-png.png)

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator that is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

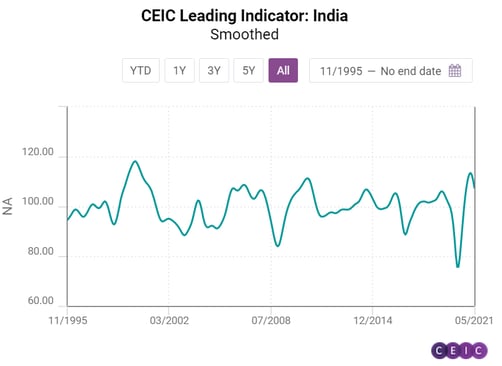

The second COVID-19 wave in India had a devastating effect on the economy, as the CEIC Leading Indicator for India shows. The indicator dropped sharply to 94.7 in May 2021 from 116.3 in April as the country suffered record high infections and mortalities due to the coronavirus. Motor vehicle production decelerated rapidly in May, dropping to 128,225 units from 305,952 in the previous month. Electricity generation also declined by 11% m/m and has decelerated on an annual basis, although growth is still present.

The yield for 91-day treasury bills accelerated slightly to 3.4% pa, from 3.32% pa in April while the amount outstanding increased by 25.3% y/y. Growth in money supply continued to decelerate, dropping to 14.3% y/y. Nevertheless, the Bombay Stock Exchange closed at a peak 51,937.4, gaining 3,155.1 points compared to the previous month. Food inflation moderated in May, with wholesale food prices’ growth decelerating to 4.3% from 4.9% in April.

The development of the smoothed CEIC Leading Indicator is also a cause of concern as it declined for the third month in a row to 107.5 in May. Although the value above 100 signifies that the economy is still performing above the long-term trend, there are signs that the business cycle of India has probably passed its peak and is in a state of a moderation. Different parts of the country are still under lockdown, which is bound to affect the economy adversely, even though the low base impact lingers on from the nationwide lockdown in the previous year.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)