-png.png)

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

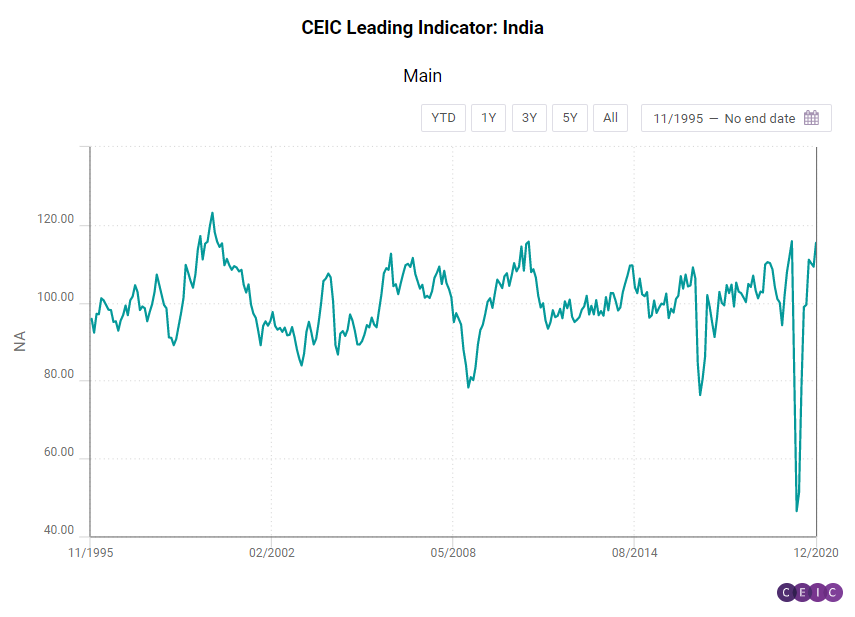

After a slight moderation in the CEIC Leading Indicator for India in November 2020, there was a considerable increase in December. The leading indicator value increased from 109.3 in November to 115.4 in December, surpassing the peak of 111.5 in September 2020. The increase in the indicator can be primarily attributed to a sustained surge in equity markets as both the Bombay Stock Exchange and the National Stock Exchanges indices attained historic highs of 47,751 and 13,981, respectively, in December. An increase in the 91-day treasury bill yield to 3.1% pa from 2.8% pa in December 2020 also reflects that investor sentiment has picked up. The M2 money supply also increased by 19.1% y/y in December 2020.

Passenger vehicle sales, after a brief slowdown in November, increased by 24.2% y/y in December 2020, which also contributed to the overall increase in the leading indicator. Metal production is undergoing a slowdown, as crude steel barely accelerated by 0.01% y/y in December, and finished steel declined by 4.2% y/y. On the other hand, electricity generation increased by 4.6% y/y in the same period. The deceleration in food prices continued for the third month in a row as the wholesale price index for food grew by 0.9% y/y in December 2020.

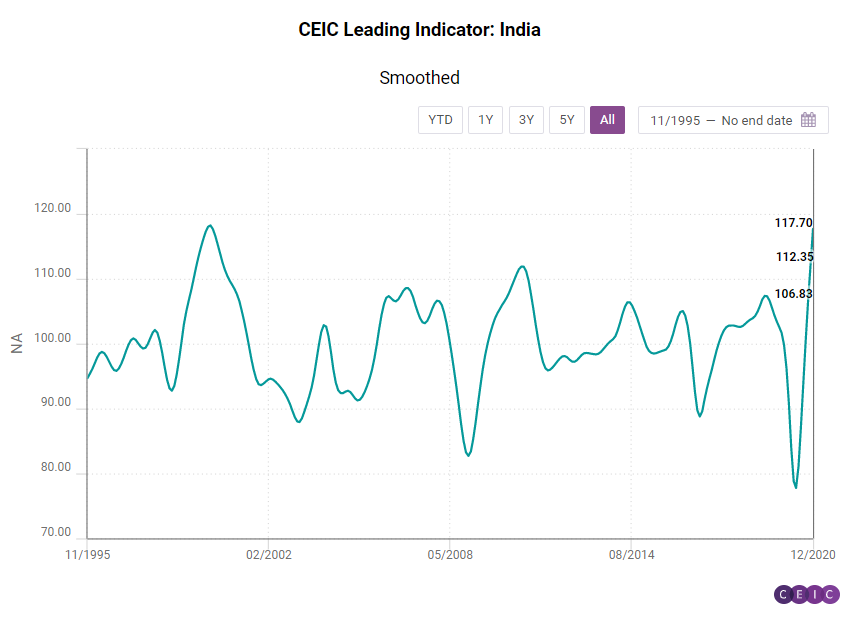

The smoothed CEIC Leading Indicator increased to a ten year high of 117.7, conveying that the recovery in the business cycle will continue in the short to medium term. However, since the increase in the actual indicator is likely from a surge in financial markets, the overall momentum of the recovery is expected to be moderate.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)