In 2020, China’s treasury yield curve experienced sharp fluctuations. In April 2020, the yield curve rebounded rapidly after reaching its lowest point in the past ten years. Among the yields of different terms, the one-year rate rose significantly, with an increase of more than 150 bps from May to November 2020. This was largely due to the reduction of the structured deposits of banks by the regulatory authority.

Monetary Policy Encouraged Financial Arbitrage in Q1 2020

The formation mechanism of China's short-term interest rates is different from that of the other major economies like the eurozone or the US. China's monetary policy is a dual regulation mechanism of price and quantity. It is not enough to just look at the policy rates of PBOC’s facilities, because these funds are limited. Chinese commercial banks cannot obtain reserves from the PBOC by their own will when conducting daily liquidity management. This means that if the PBOC lowers the OMO rates but reduces the amount, monetary policy is actually tightened. Empirically, one appropriate way to observe China’s monetary condition is through the inter-bank market funds prices.

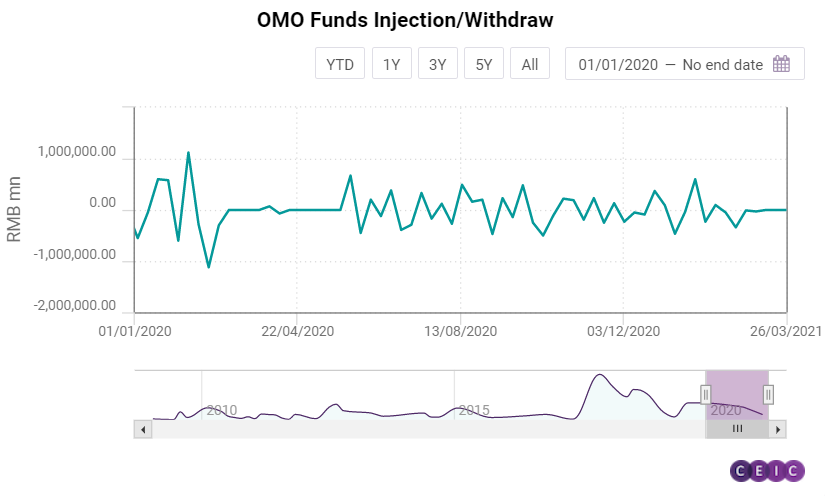

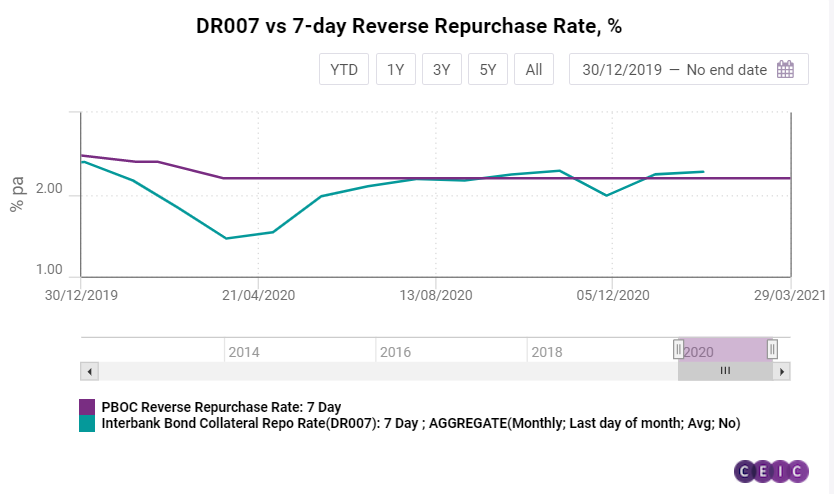

DR007 can be used to observe the banks’ short-term rates, and the one-year negotiable certificate of deposit rate or the one-year SHIBOR rate can be used to observe the banks’ medium-term rates. Besides, DR007 and one-year SHIBOR rate should fluctuate around policy rates under neutral condition. In the first four months of 2020, PBOC injected about RMB 4tn in short-term funds through reverse repurchase, RMB 500bn in mid-term funds through MLF, and RMB 1.75tn in long-term funds through RRR cuts. In terms of the policy rates, PBOC lowered the seven-day reverse repurchase rate by 30 bps, the MLF rate by 30 bps, and the excess deposit reserve rate by 37 bps. Stimulated by extra liquidity, the monthly average value of DR007 dropped from 2.40% in January 2020 to 1.46% in April 2020, 74 bps below the seven-day reverse repurchase rate (policy rate), and the monthly average one-year SHIBOR rate plummeted from 3.0% in January 2020 to 1.68% in April 2020, 127 bps below one-year MLF rate (policy rate).

