The launch of the Belt and Road Initiative (BRI) by the Chinese Government in 2013 has awaken the global movement, especially in countries along the silk routes.

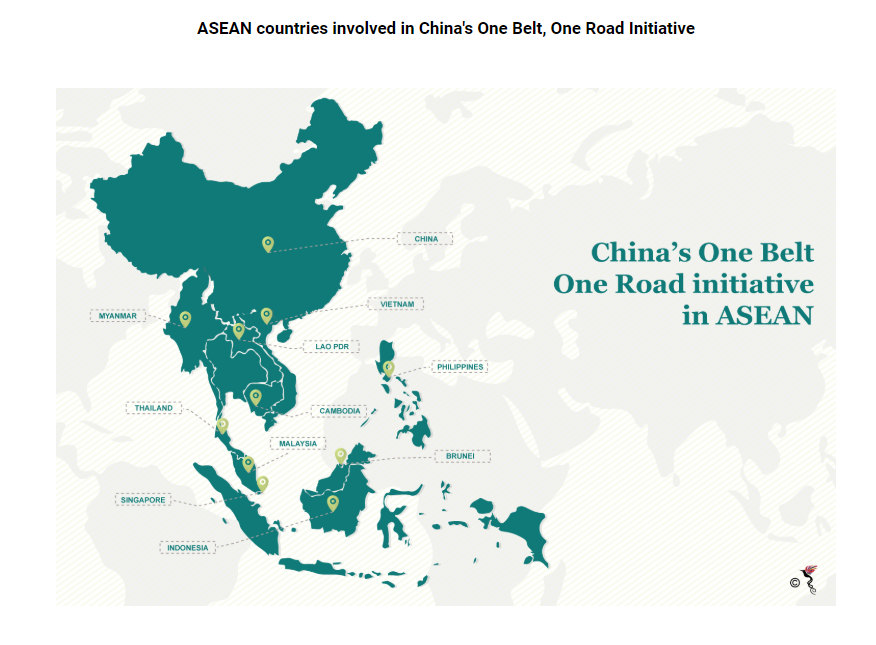

ASEAN directly relates to both the Silk Route Economic Belt and the Maritime Silk road. This region is also the location of the China-Indochina Peninsula Economic Corridor linking the Pearl River Delta Economic circle with Southeast Asian countries. This strategic corridor is expected to improve China's cooperation with the ASEAN countries in terms of infrastructure development, trade transaction, investment and tourism. This report will describe the relationship between China and ASEAN member countries as well as expected areas of opportunity stemming from the BRI.

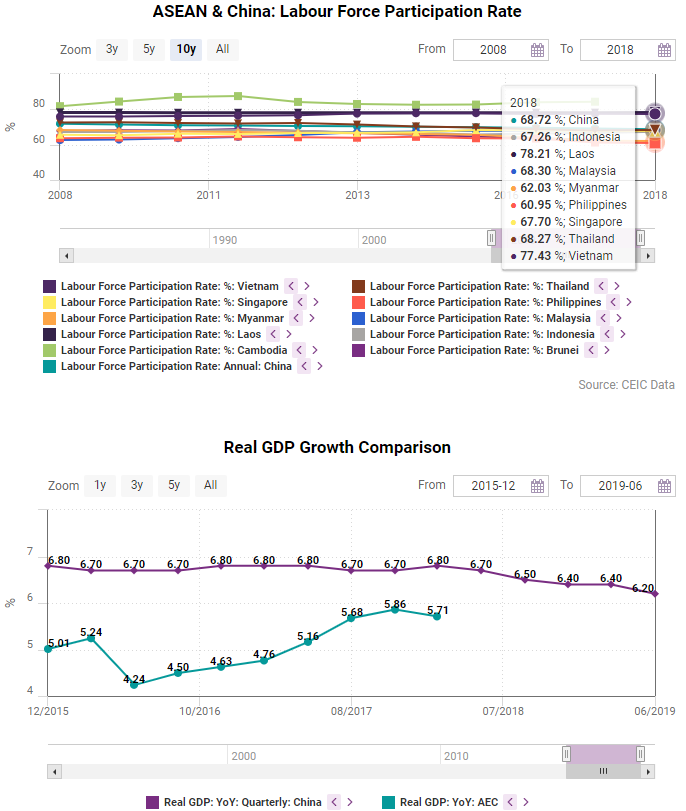

The ASEAN region shares a land border with the Southern part of mainland China. In terms of demographic comparison, the Chinese population is about 2 times greater than the total ASEAN's and the size of the Chinese economy is bigger. From ASEAN's point of view, joining the initiative would create a greater chance to gain access to China's market, to enhance the region infrastructure and economic development.

