High inflation might not be "entrenched" (yet), as per ECB's wording, but the topic of inflation is apparently here to stay in 2022, as multiple monetary authorities globally have already begun their battle against record-high consumer price growth rates. The rising concerns about potential stagflation are not unfounded, as monetary policy tightening might put the breaks to economic growth.

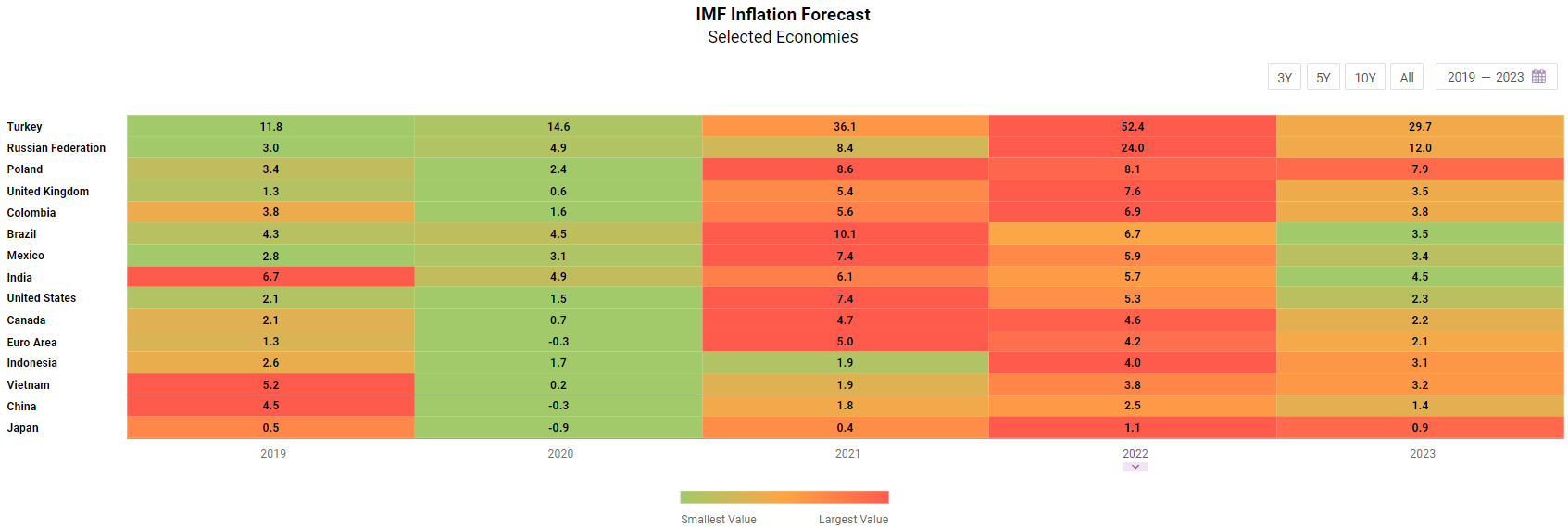

In that sense, the CEIC database is constantly expanding its inflation coverage, introducing relevant indicators, in order to provide a base for comprehensive monitoring and analysis. This expansion is reflected in the visuals below, focusing on selected economies from developed markets, as well as emerging economies in Asia, Europe and Latin America. As diverse and unique as all of these countries might be, none of them was spared the implications of the global supply chain disruptions and growing commodity prices in a still highly globalized economy.

This insight provides valuable comparisons between inflation targets, how the inflation in the respective economies deviates from the target, as well as an overview of the policy rates and IMF's inflation forecasts. Further, the regional grouping offers a glimpse of the particularities of each selected market and the wider region.

