-png.png)

The CEIC Leading Indicator is a proprietary dataset designed by CEIC Insights to precede the development of major macroeconomic indicators and predict the turning points of the economic cycle for key markets. It is a composite leading indicator that is calculated by aggregating and weighting selected leading indicators covering various important sectors of the economy, such as financial markets, the monetary sector, labour market, trade, and industry. It is developed through a proprietary CEIC methodology and employs data from the CEIC database. The CEIC Leading Indicator currently covers eight regions – Brazil, China, India, Indonesia, Russia, the Euro Area, Japan, and the United States.

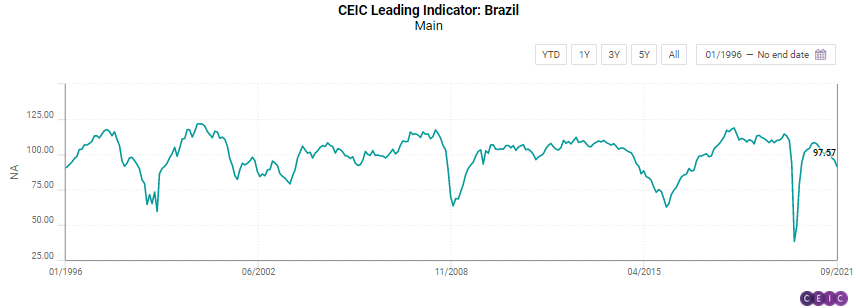

Brazil’s economy may grow below the long-term trend in H1 2022, according to the CEIC Leading Indicator, which anticipates turning points of the business cycle. After recording a five-month high of 103.5 in June, the indicator fell to 92.6 in September, below the threshold of 100 for the third straight month. The struggling labour market and the rising inflation, amid a severe energy crisis, hamper hopes for substantial GDP growth after the pandemic, and thus the biggest economy in Latin America may see subdued economic activity in 2022.

Some key variables supported the performance of the CEIC Leading Indicator in September. The equity market index Ibovespa fell to 110,979 at the end of September from 118,781 at the end of August. The heated construction industry may slow down in the next months, like the expectation to purchase inputs index slipped to 55.1 in September from 55.9 in August 2021. The consumer inflation expectation indicator peaked at 7.7 in September, supported by higher prices of electricity, food, and fuels. The international crude oil prices rose to a monthly average of USD 73.9 per barrel in September from USD 70.3 per barrel in August. The manufacturing confidence indicator dropped to 6.4% in the ninth month of the year from 7% in August, which can be explained by the global shortage of parts and components and inflationary pressures.

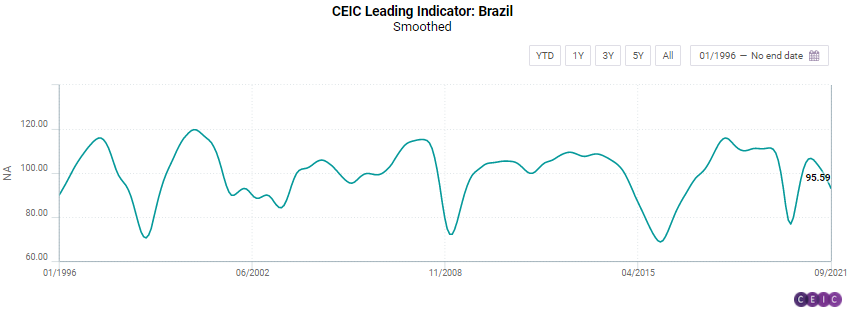

In the long run, Brazil’s economic growth may also moderate, as the smoothed CEIC Leading Indicator fell by 2 points to 94.7, below the neutral value of 100. The central bank may continue to reduce monetary stimulus in response to the growing inflation, increasing the benchmark interest rate Selic until the end of 2021, and keeping it around the same level in 2022. In addition, political uncertainties may also have some negative impact on Brazil’s economic performance in the next year, as the country will have elections in October 2022.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)