Source: The ASEAN Post

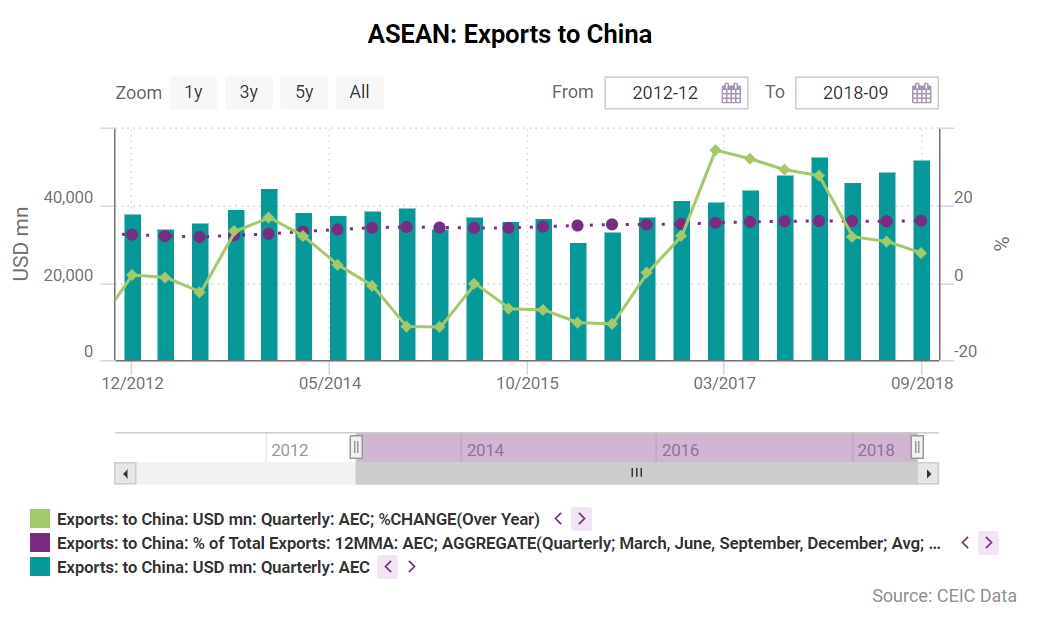

ASEAN trade figures

Foreign trade statistics show that China is one of the ASEAN's main trading partners, responsible for about 16% of total trade. Meanwhile, ASEAN attracts about 5% to 6% of China's total investments abroad. These investments are allocated in various sector including commercial services, wholesale & retail trade, electricity production, manufacturing and mining.

ASEAN Infrastructure Competitiveness

According to the World Economic Forum (WEF)'s Global Competitiveness Index, the infrastructure measurement (Pillar 2) can be assessed through a score ranging between 1 (extremely underdeveloped) to 7 (extensive and efficient). The GCI Pillar 2 score suggests that China's infrastructure condition is a bit more developed than the other countries in ASEAN except for Singapore.

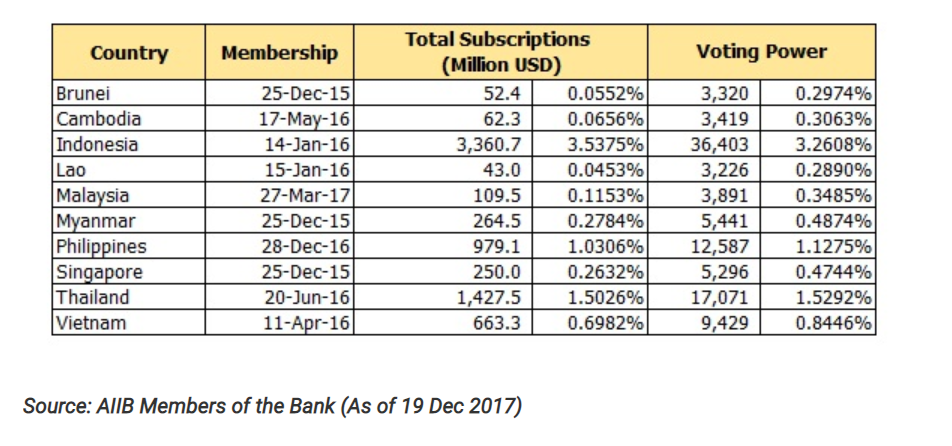

Financial Aid Availability

A resurgence of the ancient Silk Road requires substantial investment funding. In 2014, China was the mainstay in the establishment of two financial institutions: the Asian Infrastructure Investment Bank (AIIB) and the Silk Road Fund, aiming to support the financial gap for infrastructure investment in BRI's countries. Regarding AIIB, each member country has a proportion of financing according to its subscribed capital with a negotiable cost of borrowing. Below is the summary of subscribed capital and voting power by each member in the ASEAN region.

Did you know, our CEIC product suite offers over 5.5 million macroeconomic time series, such as those presented above, to allow for comparison of global markets and zero in on the deepest emerging markets data available....

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)