The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

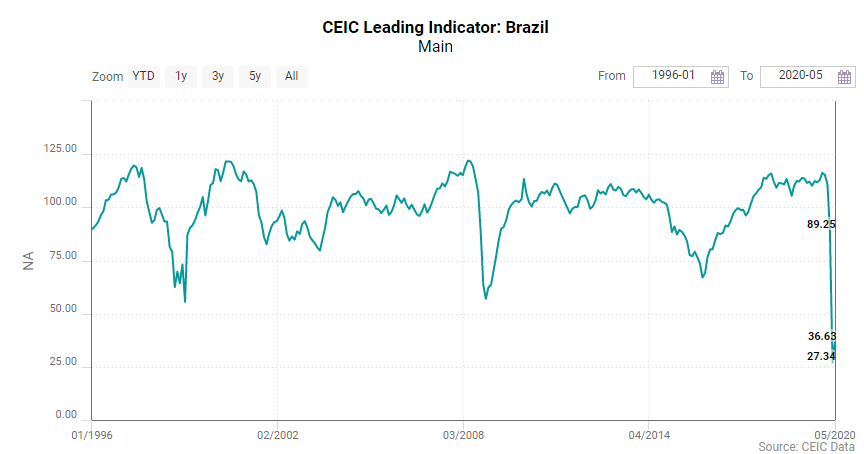

The CEIC Leading Indicator for Brazil saw a slight improvement in May 2020 to 36.63, after reaching a record low of 27.34 in April. It is still well lower than the neutral point of 100, which means that the country’s economic activity is expected to operate far below the long term trend in the coming six to nine months. The positive performance in May was supported by some key variables. The equity market index reached 87,402 points at the end of the month, after sinking to 73,019 in the end of March. Oil prices also had a partial recovery to USD 25 per barrel, compared to USD 17.7 in April. Moreover, the manufacturing confidence indicator had a moderate rebound to -38.6 in May from -41.8 in April, regardless of the fact that the sales of motor vehicles inched up by just 1,686 vehicles to 56,266 in May, still way below the average of 250,000 vehicles sold per month in the second half of 2019.

However, the country faces the prospect of a deep recession in 2020, as the CEIC Leading Indicator for May is well below the levels observed during other periods of crisis such as 1999, 2009 and 2015-2016, when the indicator did not fall below 55. The smoothed indicator plunged to 39.64 in May, the lowest value of the series on record, as it remained below the neutral point of 100 for the third month in a row, with a significant impact on the long term trend. Notably, the declining trend of the smoothed indicator started in January 2020, a few months before the COVID-19 outbreak in Brazil, as revealed by relevant changes in some of its components such as commodity prices and financial indices.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)