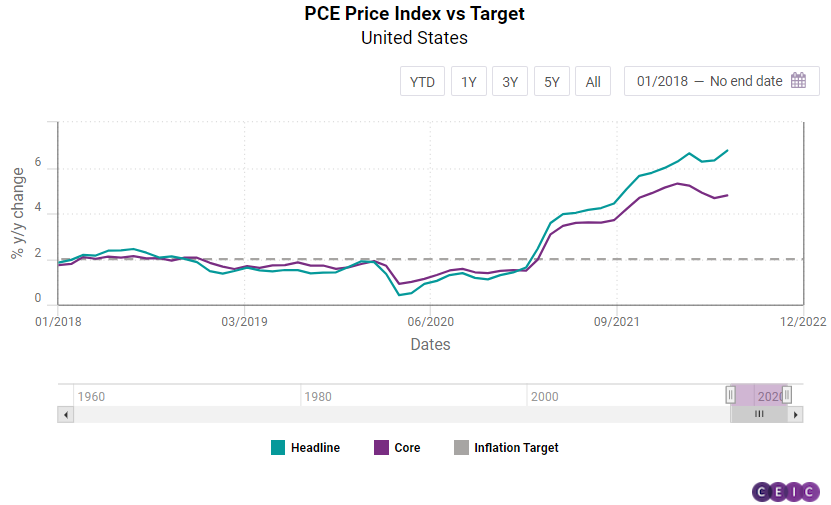

- By historical standards, households and businesses in big developed markets like the US and the Euro Area are the most concerned about the currently observed high inflation, which climbs to decade-highs. Further, if the authorities fail to strike a balance between taming prices and maintaining the growth rate, the most likely outcome will be stagflation. The Federal Reserve Bank of the US started its monetary policy tightening this year, and its preferred gauge for measuring consumer inflation, the personal consumption expenditure (PCE) price index shows signs of decelerating. The headline indicator stood at 6.4% in May compared to 6.6% y/y in March. The core PCE index, which excludes volatile components like food and energy prices, exhibits a more pronounced deceleration slowing down to 4.7% in May from a recent peak of 5.3% y/y in March. In neighbouring Canada, the majority of businesses are bracing for a high inflation period, as 78% of the respondents in the Business Outlook Survey forecast inflation above 3%.

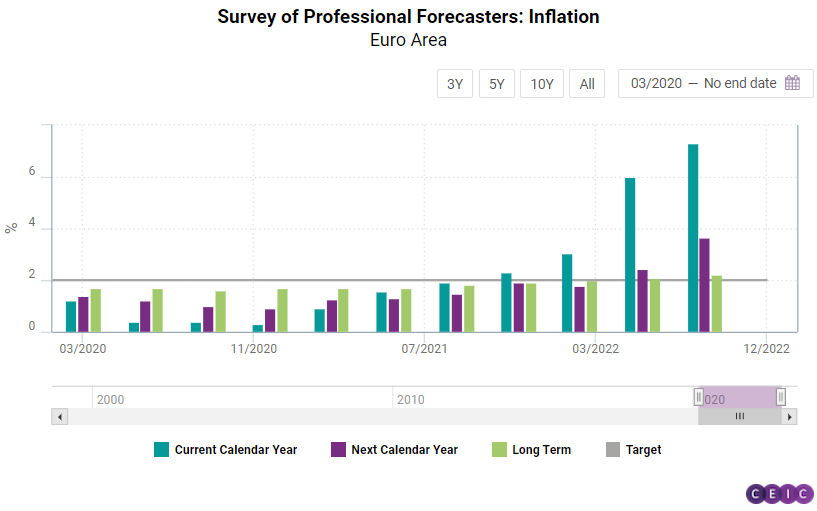

- Unlike the Fed, the European Central Bank (ECB) maintained its accommodative monetary policy stance for longer and put an end to its quantitative easing in Q2 2022. Accordingly, it lifted its key interest rates in July for the first time in 11 years. Essentially the end of the cheap money era in the Euro Area might lead to a recession, especially in an environment of elevated geopolitical uncertainty and looming energy crisis. ECB's survey of professional forecasters has been revising its inflation projections upwards since Q1 2021 and as of Q3 2022 points to average inflation of 7.3 in the current calendar year. It is expected to stay above target in the following calendar year and eventually reach the target of 2% in the long term.

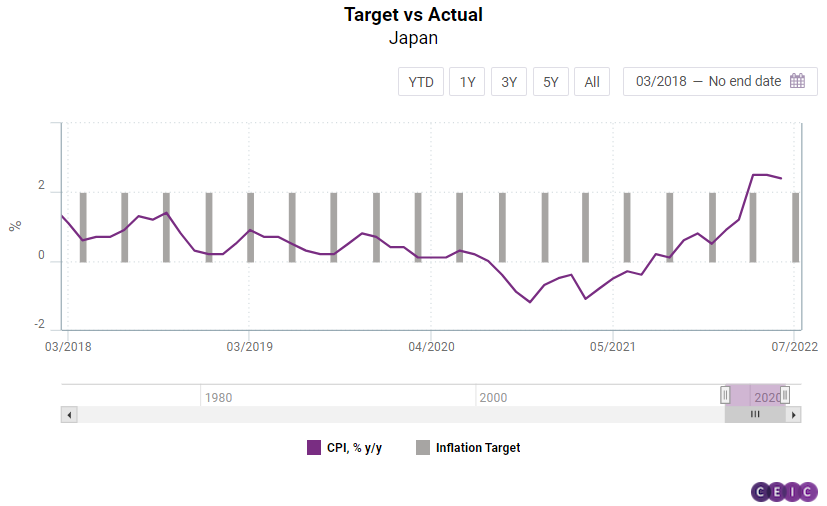

- Japan is a notable outlier among the developed economies because the consumer inflation there is significantly lower than that of the US and Western Europe. However, price growth in Japan is at an 8-year high of 2.4% in June, albeit decelerating slightly from 2.5% y/y in the previous month.