The rapidly declining fund prices had created room for arbitrage. The average interest rates of three-month and one-year AAA commercial papers in April were 1.63% and 1.97%, respectively, while the average yield to maturity of structured deposits over the same period was 3.5%-3.8%. The gap between the rates of commercial papers and structured deposits was an opportunity for arbitrage. On the surface, current structured deposits are a risky asset combined with deposits and options linked to exchange rates, indexes, commodities, etc., but essentially, they are a low-risk and high-yield instrument that banks use to take deposits, since these options have high probabilities to be exercised. Therefore, enterprises could borrow commercial papers to buy structured deposits for arbitrage. As a result, the value of structured deposits grew rapidly, from RMB 11.98tn at the beginning of 2020 to a peak of RMB 15.23tn in April 2020. Among them, structured deposits from enterprises in small and medium-sized banks had increased the most, accounting for 46.16% of the total increase in structured deposits. Correspondingly, short-term bill financing surged to RMB 1.6tn in March. These data imply that structured deposits were used by small and medium-sized banks to take deposits and by enterprises to make arbitrage.

Preventing Financial Risk is the Core of Chinese Deleveraging

In the process of China's deleveraging in the past three years, the core idea was to prevent financial risks. Looking back at China's deleveraging process that started in 2017, it could be seen that the sector that had truly been deleveraged was financial institutions. From 2017 to 2019, China’s macro leverage ratio rose from 238.8% to 245.4%; the leverage ratio of the non-financial enterprise sector fell from 157.6% to 151.3%; the share of financial institutions' assets as a percentage of GDP fell from 77.9% to 54.8%; while the leverage ratio of government and households continued to rise. These data showed that financial institutions had been deleveraged more significantly. In the first three quarters of 2020, when the Chinese government suspended the deleveraging process of real entities to protect the economy from the pandemic, the leverage ratio of the non-financial enterprises sector rose from 151.3% to 164%. In contrast, the ratio of financial institutions’ assets to GDP merely ticked up from 54.8% to 55.6%. It is worth noting that financial institutions in China could hardly expand their balance sheet even in a depression.

It can be inferred that preventing excessive financial balance sheet expansion and financial risks were of high priority for China’s decision makers. Since 2017, CBIRC began to take actions to suppress inter-bank arbitrage, illegal wealth management products and off-balance sheet businesses, with a purpose to improve the stability of the financial system.

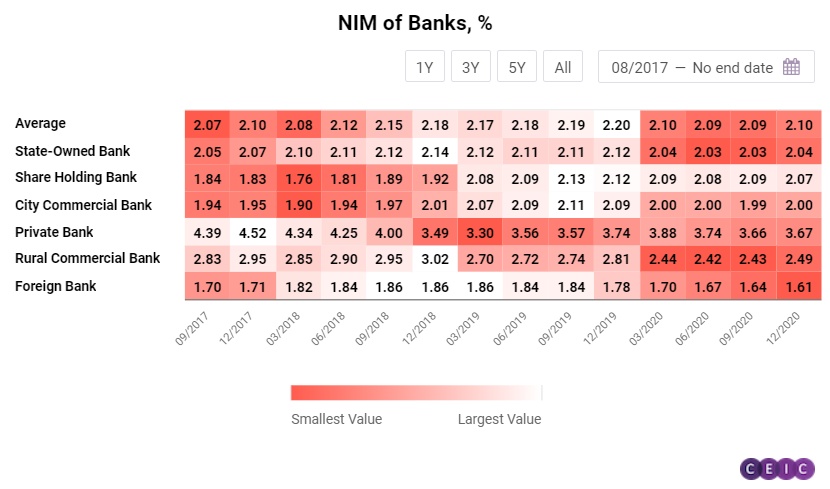

In June 2020, the Chinese government proposed that the financial system to reduce profit of RMB 1.5tn to benefit the real entities. Therefore, bank loan interest rates, which are pegged to the loan prime rate (LPR), fell sharply, while the household savings deposit rates remained unchanged, so the banks’ NIM contracted sharply. In this case, restricting structured deposits arbitrage was a necessary measure to protect bank profits and prevented systemic financial risks.

