CEICData.com © 2018 Copyright All Rights Reserved

CEICData.com © 2018 Copyright All Rights Reserved

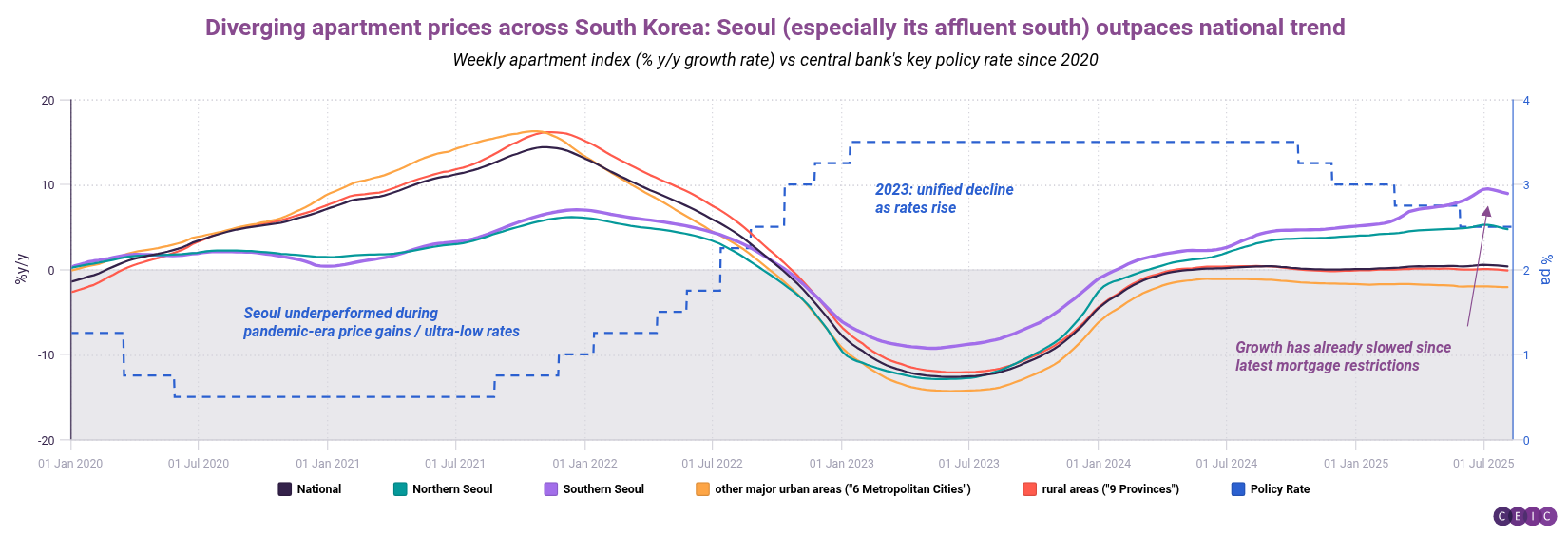

Seoul's wealthiest districts have decoupled from the national trend — and given falling interest rates, the house-price boom has South Korea's new government concerned enough about a bubble to tighten up mortgage rules.

To curb speculative demand for apartments, the new policy includes a uniform cap of 600 million won (about USD 430,000) on home loans and prohibits owners of more than one home from obtaining new mortgages in the capital region.

Our chart shows the context for this move. While price growth has remained sluggish in rural areas and secondary cities, apartments in Seoul — particularly in affluent southern districts like Gangnam — started surging over the past year.

The policy already appears to be having an effect: our weekly figures on Seoul apartments show five consecutive weeks of slowing growth since the June 27 implementation.

The divergence is notable when compared to the pan-national housing bust of 2023, when surging interest rates constrained mortgage availability. And during the pandemic, Seoul districts were relative underperformers.

While the new regulations target the demand side, supply constraints also help explain Seoul’s soaring property prices. Our second chart highlights this imbalance: unsold apartment inventory in the capital accounts for just 5% of monthly transactions, compared to over 30% nationally.

Despite the sluggish housing markets outside Seoul and rising input costs for homebuilders, the current environment has helped South Korean construction stocks outperform the broader KOSPI. This rally is fueled by the new government’s shift toward stimulus-led growth through increased nationwide infrastructure investment, boosting investor confidence across the sector.

Meanwhile, the central bank has taken a dovish stance to support the economy amid weakening global demand and pressure from US tariffs.

Since October 2024, the Bank of Korea has cut its policy rate by 100 basis points (though it held rates steady at 2.5% at last month's meeting). The central bank faces a policy dilemma: lowering rates supports domestic growth, but also could risk fueling a real-estate bubble. The BoK has emphasized financial stability concerns — particularly regarding the Seoul housing market and households' leverage — as a key policy consideration.

As of Q1 2025, household debt amounted to over 90% of GDP — one of the highest ratios in the world, trailing only Australia and Canada. Not only does this put borrowers' finances and the economy at risk of a downturn; mortgage costs could also crowd out consumer spending.

Meanwhile, we turn to our proprietary South Korean inflation nowcast for insights into what the BoK's next move might be when it meets on Aug. 28. Our nowcast suggests inflation will remain around the central bank's 2% target, supporting the case for further monetary easing -- but the timing of another cut might largely depend on what happens to those Gangnam apartments.

Click here to read about our proprietary South Korean inflation nowcast

If you are a CEIC user, access the story here.

If you are not a CEIC client, explore how we can assist you in generating alpha by registering for a trial of our product: https://hubs.la/Q02f5lQh0

CEICData.com © 2024 Copyright All Rights Reserved