, smart computing centres, and smart transportation. Similar to the traditional infrastructure investment, it will boost long-term productivity without incurring problems like overcapacity.

Manufacturing Investment

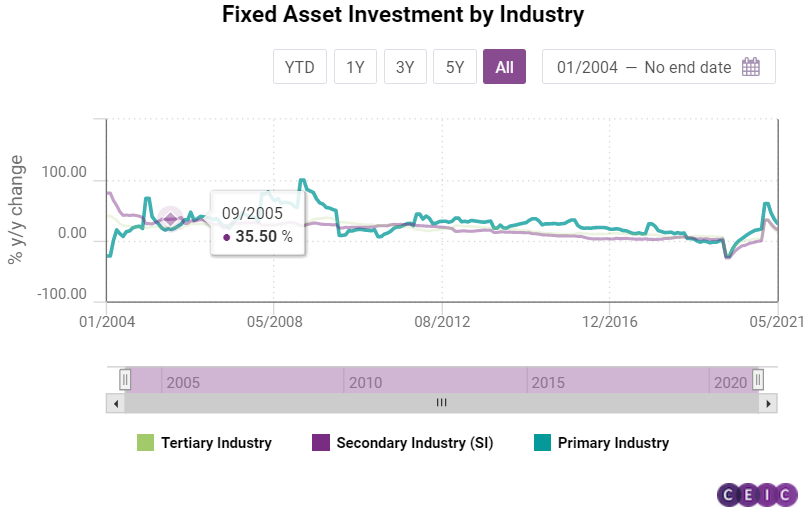

In the first four months of 2021, China’s fixed-asset investment (excluding rural households) continued to recover steadily, with a y/y increase of 19.9%. On a two-year average basis, it increased by 3.9%, accelerating from the 2.9% growth in January-March. The m/m growth in April 2021 was 1.49% and it was the lowest in the first four months of the year.

From January to April 2021 investment in the primary industry increased by 35.5% y/y. The two-year average growth rate was 15.2%, an increase of 0.4 pp from that in the first quarter. Investment in the secondary industry increased by 21.7% y/y, with an average two-year growth rate of 0.8%, a significant improvement from a contraction of 0.3% in the first quarter. Of it, manufacturing investment increased by 23.8% y/y. Its two-year average growth rate was still in negative territory, but the rate of decline has narrowed significantly and the manufacturing investment was close to the level of the same period in 2019. Within the sector, investment by raw material manufacturers increased by 29.8%. The surging prices of a wide range of raw materials thanks to the economic recovery worldwide have pushed up manufacturers' profit margins, leading to large-scale capital expenditure.

The profit of chemical fibre manufacturers in the first four months of 2021 increased sixfold y/y according to a recent survey of above-scale industrial enterprises nationwide. Likewise, ferrous and nonferrous metal-related manufacturers also saw their profits soaring by over 400%. Against this backdrop, investment in the smelting and rolling of ferrous metals, and in chemical goods manufacturing increased by 51.6% and 35.5%, respectively. Equipment manufacturing and consumer goods manufacturing also saw growth rates of above 20%.

However, a caveat is that the increase in profits is not evenly distributed among industrial enterprises as the upstream sector has taken most of them while the midstream and the downstream sectors suffer from rising costs although the rise in raw material prices has already slowly transmitted to the final consumption goods.

This is partly because of the more fierce competition in the downstream sector. The other critical factor is that many below-scale enterprises simply do not have the bargaining power to slash the cost. Thus, raw material manufacturers make higher profits and spend more on capital expenditure, while the profit margins of smaller downstream enterprises are seriously squeezed and their investment growth is still sluggish.

On another note, the pickup in manufacturing investment, apart from domestic factors, benefited heavily from the strong external demand. As one of the major textile and apparel exporters in the world, India is still reeling from the deadly second wave of the pandemic, forcing its textile industry to completely shut down or work at half capacity. Overseas orders thus have been transferred to Chinese manufacturers, leading to a 22% investment growth in the first four months of 2021.

This trend, however, is not likely to continue for a long time as production capacities in other countries slowly return to normal. The global economy is on track to a slow recovery and the demand for capital goods, including equipment and machinery, will continue to be steady. Due to the high base effect in the second half of 2020, the export sector is not likely to keep its momentum in the long run, therefore manufacturing investment stimulated by exports is likely to slow down.

