China’s real GDP growth rate was 6% y/y in Q3 2019, the slowest pace since the 1990s and lower than expected, indicating deterioration due to internal and external challenges.

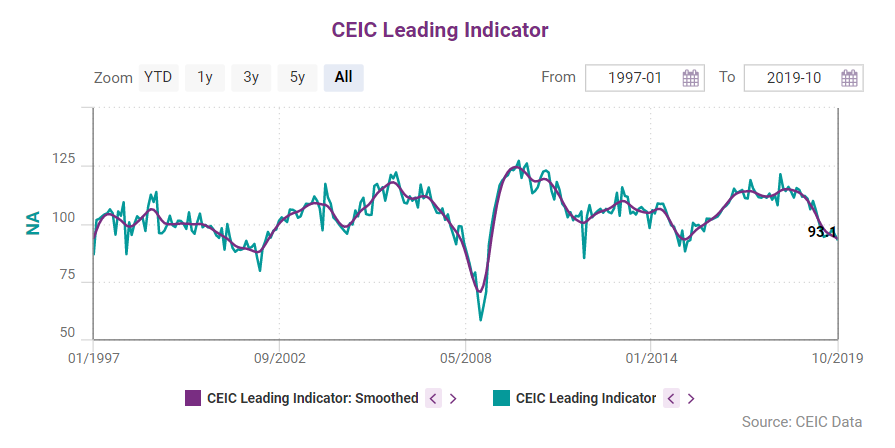

The CEIC smoothed leading indicator for the Chinese economy slipped to 93.5 at the end of Q3 2019 from 95.4 at the end of Q2, suggesting protracted slowdown trend due to internal and external challenges.

Business scope - purchasing managers' index, SMEs and confidence

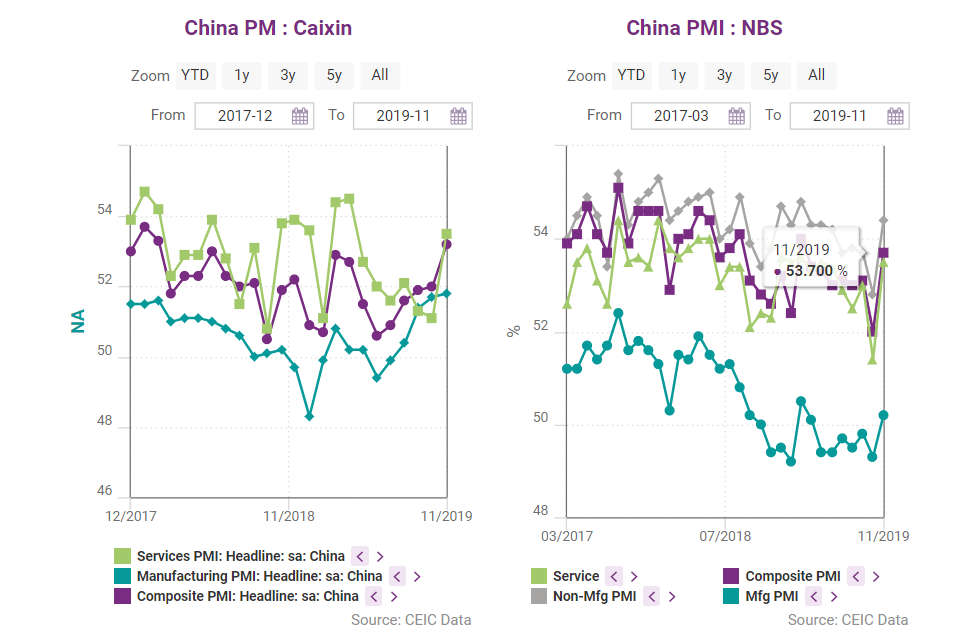

The composite purchasing managers’ index (PMI), however, suggest a slightly better outlook for production. The composite PMI published by the National Bureau of Statistics indicated a slight expansion to 53.1 at the end of Q3 2019 from 53 at the end of Q2. Moreover, the Caixin composite PMI registered notable gain to 51.9 at the end of Q3 from 50.6 at the end of Q2, driven by a robust rebound in manufacturing and by an increase in services, albeit slower.

This is notably due to the counter-cyclical policies such as the tax cuts in manufacturing, as well as the loan prime rate (LPR) reform aimed to lower the funding costs of SMEs’ in manufacturing and services.

