The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator that is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

The CEIC Leading Indicator bounced back to 101.9 in June 2021 from 95.7 in May, effectively bringing the Indian economy back into an expansion phase. Despite moderation in the growth rate of electricity generation to 6.3% y/y in June, it was one of the key drivers of the increase in the leading indicator. Passenger vehicle production growth moderated as well, to 174.9% y/y, still experiencing favourable base effects, and was another important contributor to the leading indicator’s rebound. The y/y growth in crude steel slowed down from 46.9% in May to 19.9% in June.

Finished steel production followed suit, as growth decelerated from 58.4% in May to 25.8% in June. Under monetary and financial segments, the money supply increased by 14.9% in June, and the Bombay Stock Exchange Sensex closed at 52,482.7 points, the highest value on record. The 91-day Treasury bills yield increased marginally, by 4 pp, to 3.44% pa in June. The wholesale price index pertaining to food slowed down from 8.1% y/y in May, to 6.7% y/y in June.

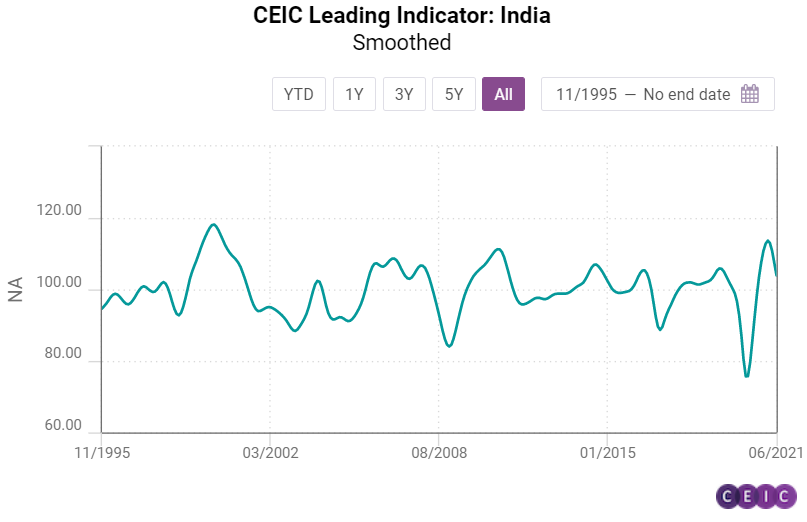

The smoothed CEIC Leading Indicator declined further to 103.9 in June, from 107.4 in May, echoing the extent of damage caused by the second wave of infections. However, the rebound in the actual leading indicator is suggestive of the decline bottoming out, although much depends on how India’s vaccination drive pans out. Most parts of India are now functioning normally, without any major lockdowns but the impending threat of a third wave makes economic recovery more uncertain.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)