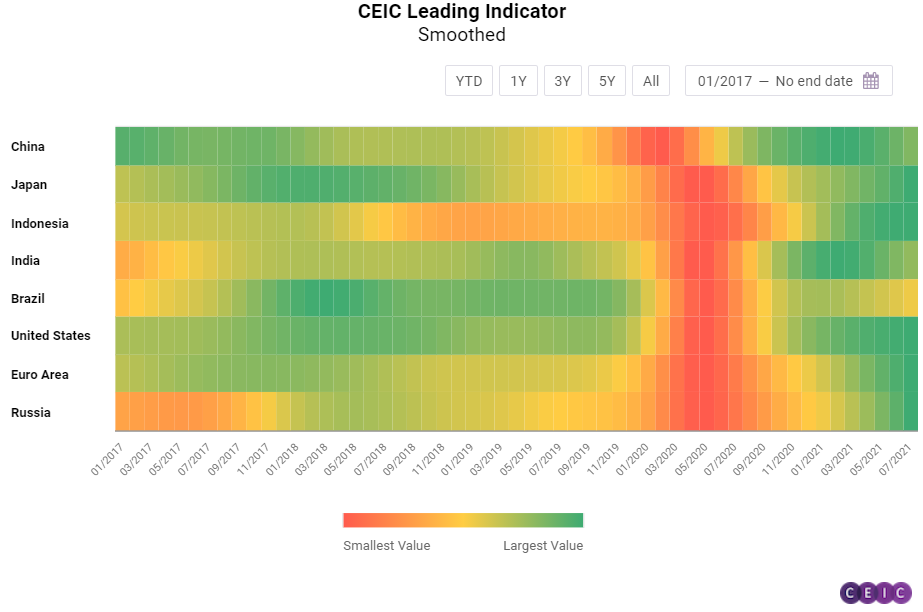

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator that is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade, and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan, and the United States.

According to July 2021 data for the CEIC Leading Indicator, the majority of the surveyed economies are still performing above the long-term average of 100. However, Brazil is following a downward path and posted a value below 100 for the second consecutive month. The smoothed indicator for the US, on the other hand, has been confidently increasing since November 2020. Indonesia too is performing well, with the indicator approaching 120, while in China and India a deceleration is observed.

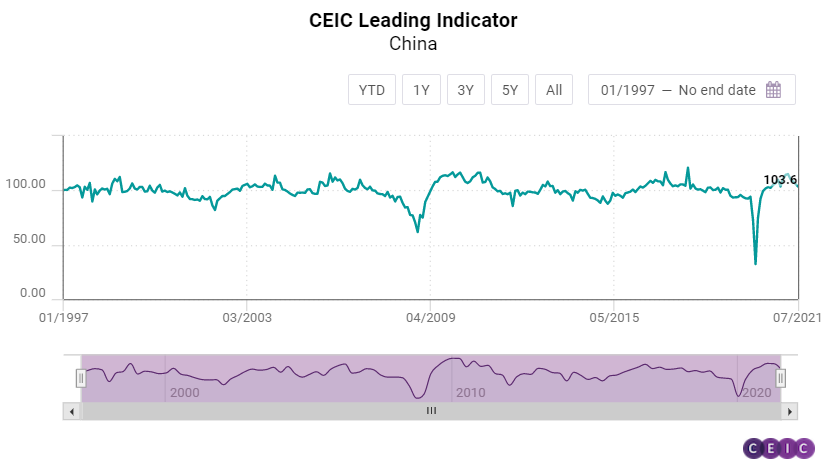

China: Plunging PMI Raises Concerns

The CEIC Leading Indicator for China declined for the fourth month in a row in July, reaching its lowest level since August 2020. Growth in China's manufacturing sector fell sharply in July, as reflected by the plunge in the official manufacturing PMI. In July, China's official manufacturing PMI dropped further to 50.4, the lowest value since February 2020. Profit margins of manufacturers continued to be squeezed, as reflected by the divergence between the growth of input and output prices. Automobile production declined by 15.36% y/y in July.

China’s credit expansion also slowed down in July. China’s total social financing increased by RMB 1.06tn in July, the lowest level since February 2020. Growth of money supply decelerated, increasing by 8.32% y/y in July from 8.56% in the previous month. The growth rate of financial institution deposits followed a similar pattern, decelerating to 8.64% y/y in July. The recovery in the real estate sector continued to cool down, as floor space sold of commodity buildings in the period January-July 2021 increased by 21.54% y/y compared to 27.71% y/y growth in the period January-June 2021.

