The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

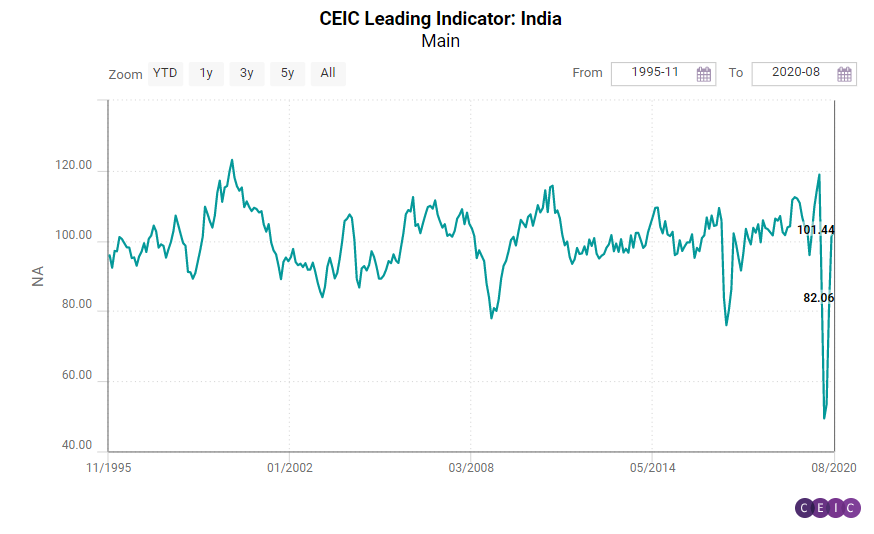

Keeping up the positive trend, the CEIC Leading Indicator for India rose to 102.6 in August 2020 from 101.4 in July. The key drivers of this increase are the narrowing declines in automobile sales and steel production. Passenger car sales have seen a V-shaped recovery, and are back to pre-COVID-19 levels, even though sales declined by 6% y/y in August. In terms of metal production, crude and finished steel declined by 4.2% y/y and 5.5% y/y respectively, but this has been a substantial improvement, bringing them closer to their 2019 levels. Electricity production declined by 2.6% y/y in August as compared to a 0.1% y/y decline in July. The growth of financial indicators such as 91-day treasury bills and money supply moderated. The growth of wholesale food price inflation also slowed down.

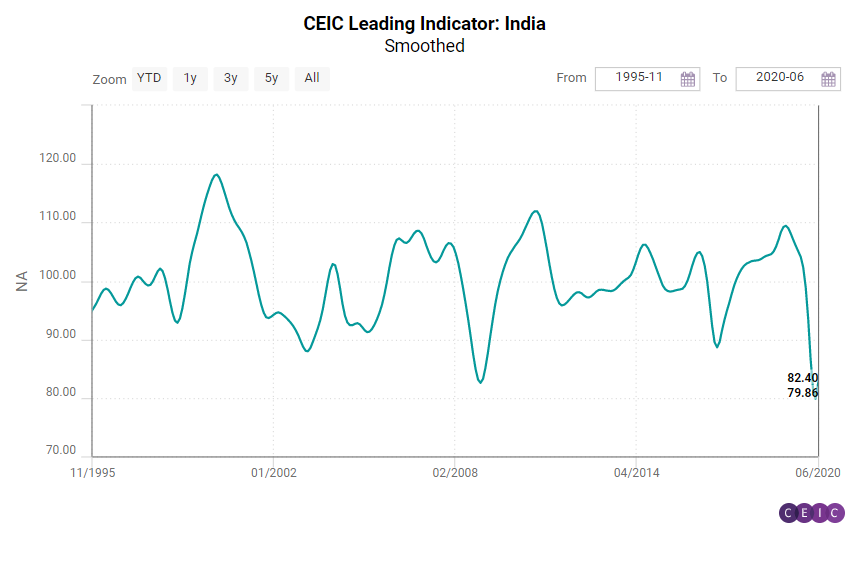

The turnaround in the smoothed CEIC Leading Indicator also continued further – it increased to 92.9 in August 2020 from 87.33 in July. The increase in the smoothed indicator for two consecutive months sparks hope for sustained recovery of the economy, despite the daily number of COVID-19 cases in India becoming the highest in the world. India saw the sharpest historical contraction in GDP by 23.9% y/y in the second quarter of the year as a result of the lockdown.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)