The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator which is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan and the United States.

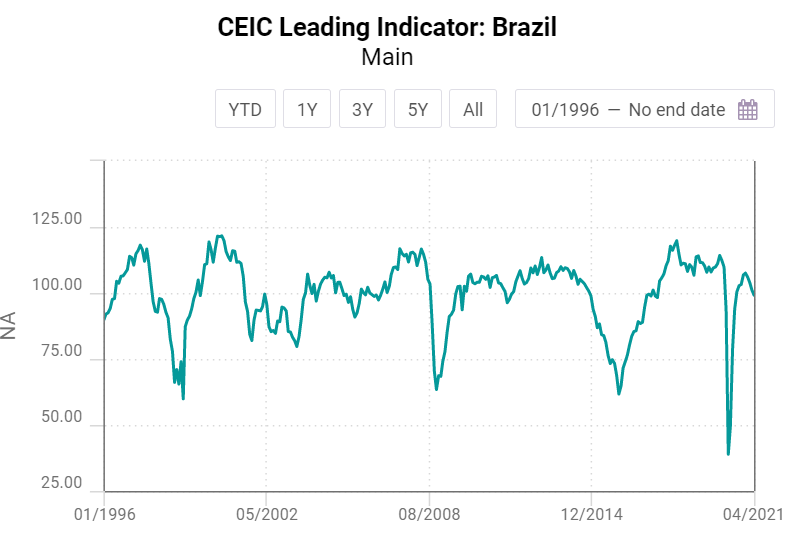

The CEIC Leading Indicator for Brazil fell to 99.2 in April 2021 from 101.2 in March, as many regions implemented lockdowns to rein in the spread of COVID-19 and avoid a collapse of the healthcare system. The indicator stood below the benchmark value of 100 for the first time in nine months, which means that the recovery of economic activity in the next months may slow. Some key variables supported the performance of the CEIC Leading Indicator in the fourth month of 2021. The manufacturing confidence indicator recorded its fourth fall in a row to 3.5% in April, seasonally adjusted, as many factories halted operations because of regional lockdowns and shortage of inputs. Consequently, the sales of new vehicles declined to 191,853 units from 208,801 in March.

In the construction industry, the expectation to purchase inputs index narrowed to 51.7 from 52.4 in March 2021, as the sector also struggles with a shortage of construction materials and an increase in building costs. The consumer inflation expectation indicator reached 5.6 in April, the highest figure in thirty months, as inflation indices accelerated on the back of higher prices of fuels. In contrast, international crude oil prices inched down to a monthly average of USD 63.2 per barrel in April, from USD 64.6 per barrel in March. In the stock markets, the equity market index rose to 118,893 at the end of April from 116,633 at the end of March, amid lower political uncertainties after the approval of the 2021 federal budget.

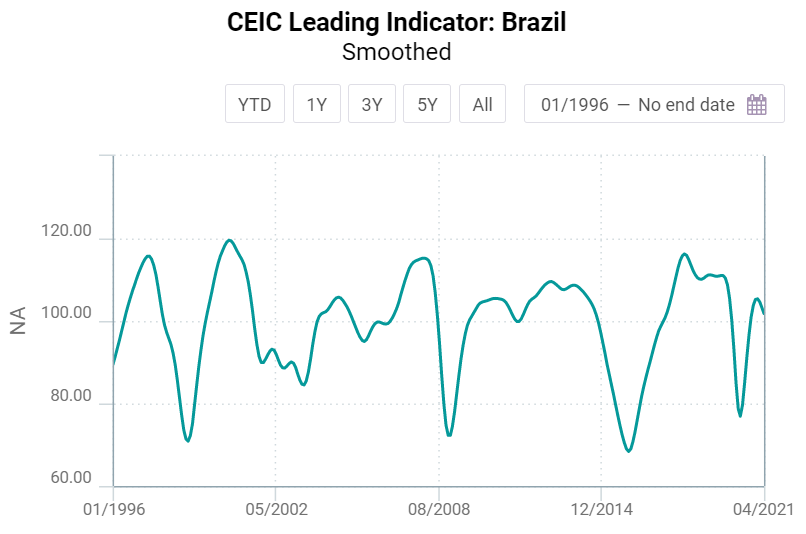

The smoothed CEIC Leading Indicator also declined in April, by 1.5 points, but stood at 101.8 – higher than the neutral value of 100 – meaning that the economy may continue on a recovery path in the long run. Since mid-April, the most populous states have relaxed some social distancing measures, as ICU occupancy rates have fallen. Moreover, the country had vaccinated most of its elderly population by the end of April, which also helped reduce hospitals’ occupancy rates.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)