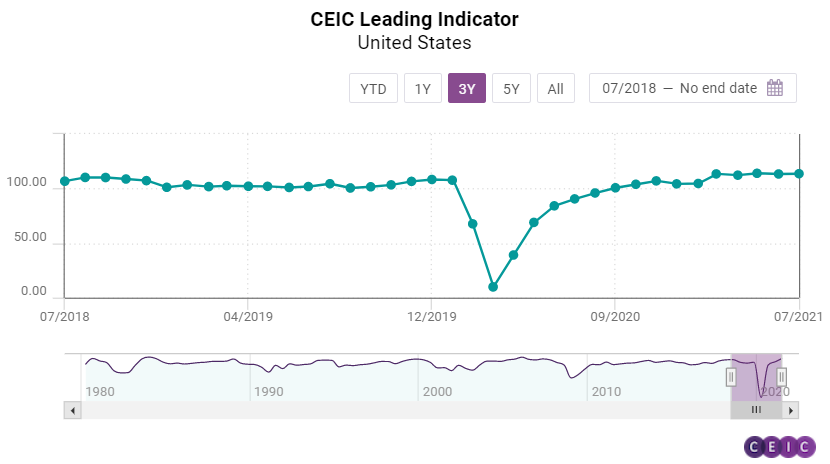

US, Euro Area, and Brazil: Uncertainties May Curb Brazil's Economic Growth

The CEIC Leading Indicator for the US in July stayed around its highest levels in over a decade, supported by the economic recovery. Consumer confidence is approaching its pre-pandemic levels at 129.1 in the seventh month of 2021 and the capacity utilisation rate grew for the fifth month in a row, reaching 76.12%. The motor vehicles sales growth rate decelerated to 4.7% y/y in July from 18% y/y in June, which can largely be explained by the subsiding low-base effect. The financial markets performed well, following a steep upward path, with the S&P500 index up by 17% since the beginning of the year. Business confidence, on the other hand, measured by the Purchasing Managers' Index (PMI), decelerated slightly, but stayed above the 50-point threshold.

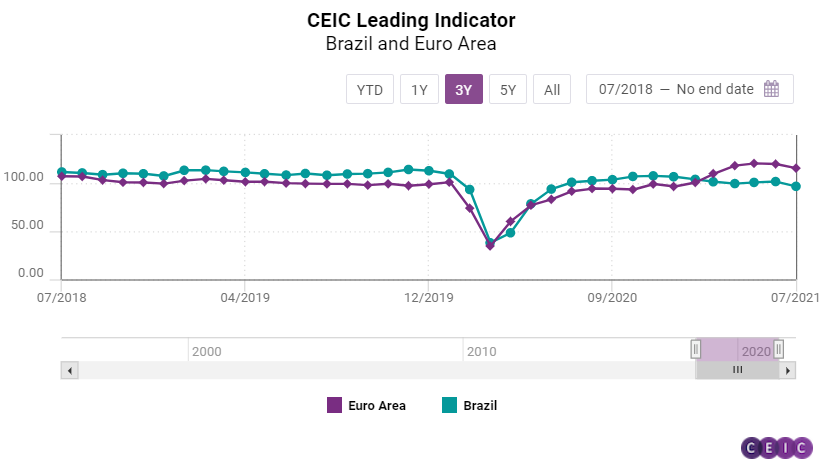

The CEIC Leading Indicator for the Euro Area declined for the second month in a row, reaching 115.56. The employment component of the manufacturing PMI keeps increasing and the 58.5 in July is well above the pre-pandemic levels. It actually matches the figures from the end of 2017. The industrial confidence indicator (ICI), specifically for the basic metals manufacturing industry, is following a similar path. The July data shows that the indicator stayed at 23.3 pp, more than offsetting the COVID-19 related collapse at the beginning of 2020. The European Commission's consumer confidence indicator, measuring the expectations over the next 12 months decreased to 0.9 pp compared to 2.1 pp in June. Such dynamics can be attributed to the approaching autumn and winter months, as households grow more and more uncertain about the pandemic's development.

The economic activity in Brazil may moderate in Q1 2022, according to the CEIC Leading Indicator, which anticipates turning points of the business cycle. Higher interest rates and fiscal risks tend to hamper hopes of substantial GDP growth after the pandemic, and thus the biggest economy in Latin America may grow below the long-term trend in Q1 2022. Some key variables supported the performance of the CEIC Leading Indicator in July. The equity market index Ibovespa fell to 121,800 at the end of July from 126,801 in the end of June, amid uncertainties regarding new public expenditures on cash transfer programs and indemnities from lawsuits against the government. The heated construction industry may slow down in the next months, like the expectation to purchase inputs index declined to 53.8 in July from 56.6 in June 2021, reflecting the skyrocketing prices of building materials. The consumer inflation expectation indicator recorded its sixth increase in a row to 6.7 in July, supported by higher prices of electricity and gas. The international crude oil prices edged up to a monthly average of USD 73.5 per barrel in July from USD 71.9 per barrel in June. The manufacturing confidence indicator, however, inched up to 8.4% in the month from 7.6% in June, reflecting a higher optimism among industrial companies, despite a shortage of parts and components in the manufacturing sector and growing costs.