Reduction of Structural Deposit Caused Liquidity Shrink of Mid-term Funds

The regulatory actions to reduce structured deposits led to a contraction of inter-bank liquidity and caused interest rates to diverge from the MLF rate. In June 2020, the CBIRC asked banks to reduce structured deposits to their levels at the beginning 2020 by the end of Q3 2020, and further to two-thirds of the levels at the beginning of 2020 by the end of 2020. Therefore, the four big state-owned banks, other large banks, and small and medium-sized banks had to reduce the size of structured deposits by RMB 0.79tn, RMB 1.1tn, and RMB 2.1tn respectively. Since structured deposits are an on-balance sheet asset, their reduction would not impair the overall liability of banks, and the funds would only be converted between different deposit accounts and different bank accounts. However, this reduction will cause an imbalance in liquidity and especially a shortage of liquidity in banks with limited sources of deposits. Therefore, since June 2020, the issuance of negotiable certificates of deposit, which is another source of liquidity, surged substantially, and SHIBOR rates also climbed rapidly.

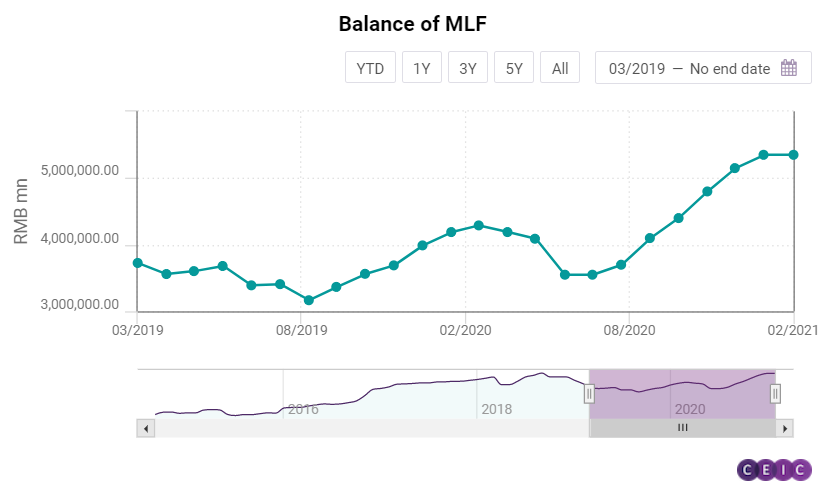

When comparing the DR007 and PBOC's seven-day reverse repurchase rate with the one-year SHIBOR rate and the one-year MLF rate, it can be seen that the rebound of one-year SHIBOR rate was more significant than that of DR007. This can be attributed to the reduction of structured deposits. After August 2020, PBOC consistently injected MLF in the market and the MLF balance increased stably, but the one-year SHIBOR rate continued to rise. The monthly average one-year SHIBOR rate rose from 2.36% in June 2020 to 3.29% in November 2020, while the MLF rate remained unchanged during the same period at 2.95%. In December 2020, when the structured deposits reduction requirement ended, the one-year SHIBOR rate finally converged with the MLF rate.

Outlook for Chinese Monetary Policy in 2021

From the current policy attitude, it can be concluded that the overall monetary policy will not be significantly tightened in 2021, and more frequent supervision will be made on specific services such as preventing financial arbitrage, restricting real estate financing, and regulating Internet platform financing. The Chinese Economic Work Conference in December 2020 set the attitude for the overall financial condition of 2021: no immediate hawkish, but accurate strike. Thus, treasury yields are not seen rising sharply, since the central bank will guarantee sufficient liquidity support, and the price of funds among financial institutions will be stable and low. However, the overall financing condition will be tightened since financial institutions will be constrained to expand their balance sheets, and the regulation will be on the specific business of these institutions, just like the reduction of structured deposits reviewed in this insight.

From what happened in December 2020, the above hypothesis could be confirmed. The balance of MLF had risen, and the treasury yields and SHIBOR rate had fallen. At the same time, watchdogs began to strike Internet financing by prohibiting online financial platforms from selling Internet deposit, which is a business usually cooperated with small and medium banks, and by reducing Internet consumer loans. In addition, on December 31, 2020, the PBOC and the CBIRC issued a regulation policy focusing on real estate loans. The regulation set a cap on real estate loans for different banks, including both family mortgage loans and real estate company loans. In the context of the downward economic cycle and the upward real estate cycle, coupled with the uncertainty of the pandemic, China’s economic policies will face great challenges. It may be difficult for traditional monetary and fiscal policies to cope with this cyclical mismatch, so specific regulations will become the main method for Chinese government.

Sign in to read the full data analysis here. Alternatively, download the latest, comprehensive analysis of China's economy with the CEIC China Economy in a Snapshot Q1 2021 Report.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)