-png.png?width=747&name=shutterstock_1456179932%20(2)-png.png)

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

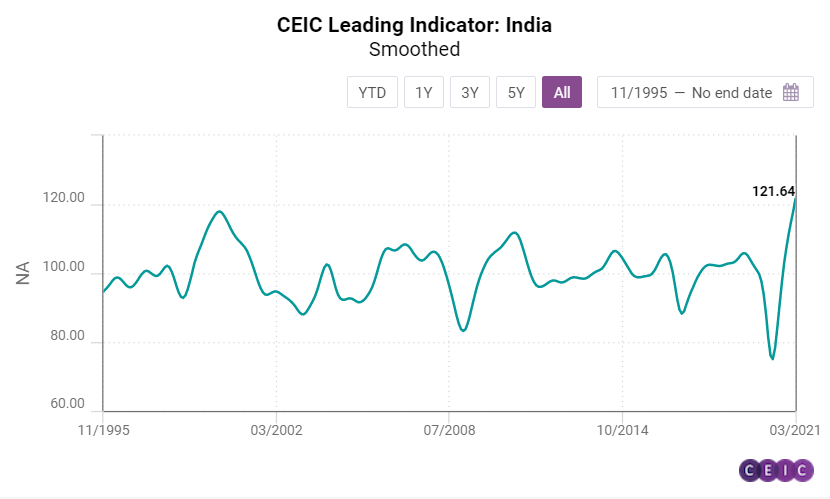

The CEIC Leading Indicator for India surged to 122 in March 2021 from 115.4 in February. The key driver of the increase in the indicator was a historic rise in electricity generation, by 23.5% y/y in March 2021, primarily on the back of a low base effect. India underwent a stringent lockdown between March 25, 2020, and May 3, 2020, which is likely to cause a low base effect for many other indicators. Steel production also benefitted from the low base, with a stellar increase of 25.7% y/y in the finished steel segment in March 2021 and a 19.3% y/y increase in the crude steel segment. Owing to the same phenomenon, passenger vehicle sales posted a whopping 78.7% y/y increase. Monetary indicators such as money supply and the amount outstanding in 91-day treasury bills both slowed down, to 15.5%and 9.4% y/y, respectively. The 91-day treasury bill yield increased once again to 3.3% in March 2021, signalling volatility in markets, thanks to an increase in new COVID-19 cases in the country. The Bombay Stock Exchange Sensex index averaged at 50,100 before closing at 49,509 at the end of March, showcasing the economic uncertainty accompanying the mounting cases of infections. The wholesale food prices also increased sharply in March 2021, by 5.3% y/y.

The smoothed CEIC leading indicator increased from 118.3 in February to 121.6 in March 2021. This increase was more cautious, accounting for the base year effect, and incorporating the downside risks from the new infections. India’s second wave of COVID-19 has been more severe, and the country has replaced Brazil as the second-worst affected nation globally. While another national lockdown is unlikely, sporadic lockdowns and curfews across the nation threaten to slow the economic recovery process of India in the short term.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)