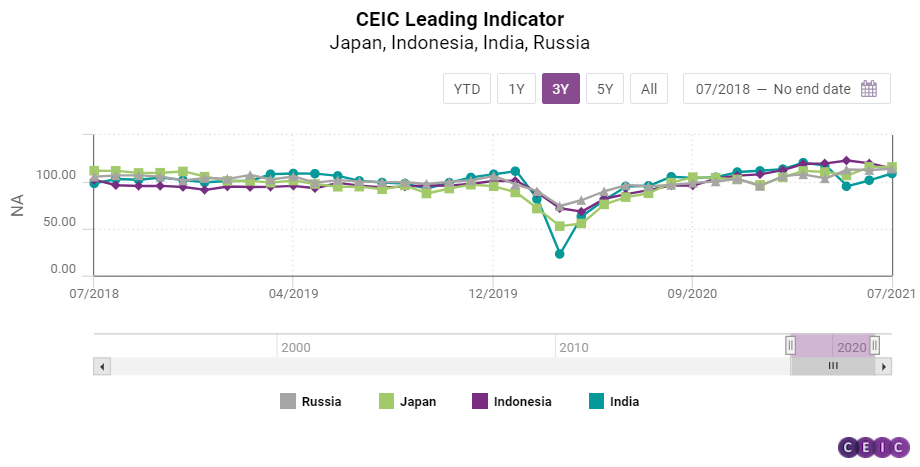

Japan, India, Indonesia, and Russia: India Sees Light at the End of the Tunnel

Japan's CEIC Leading Indicator barely changed in July, staying at 115.97 compared to 115.99 in June. The machine tool orders decelerated a bit, amounting to JPY 43.5bn in July compared to JPY 44.7bn in the previous month, but the figure remains above the pre-pandemic levels. Motor vehicles sales, on the other hand, declined on an annual basis for the first time since September 2020, dropping by 4.8% y/y in July. Consumers, nonetheless, apparently stay optimistic, with the indicator measuring overall livelihood, inching up to 39 from 38.6 in June. The financial market players seem optimistic, as the TOPIX index for small companies is up by 7% since the beginning of 2021.

The CEIC Leading Indicator for India continued its upward trend for a second consecutive month, rising to 108.9 in July from 101.8 in June. Electricity generation and steel production proved to be key drivers of this increase, despite only a marginal increase in the former, and a slowdown in the case of the latter. Electricity generation grew by 6.8% y/y in July, as compared to 6.3% y/y in June. In terms of steel production, crude steel output growth slowed to 11.9% y/y in July from 21.4% y/y in June, while finished steel growth slowed from 26.1% y/y to 10.6% y/y over the same period. The dissipation of the low base effects also led to a moderation in passenger vehicle production, which registered a growth of 52.6% y/y in July, in contrast with 174.9% y/y in June. Wholesale prices of food have also been declining since June, after peaking in May 2021. In July, food inflation at the wholesale level slowed to 4.5% y/y from 6.7% y/y in June. In terms of monetary and financial indicators, money supply, as well as the amount outstanding in 91-day treasury bills, decelerated to 14.6% y/ and 6.6% y/y in July, respectively. The yield for 3-month treasury bills also fell to 3.39% pa in July by 0.05 pp. The Bombay stock exchange (BSE) Sensex closed at 52,586.84 points in July, but the rate of growth slowed to 39.8% y/y. The pattern is similar for the monthly average of the BSE Sensex.

The CEIC Leading Indicator for Indonesia decelerated for a second consecutive month to 114.44 from 119.68 in June. The spot price of crude palm oil rebounded to USD 1,185 per tonne but did not offset the substantial decrease in June. Non-oil and non-gas exports kept growing in July. The growth rate decelerated to 28.3% y/y in July compared to 51.3% y/y in June, reflecting the subsiding low-base effect. The FX rate stayed stable in the seventh month of 2021 at IDR 14,491 per US dollar.

In Russia, the CEIC Leading Indicator rebounded in July after a slight drop in June and reached 114.07. The manufacturing industry is apparently growing optimistic because the tendency indicator increased for a third consecutive month to reach 22.6%. The expectations for the sales prices in the next three months improve as well. New car sales declined, both on a monthly and quarterly basis, staying at 132 640 units in July. The spot crude oil prices follow a confident upward path, reaching USD 73.5 per barrel in July compared to USD 71.89 per barrel in the previous month.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)