The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

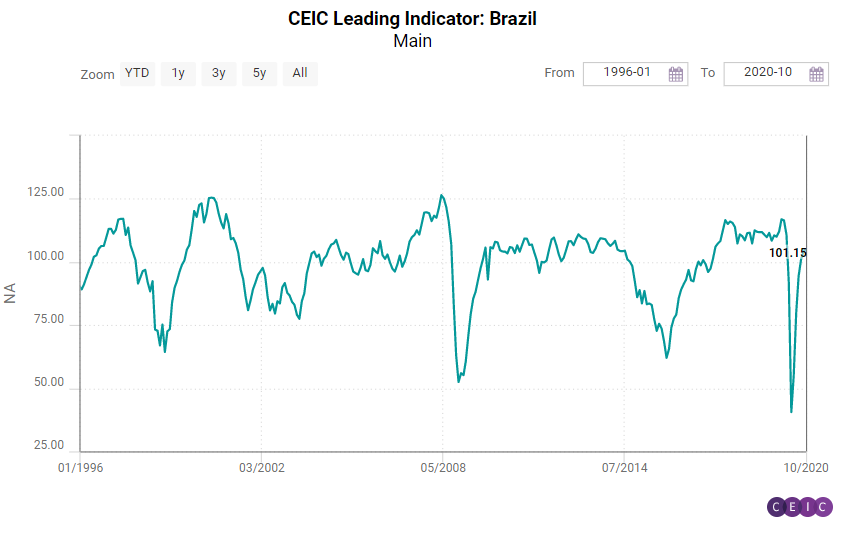

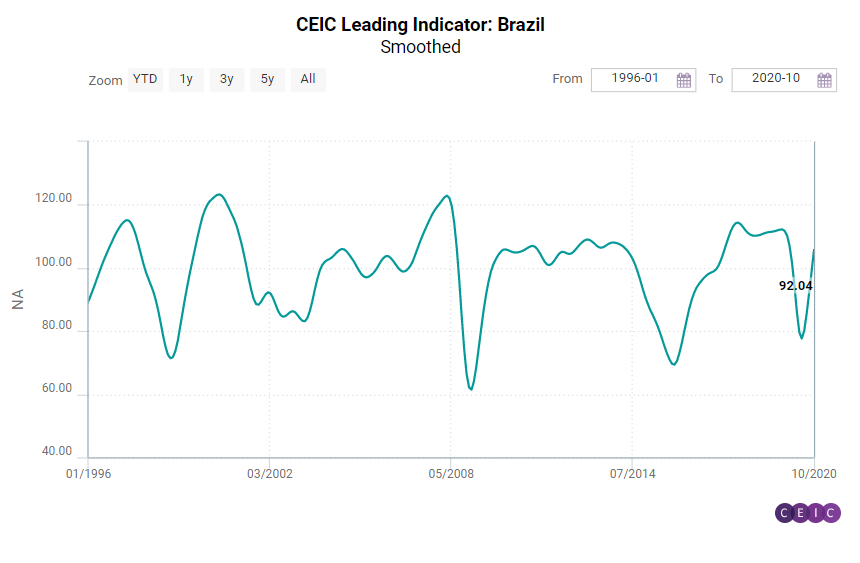

The Brazilian economy is expected to register a significant growth in the second quarter of 2021, according to the CEIC Leading Indicator for Brazil. The index recorded the sixth increase in a row in October, reaching 105, higher than the benchmark value of 100, which separates a GDP acceleration prospect from a deceleration one. The robust improvement in some key indicators signals that the country’s economy is likely to grow significantly above the long-term trend in the next six to nine months. Several industries continued to rebound in October as the government’s cash transfer programmes and lower interest rates supported domestic demand. The manufacturing confidence indicator was 11.2 in the month, a nine-year record, as many local factories are accelerating production. In the construction industry, the expectation to purchase inputs indicator was 54.2 in October 2020, above the neutral value of 50, and higher than the 53 in October 2019. Crude oil prices declined to USD 40.1 per barrel in October, from USD 41.5 in September, amid uncertainties surrounding the economic recovery in the US and the EU. Following the global instability, the equity market index inched down to 93,952 in the end of October from 94,603 in the end of September.

The country may return to a long-term growth trend in Q2 2021, as the smoothed indicator stood at 105.7 in October, the highest value since December 2019. Brazil is expected to register positive growth in Q2 2021, influenced by a rebound in the labour market and the low basis of comparison in 2020. In addition, the central bank may continue with the monetary stimulus in 2021, as the key interest rate SELIC is likely to remain lower than the inflation rate for most of the year. For 2020 Brazil’s GDP is still expected to contract, according to the readings of the CEIC Leading Indicator between March and July this year.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)