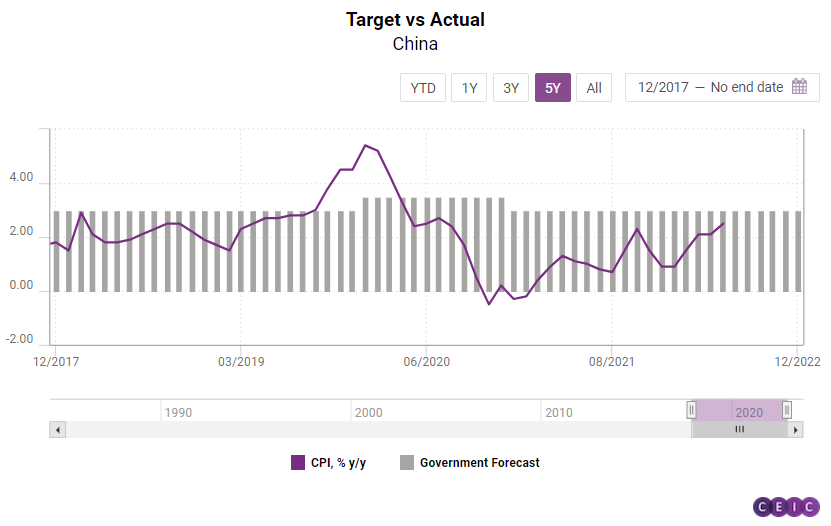

- In the current global high-inflation environment, the Asian markets get the least attention, as they are not experiencing the spikes observed in other continents. The consumer price index in China stays a bit below the target level of 3% since the resumption of economic activity following the COVID-19 outbreak back in 2020. Prior to that, China saw accelerated inflation: in January 2020 it reached 5.4% y/y, the highest level since 2011. Curiously enough, Vietnam is another Asian emerging market, where inflation is contained below, but close to the target.

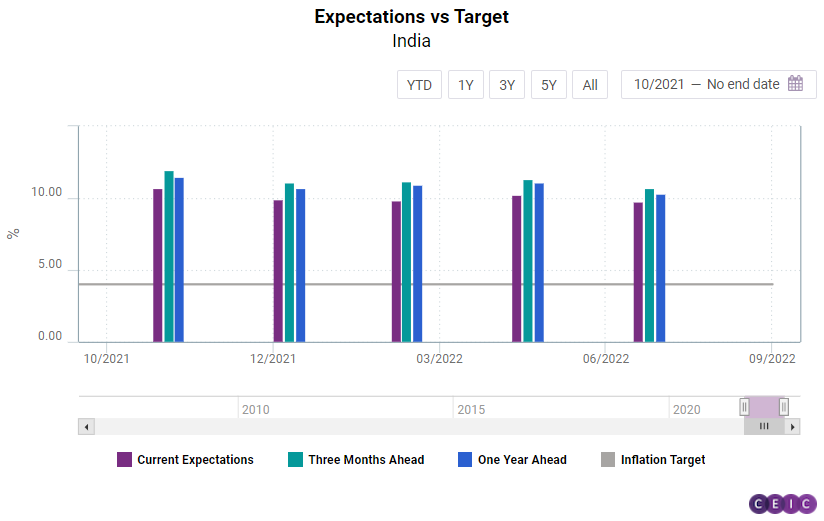

- In India, the most recent data points to an inflation of 6.8% y/y, which is above the target set at 4%. The Reserve Bank of India (RBI) publishes a survey of inflation expectations among households and apparently the population forecasts acceleration of consumer prices, both short and medium term, as the current expectations are for 10.25% y/y, for the next three months - 11.4%. Even one year ahead, Indian households revise their forecasts only to 11.1% y/y, which is well above the target and the actual figures.

- In Indonesia and the Philippines for example, inflation is above target, but still in the single digits. In Indonesia, the expectations of the government are the same as the Central Bank's target (3%), while the actual inflation reached 4.4% y/y in June. The Philippines have a target range of 2-4%, while inflation has been following a rather steeper path, with the consumer price growth rate staying at 6.1 in June, a four-year high. The Central Bank's expectations, on the other hand, exhibited a less pronounced increase by 0.2pp in June to reach 5.7% y/y for the next 12 months.

Keep informed each month on the predicted turning points of the economic cycle for key markets with our free, proprietary CEIC Leading Indicator. Learn more and register here

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)