The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

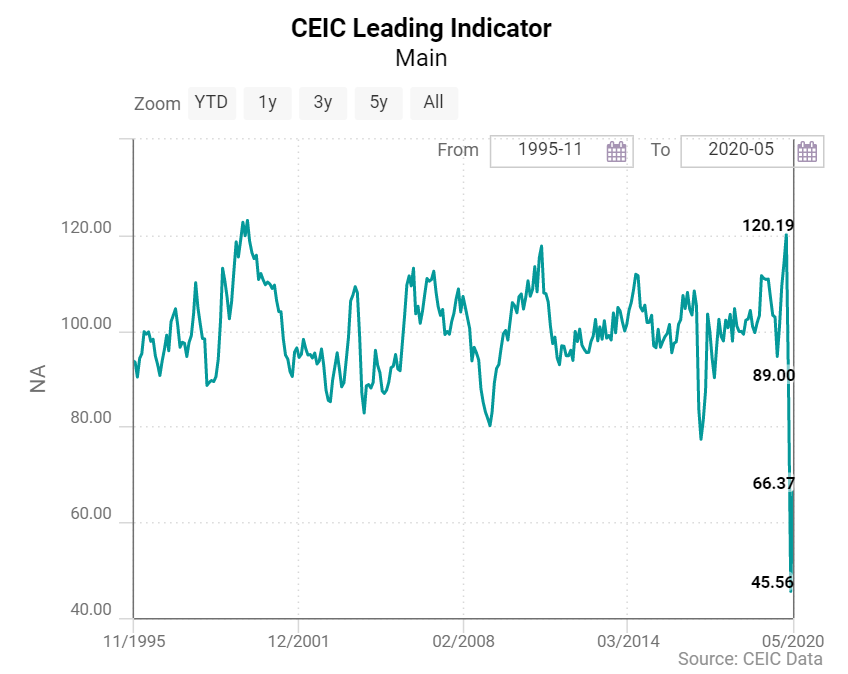

The Indian economy was experiencing a slowdown before the COVID-19 pandemic began. However, the CEIC Leading indicator showed signs of recovery from October 2019. In February 2020, the indicator reached a high of 120.2, but as a result of the COVID-19 pandemic and the subsequent lockdown until the first week of May, the indicator plunged substantially in March and April 2020 to 89 and 45.6, respectively. As the lockdown eased and industries restarted operations, the CEIC Leading indicator for May 2020 saw an increase to 66.4, hinting at the start of an economic revival.

The improvement of the indicator can be primarily attributed to a recovery in crude steel production and electricity generation. The decline in both crude steel and electricity generation values in May 2020 slowed down - crude steel production contracted by 43.8% y/y in May 2020 as opposed to 65.2% y/y in April 2020, while electricity generation contracted by 17.8% y/y in May 2020 against 25.8% y/y in April 2020. The M2 money supply, whose annual growth ranged between 10.7% and 13.8% in the 12 months ending April 2020, increased by 14.7% y/y in May 2020, signifying an uptick in demand deposits and currency in circulation.

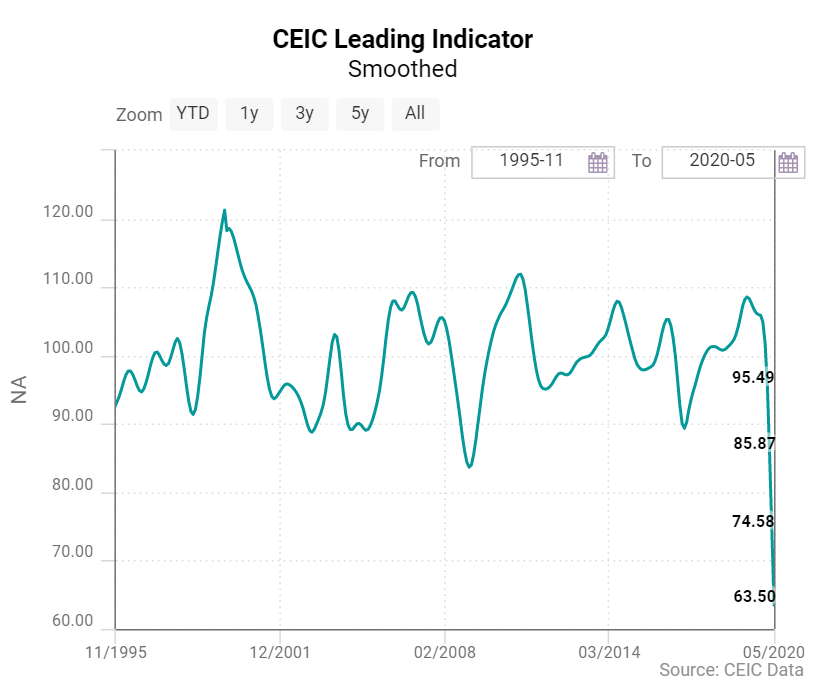

On the other hand, the smoothed CEIC Leading indicator for India, has been declining since June 2019, demonstrating that the uptick in economic activity has been unable to outweigh the slowdown. The smoothed indicator remained on a downward trend in contrast to the main leading indicator. The turning point in the smoothed indicator can be expected in the near future, once the revival gains momentum.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)