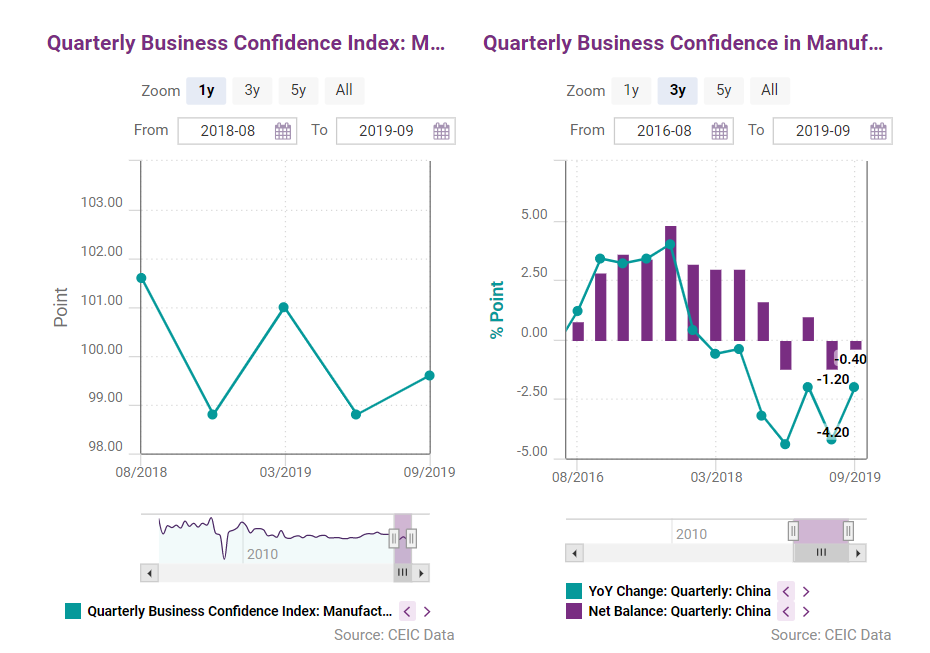

Business confidence remained in the contraction area, although the corresponding index climbed to 99.6 points in Q3 2019 from 98.8 in Q2. Despite a slip from 125.9 points in Q2 to 124.1 in Q3, consumer confidence was still in the expansion area.

China's growth stagnation in numbers and causations...

China’s economic growth is in an orderly slowdown, with a series of counter-cyclical measures including monetary, fiscal and structural policies. However, the higher CPI expectations for around 4% at the beginning of 2020, triggered by the soaring pork prices, would constrain the room for easing the monetary policy. Struggling to balance between slowing economic growth and rising CPI, policymakers are more likely to rely on fiscal policies and structural reforms as means to support the weakening economy.

Given the continuously worsening external demand, there is no sign of improvement in goods exports, which is exerting stress on industrial production, employment and investment confidence. Despite the gloomy global trade environment, the financial account might experience a capital inflow in the near future as a result of the substantial opening-up reforms implemented with the aim of attracting more foreign investments. Furthermore, domestic consumption is likely to remain resilient since several counter-cyclical policies have been introduced to support consumption. They include relaxing the restrictions on automobile purchases, opening more duty-free stores in big cities and increasing disposable personal income in rural areas. The government did not mention specific measures to achieve the latter, but the steps could include cutting taxes, renting farmland and more inclusive financial services. The fixed asset investment (FAI) in infrastructure is expected to support the economic growth as the Chinese government lifted the restrictions on local government funding for major infrastructure investments, speeded up the issuance of government special purpose bonds and allocated 60% of the quotas for new special bonds in 2020 before the approval of the annual budget.

Economic forecasts

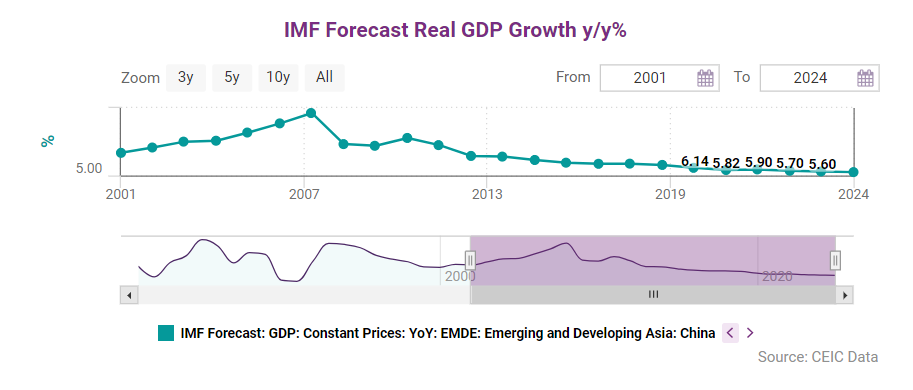

The IMF downgraded its 2019 real GDP growth forecast for China from 6.2% y/y to 6.14% y/y in the October World Economic Outlook (WEO), reflecting the negative effects from the imposed trade tariffs and the slowing domestic demand. According to the IMF, the fiscal deficit will be 6.1% of GDP in 2019 and will remain at this level for six more years to come.

The IMF forecast shows the current account balance settling at a more stable level of 0.37% of GDP. The downside risks to the outlook stem from the synchronised global economic slowdown, trade barriers and increased geopolitical risks worldwide.

The full CEIC China Economy in a Snapshot Q4 2019 Report will be released in early January 2020. In the meantime, take a look at our other free reports avbailable for download...

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)