-png.png)

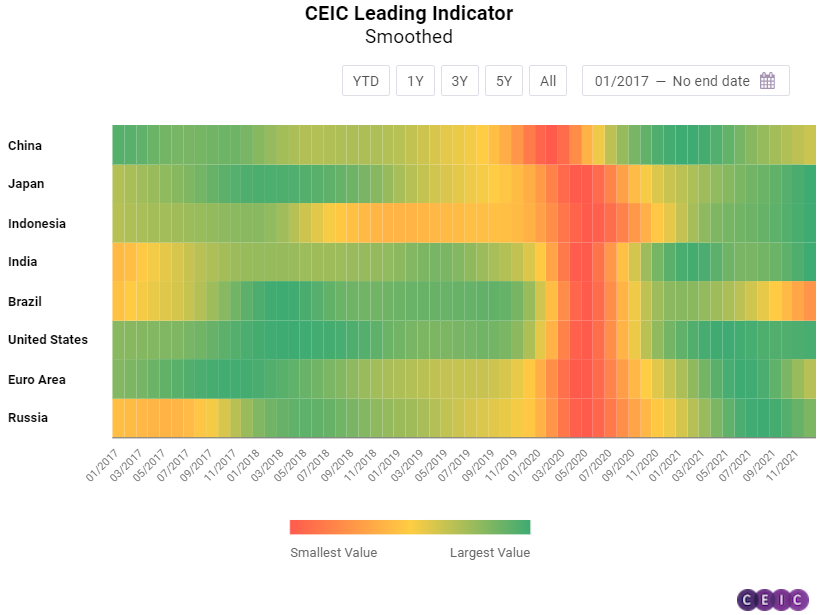

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator that is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade, and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan, and the United States.

According to the December data for the CEIC Leading Indicator, most observed regions closed 2021 on a cautionary note with recovery being put once again in doubt due to the rapidly spreading Omicron variant of the coronavirus. Increasing demand is still facing supply chain shortages and inflationary pressures remain a threat to consumer driven economies. Growth in most observed economies eased except for India where the recovery continues to be robust.

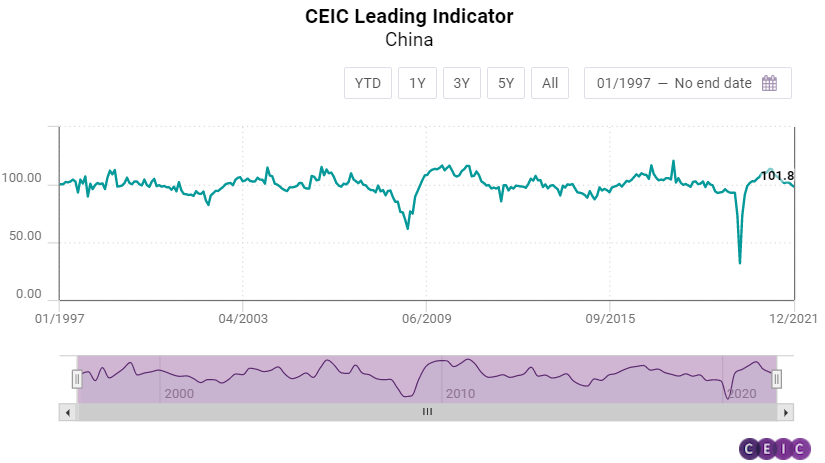

China: Slowdown Expected in H1 2022

The CEIC Leading Indicator for China improved to 99.9 in December 2021 from 98.98 in the previous month. However, December’s reading was still below the long-term average of 100. The official manufacturing PMI stood at 50.3 in December 2021, up from 50.1 in the previous month. Automobile production finally recorded a positive y/y growth in the last month of 2021, increasing by 2.35%. Growth of money supply M2 accelerated to 8.97% y/y in December 2021 from 8.47% y/y in the previous month.

The growth rate of financial institution deposits also accelerated to 9.26% y/y from 8.6% in November. Throughout 2021, the floor space sold of commodity buildings increased only by 1.9% y/y, down from 4.84% y/y in the first 11 months of 2021. The smoothed CEIC Leading Indicator continued to move downwards. In December, it declined further to 98.79 from 99.42 in the previous month, anticipating the further slowdown of China's economic growth in H1 2022.

