The Chinese economy faced external headwinds and weaker business confidence in Q2 2019.

Real GDP growth slowed down to 6.2% y/y, driven by policy shifting from high-speed to high-quality growth and an increasingly uncertain external environment.

The US trade conflict

The trade conflict with the US escalated since its start in spring 2018, and the outlook for the global economy in 2019 is weaker than in 2018. Two rounds of the US tariffs and counter-tariffs were implemented before negotiations began at the end of 2018. However, the negotiations fell through in the middle of Q2 2019 and triggered another round of tariff increases.

At the end of June presidents Xi and Trump agreed to restart the talks. The turbulent trading environment had a negative impact on net exports, which contributed 1.2% y/y to real GDP growth in Q1, slipping from 1.5% y/y in Q1.

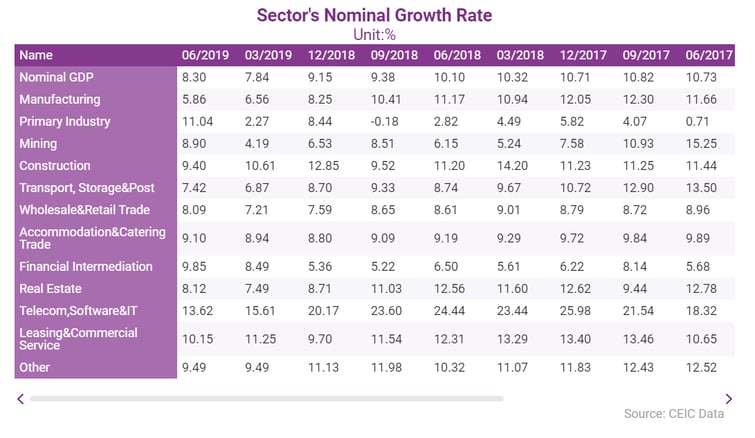

Nominal GDP growth and China's manufacturing

Nominal GDP growth in Q2 2019 accelerated to 8.3% y/y from 7.84% y/y in Q1, driven by slightly rising producer prices and significantly climbing food prices. Mining, primary industry, and most of the sub-sectors in the tertiary industry experienced higher nominal growth than in Q1. However, the manufacturing and construction sectors’ nominal growth decelerated compared to Q1.

Based on the Purchasing Manager Index (PMI) , business activities were mixed in Q2 2019. PMI indicated that the non-manufacturing sector continued to expand, while the manufacturing sector experienced a contraction. The underlying segments of PMI indicators tell an identical story. New orders, material inventory and employment all plunged deeper into negative territory compared to Q1.

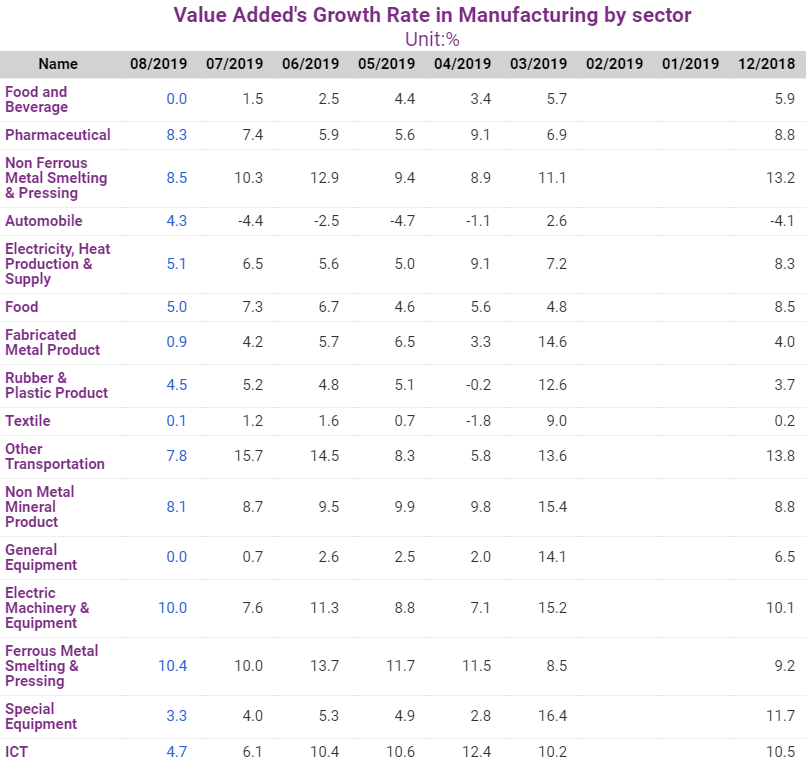

Industrial production’s real growth rate declined from 8.5% y/y in Q1 to 5.6% y/y in Q2.

Nominal retail sales growth recovered to 8.4% in June 2019.

Sector's nominal growth rate

In Q2 2019, the consumer confidence index stood at 125.9 points, up by 1.8 points from 124.1 in Q1. The monthly index suggested that confidence bounced back in June, in spite of the rising tension between China and the US, which eroded consumer confidence in May.

FAI growth rate stayed around 6% y/y in Q2 2019. The growth rate was in line with the long-term downward trend since 2009. Private FAI growth rate was about 5.3% y/y, lower than the state FAI growth rate of 7.3% y/y, since the trade tensions between China and the US and the stagnating reforms in state-owned enterprises clouded business confidence in private investment. . The monthly data showed a pronounced drop in May, following the strong trade headwinds.

The real estate investment’s growth rates in April, May and June were 11.9%, 11.2% and 10.9%, respectively. The optimistic outlook in real estate investment could be explained by the lower inventory and the expectations for another run of housing sector incentives by the authorities. However, during its meeting on July 2019, the Politburo confirmed that China would not use investments in real estate and stimulate households to buy residential property as a short-term remedy to support economic growth. Under the guidelines issued during the July meeting, real estate investment’s growth rate might decelerate, and property prices might hit a plateau in the next quarter.

Access our Q3 report suite, including the full CEIC China Economy in a Snapshot Q3 2019 Report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)