-png.png)

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

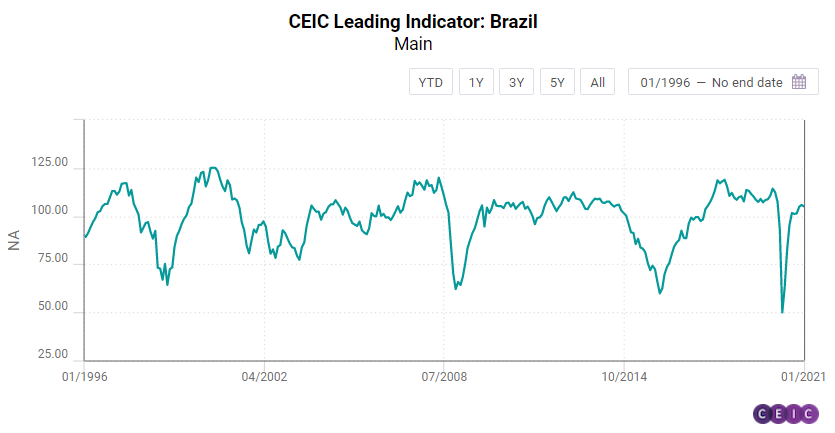

The CEIC Leading Indicator for Brazil inched down to 105.1 in January 2021 from 105.9 in December in an environment of rising COVID-19 cases in the country and delayed acquisition of vaccines. The index remains higher than the benchmark value of 100, meaning that the economy may grow moderately in Q3 2021. The manufacturing confidence indicator slipped to 11.3 in January 2021 after reaching a ten-year record of 14.9 in December, reflecting the end of the major income transfer programme – the emergency aid – and the risk that local governments may reintroduce social distancing measures to control the accelerated spread of COVID-19 infections.

The consumer inflation expectation indicator remained unchanged at 5.2 in January 2021, meaning that consumers see prices unaffected by the end of the emergency aid, which may reduce substantially the purchasing power of low-income families. In the construction industry, the index measuring the expectation to purchase inputs rose to 57 from 54.5 in December 2020, well above the neutral value of 50. On the financial markets, the equity market index fell to 115,067 in the end of January 2021 from 119,017 in the end of December 2020, influenced by uncertainties regarding the local vaccination programme and the sustainability of public finances. Moreover, crude oil prices rose to a monthly average of USD 54.4 per barrel in the first month of 2021 from USD 49.2 per barrel in December 2020, reflecting a subdued global supply and a potential higher demand for fuel in the US, as the country faced a harsh winter in January 2021. In addition, the purchasing power of many Americans may increase if the US Congress approves a broader stimulus plan, which may further boost the North American demand for fuel thus pushing up oil prices.

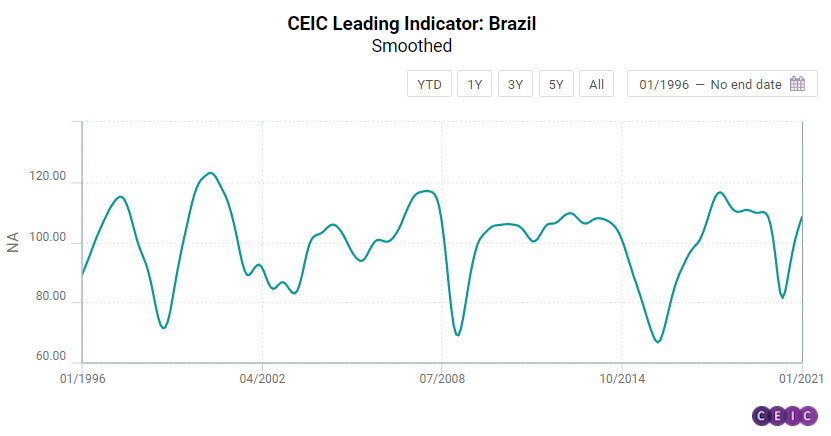

The smoothed CEIC Leading Indicator reached 108.3 in January 2021, the highest value since November 2019, which means that the country will return to the long-term growth path observed before the coronavirus outbreak. The monetary easing programme implemented by the central bank may be a driving force as the liquidity injection is expected to encourage banks to increase lending, in turn stimulating the residential construction and the consumer goods sector. In addition, the development of vaccination campaigns in the medium term, even if gradual, can bring a perspective of recovery in the long run, particularly for the services sector, which represents most of the country’s GDP.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)