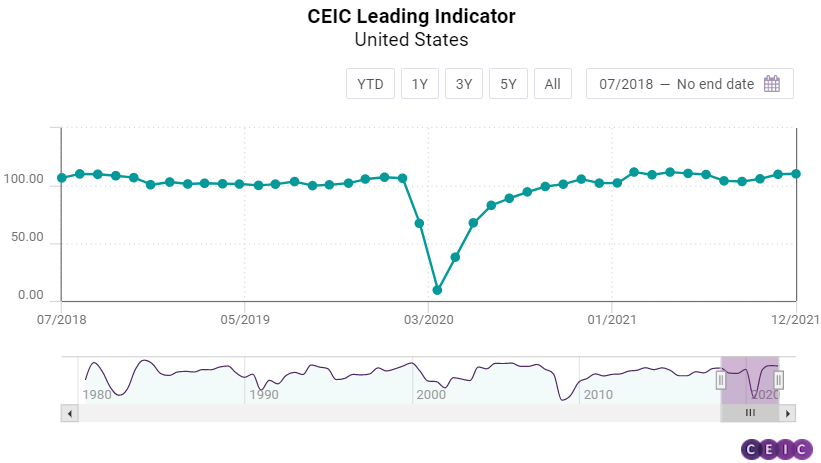

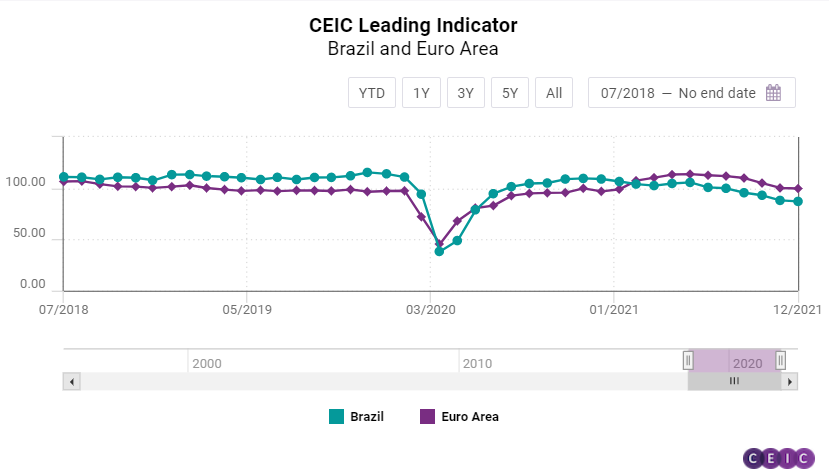

US, Euro Area and Brazil: US Performs Strongly, EA and Brazil Further Down

The CEIC Leading Indicator for the US grew for a third consecutive month in December 2021, increasing by 0.3 points to 107.8. However, the growth decelerated visibly from the 2.6 and 1.8 points in October and November, respectively. December was also the eleventh consecutive month of the non-smoothed indicator being above the threshold value of 100, which separates expansion from contraction. The smoothed CEIC Leading Indicator remained unchanged at 106.4, after five months of deceleration. The performance of the CEIC Leading Indicator was supported by a rebound in motor vehicle sales, which rose to 1.2mn units in December from 1mn units in the previous month, although on a yearly basis the decline was still significant, by 25.5%. Consumer confidence was at its highest since July, at 115.8 compared to 111.9 in November, despite rising inflation and the spread of the Omicron variant of the coronavirus. The housing market was at its strongest in 12 months, reflecting robust demand for new homes among US consumers. The labour market conditions continued to improve, with unemployment insurance claims dropping under 200,000 on average in December, below pre-pandemic figures. On the other hand, ISM manufacturing PMI dropped to its lowest level since January, at 58.7, although it is still way above the threshold value of 50. The S&P 500 index closed in December at a record high of 4,766.2, gaining 4.3% m/m.

In the eurozone, the CEIC Leading Indicator remained below 100 for the second consecutive month in December 2021. It declined to 96.9 from 97.5 in November, the lowest reading since January 2021. The smoothed indicator dropped below 100 for the first time since December 2020, suggesting that the eurozone might be entering a contraction phase of the business cycle. Consumer confidence in the eurozone deteriorated in December, declining by 2.2 pp, the worst since February. Inflation continued to boom, reaching 5%, seasonally adjusted, the highest on record. Financial constraints in the construction sector increased slightly according to DG ECFIN’s business confidence survey. Industrial confidence accelerated for the first time since June, by 12.9 pp. The employment component of the manufacturing PMI also improved slightly in December, increasing to 55.3. The Dow Jones Euro Stoxx index regained its November losses, managing to close December at a record high of 478.8.

The CEIC Leading Indicator for Brazil fell for the sixth straight month in December 2021, standing at 85.4, well below the threshold of 100. The fast-growing inflation and the rising interest rates may continue to reduce Brazilians’ purchasing power during the year. Consequently, Brazil’s domestic demand may remain moderate in 2022, with a negative impact on the overall economic activity, particularly on retail and manufacturing. Rising inflation expectations were at the core of the underwhelming performance of the CEIC Leading Indicator in the last month of 2021. The FGV’s consumer inflation expectation indicator rose to a five-year high of 10.1 in December, from 10 in November, reflecting higher prices of electricity and fuels. Amid weak demand and a global shortage of parts and components in the manufacturing sector, the manufacturing confidence indicator dropped to 0.1% in the last month of the year, from 2.1% in November. The heated construction industry may slow down gradually in the next months, as the expectation to purchase inputs index slipped to 54.2 in December from 54.4 in November 2021. After reaching a seven-year high of USD 82 in October, international crude oil prices declined to a monthly average of USD 74.4 per barrel in December. The equity market index Ibovespa improved in December, rising to 104,822 in the last business day of the year, from 101,915 at the end of November.

