-png.png)

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

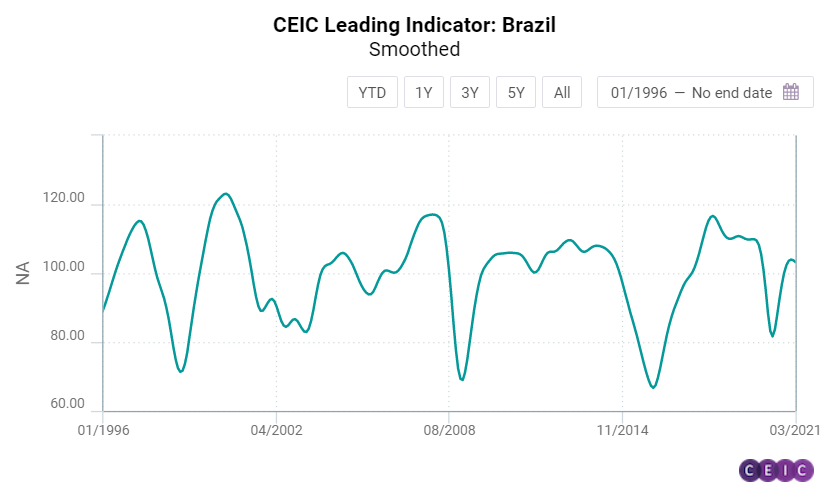

Brazil is going through yet another wave of rising COVID-19 infections, which was reflected in the performance of the CEIC Leading Indicator for March 2021. The non-smoothed value of the indicator fell to 99.7, dropping below the threshold of 100 for the first time since July 2020. The development of the smoothed CEIC Leading Indicator might be even more worrisome, as it registered a monthly decline for the second time in a row, suggesting that Brazil could be past the peak of the business cycle and entering a period of decline. The manufacturing confidence indicator recorded its third fall in a row to 4.2% in March 2021, seasonally adjusted, due to the high numbers of COVID-19 infections and deaths which had an adverse effect on new orders and production output for firms in the sector. In the construction industry, the expectation to purchase inputs index slipped for the second month in a row, to 52.4 from 55.3 in February 2021, approaching the neutral value of 50. The inflation expectation index rose for the third time in a row, reaching 5.5 driven by an increase in production costs and the ever-increasing prices of fuels. International crude oil prices rose to a monthly average of USD 64.6 per barrel in March 2021, from USD 61.1 in the previous month.

The smoothed CEIC Leading Indicator dropped to 103.2 from 103.7 in February 2021, signaling that the business cycle might have passed its peak. A value above 100 suggests that the country is still performing above the long-term average, but the economic rebound might be short lived.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)