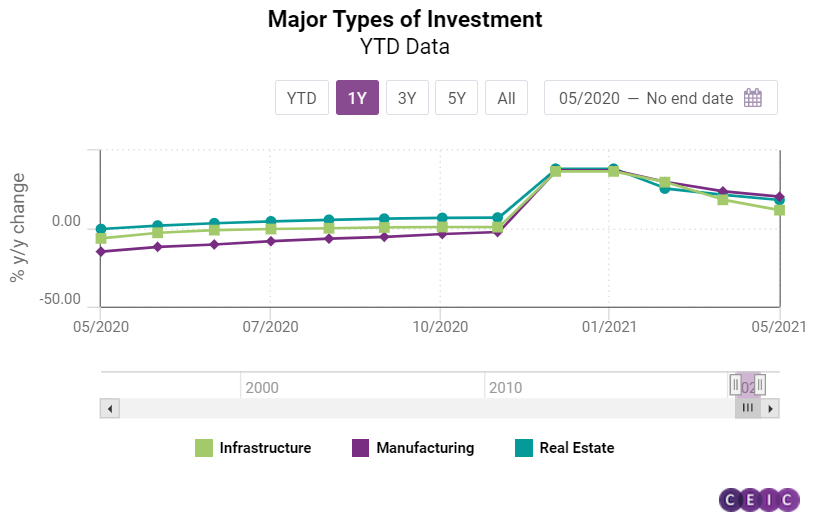

Property Investment

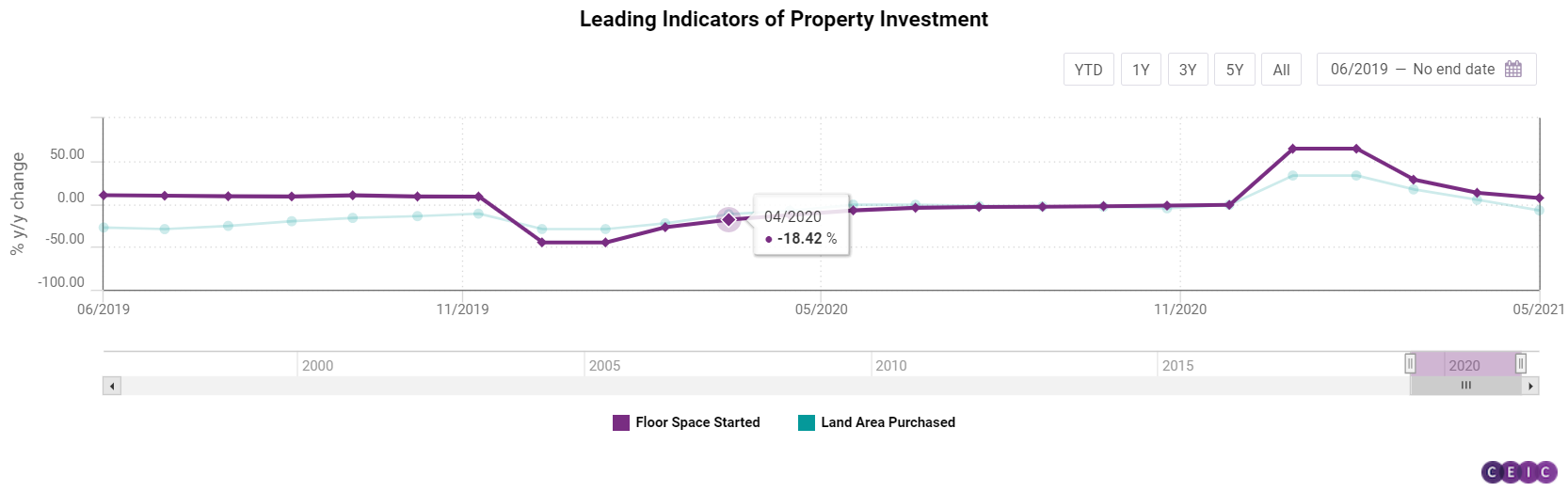

Property investment remained resilient during the pandemic. After a moderate decline in the first quarter of 2020, it recorded an annual growth of 7% as the benchmark five-year loan prime rate dropped from 4.8% as of end-2019 to 4.65% in April 2020 and has remained flat ever since. In comparison, in 2020, manufacturing investment contracted by 2.2% and infrastructure investment growth was merely 0.9%. From 2018 onwards, the driver of investment growth has actually changed from infrastructure investment to real estate investment.

Guoshuqing, the chairman of the China Banking and Insurance Regulatory Commission (CBIRC) said in 2020 that the property market was China's largest "grey rhino", referring to its financial risks. Under the principle that housing is for living in, not for speculation, and that the property sector should not be used as a short-term stimulus to prop up the economy, the financial regulators have taken a tighter grip on the property sector.

The liability asset ratio of the real estate sector has gradually inched down. The share of newly increased bank loans to the real estate sector has also seen a steady drop from nearly 50% at its peak in 2016 to around 20% in 2020 while the sector still accounts for almost one-third of outstanding bank loans. In August 2020, China put in place new rules in real estate financing in a bid to limit debt levels, outlining caps for debt-to-cash, debt-to-assets, and debt-to-equity ratios for property developers. Specifically, the ratios of liability to asset and net debt to equity are not allowed to surpass 70% and 100%, respectively.

Sign in to access all datasets for this insight piece here. Alternatively, you can learn more about the CEIC China Premium Database - the premier source for everything you need to know about the Chinese economy, housing an unprecedented wealth of information revealing the drivers of this market.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)