CEICData.com © 2018 Copyright All Rights Reserved

CEICData.com © 2018 Copyright All Rights Reserved

Chile’s presidential race is headed to a polarized run-off vote on Dec. 14. Communist Party candidate Jeannette Jara is trailing anti-immigration conservative José Antonio Kast in the polls.

With markets overwhelmingly pricing in a Kast victory (Polymarket put his odds of winning at 96% as of Dec. 2), Chilean assets have rallied sharply. Kast has pledged to cut spending by USD 6 billion over 18 months and reduce corporate taxes to reignite investment. This has reversed the capital flight that defined the early years of outgoing president Gabriel Boric’s regime.

.png?width=1210&height=1050&name=Chilean%20politics%20and%20international%20investment%20outflows%20under%20Boric%20inflows%20ahead%20of%20likely%20Kast%20win%20(1).png)

We've tapped exclusive fund-flow data from EPFR to show the decisive shift in investor positioning.

As our visualization shows, bond investors began aggressively buying Chilean assets from mid-2025, anticipating a business-friendly outcome in the vote. We also compared this trend to Cbonds indices tracking the recent rally in corporate and sovereign debt: both are up roughly 10% year-to-date.

Our second chart takes a continent-wide view. Chilean inflows have now caught up with the rest of Latin America following the outflows seen earlier in the Boric years.

EPFR data also shows that the Global Emerging Market (GEM) category of active fund managers have significantly increased their weighting in Chilean bonds. This marks a major turning point; these managers had been persistently underweight Chile for years.

Touring Chile's macro indicators and financial markets suggests that investors are once again treating the nation as a regional safe haven. Chile now offers the lowest real yields (defined as the 10-year government bond yield minus the inflation rate) not only in Latin America, but among major emerging-market peers.

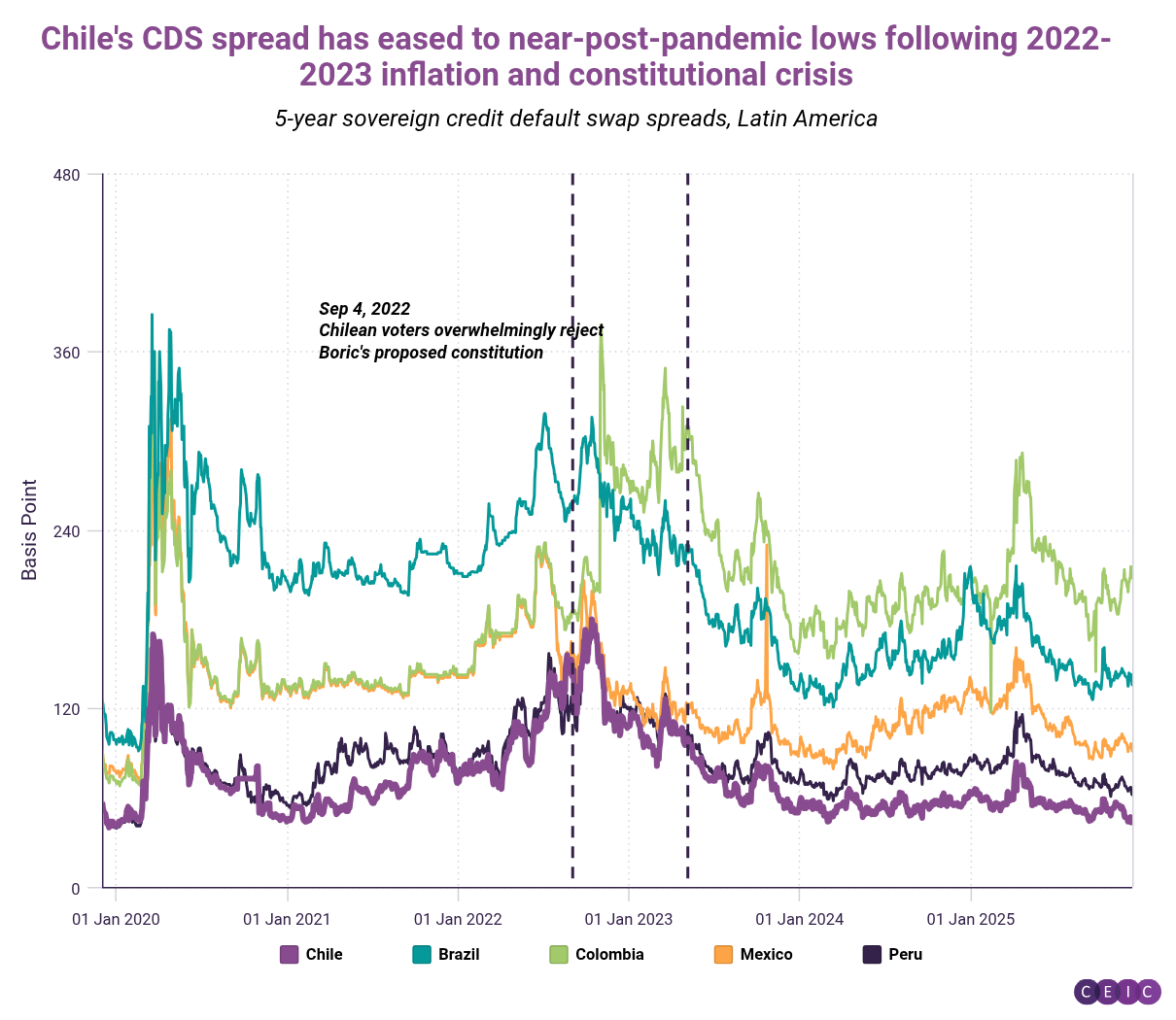

And after volatility stoked by Boric's 2022-2023 effort to replace the nation's constitution, the cost of insuring Chilean government debt against default has collapsed to near post-pandemic lows; its CDS spread has also diverged from neighboring Peru.

This provides the context for the likely rate cut from Chile's central bank on Dec. 16. Inflation has retreated within policymakers' 2-4% target range.

Finally, we revisit a previous theme: the relationship between copper prices and fund flows to Chilean equities. With copper prices staying strong this year, Chile -- the biggest producer of this metal -- has also seen a surge in equity inflows since mid-2025.

If you are a CEIC user, access the story here.

If you are not a CEIC client, explore how we can assist you in generating alpha by registering for a trial of our product: https://hubs.la/Q02f5lQh0

CEICData.com © 2024 Copyright All Rights Reserved