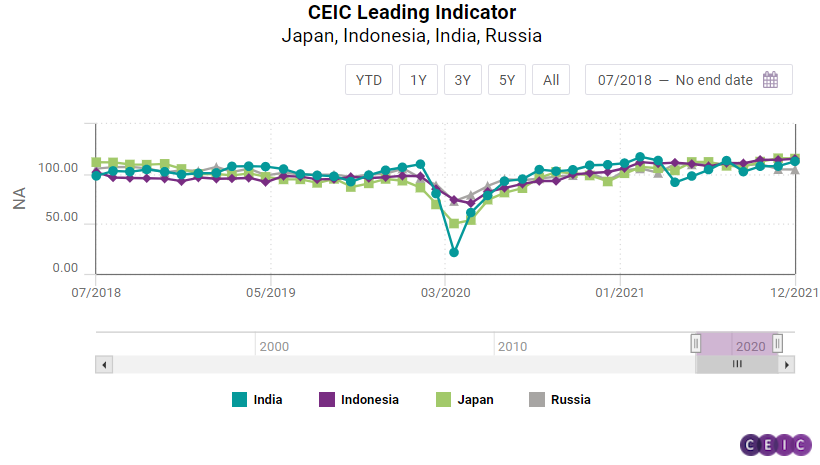

Japan, India, Indonesia and Russia: No Significant Changes

In Japan, the CEIC Leading Indicator decreased marginally on a monthly basis, falling to 115.4 from 115.7 in November, but is still among the best performing. The corporate manufacturing sentiment dropped to 54.8 from 57.9 in November, ending three consecutive months of acceleration. On the consumer side, households assessed their overall livelihood as better in December compared to the previous month, with the consumer confidence index increasing by 0.5 points to 38.6. Domestic machine tool orders rose by 61.2% y/y, the slowest growth rate since March, signalling that the low base effect from 2020 might soon dissipate. On the other hand, motor vehicle sales declined by 11.4% y/y, improving from the 14.3% drop in November. The TOPIX small stock exchange index closed December at 2,352.2, up 3.6% m/m, managing to regain some of the losses in November.

The CEIC Leading Indicator for India increased for the third month in a row, to 112.7 in December 2021, from 107.8 in November. This development can be attributed to an uptick in electricity generation in the country, as well as to a slight monthly increase in the production of passenger cars. Electricity generation in India increased by 9.7% m/m and 2.5% y/y in December. Passenger vehicle production dropped by 13.2% y/y but increased by 2.9% on a monthly basis. The slight uptick in automobile production is a sign that the continuous global shortage of semiconductors might be easing. Crude steel production, which had been moderating since April, declined by 3.9% y/y in December. Money supply growth eased for the second month in a row, decelerating to 11.2% y/y, while the amount of 91-day treasury bills also decelerated to 9% y/y. The 91-day treasury bills yield rose to 3.66% pa, the highest since March 2020. India’s Bombay Stock Exchange (BSE) Sensex closed in December at 58,253.8, managing to regain some of the losses in November. The smoothed CEIC Leading Indicator increased by 1.6 points to an 11-year high of 110.4, thus signalling that the decline from the first half of 2021 did not lead to a contraction. However, India’s economic recovery continues to suffer from the global supply chain crisis, inflationary pressures and the rapid spread of the Omicron variant of the coronavirus.

Driven by high palm oil prices and robust motor vehicle sales, the CEIC Leading Indicator for Indonesia continues to perform strongly, despite easing slightly in December 2021. The non-smoothed indicator decelerated to 117.3 from 119 in November but is still close to the historic peaks. Motor vehicle sales in Indonesia increased by 69.2% y/y, benefitting from the luxury tax exemption introduced earlier in 2021. Palm oil prices averaged USD 1,350.7 per tonne, down from USD 1,411.9 per tonne in November, but are likely to remain high throughout the first half of 2022. Non-oil and gas exports growth eased to 37.1% y/y from 48.4% in November with exports to China slowing. The Indonesian rupiah closed December trading at IDR 14,269 per USD, slightly appreciating from IDR 14,340 per USD at the end of November. The Jakarta composite stock exchange index managed to regain some of the losses in November and closed the last month of 2021 at 6,581.9. The smoothed CEIC Leading Indicator continued to rise and reached 118.2 in December, close to the historic peak of 120.6. This signals that Indonesia’s economy is still expanding and has not reached the peak of its business cycle in the post-COVID recovery.

The CEIC Leading Indicator for Russia dropped to 104.5 in December 2021 from 104.8 in the previous month. Crude oil prices averaged USD 74.4 per barrel in December, declining for the second consecutive month, which affected Russia’s energy reliant export portfolio. Sales of automobiles on the domestic market increased slightly compared to November, amounting to 133,470 units but are still far from their performance in December 2020, declining by 19.9% y/y. Production tendency in manufacturing dropped to 13.1%, seasonally adjusted, the lowest since May. The RTS stock exchange index closed December at 1,595.8, the worst performance since May.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)