-png.png?width=747&name=shutterstock_585735608%20(1)-png.png)

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

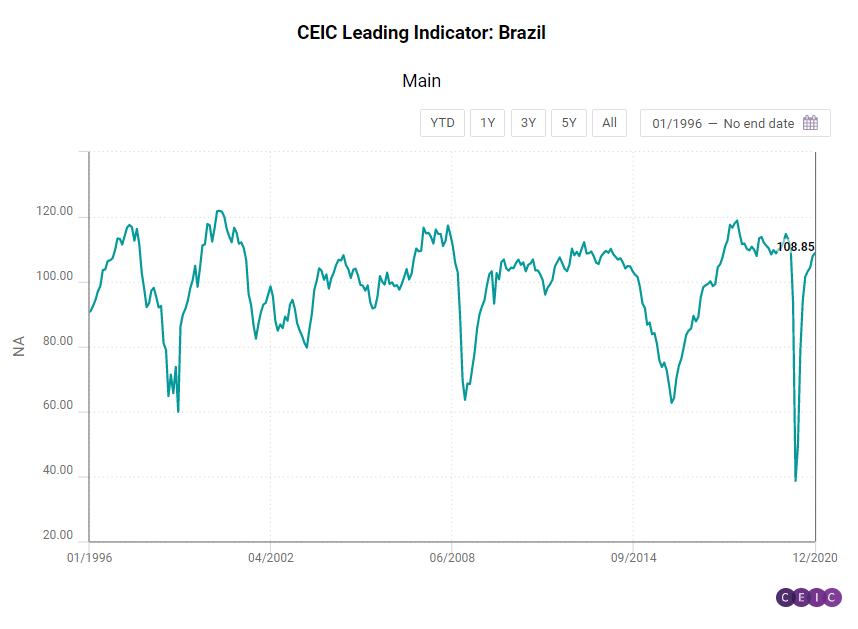

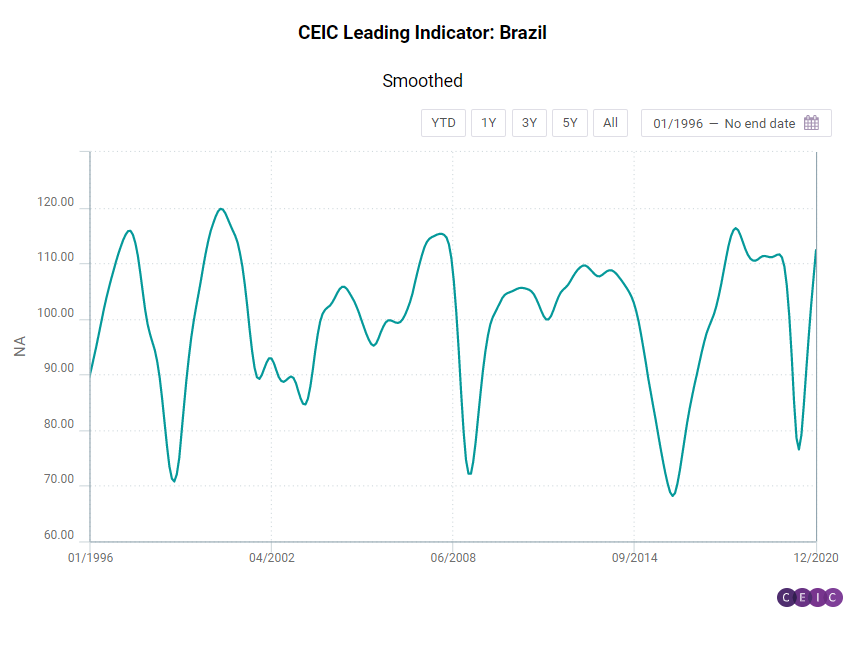

The Brazilian economy is expected to grow moderately in Q3 2021, below the long-term trend, according to the CEIC Leading Indicator for Brazil, which anticipates the development of economic activity. The index stood at 108.85 in December 2020, higher than the neutral value of 100, but lower than the long-term smoothed indicator, which was 112.35 in the same month. Some key variables supported the performance of the raw indicator in December. The manufacturing confidence indicator reached 14.9 in the month, a ten-year record, as many factories are stepping up production to meet the domestic demand stimulated by income transfer programmes and lower interest rates. In the construction industry, the expectation to purchase inputs index was 54.5 in the month, above the neutral value of 50, but lower than the 56.7 recorded in December 2019. On the financial markets, the equity market index jumped to 119,017 in the end of December, from 108,893 in the end of November, supported by positive news about COVID-19 vaccines. Following the same trend, the crude oil prices rose to a monthly average of USD 49.2 per barrel in December from USD 42.6 per barrel in November. Domestic demand is likely to remain heated in the medium run, according to the consumer inflation expectation indicator, which was 5.2, compared to 4.8 in November 2020 and December 2019.

The smoothed leading indicator stood at 112.35 in December 2020, the highest value in 29 months, which means that the country should enter a more accelerated long-term growth path than that observed before the coronavirus outbreak, reflecting the return of GDP to pre-pandemic levels. The monetary easing programme implemented by the central bank may be a driving force by increasing the amount of loans, and maintaining economic activity after the end of the temporary income transfer programmes in December 2020. In the second quarter of 2021 the country is expected to witness significant growth on the back of a low comparison basis, as social distancing measures resulted in a plunge of economic activity between March and June 2020.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)