CEICData.com © 2018 Copyright All Rights Reserved

CEICData.com © 2018 Copyright All Rights Reserved

Developed markets' fiscal stress has been a regular theme in 2025. That has prompting commentators to muse about the "return of the bond vigilantes" -- a reference to the 1980s bond market, when indebted governments had to pay more to borrow amid investors' concern that their finances were not sustainable.

The bond vigilantes disappeared as bond yields were suppressed by central banks during the post-GFC era of quantitative easing. Today, G7 central banks are well into their loosening cycle to stimulate the economy -- but 10- and 30-year government bond yields aren't following suit, as our chart shows. The synchronized repricing of risk shows how investors are demanding a steeper premium to fund deepening deficits.

We could be headed to an era of "fiscal dominance" -- where central banks find their hands tied by ballooning government deficits and soaring debt-servicing costs, making it increasingly difficult to control inflation without destabilizing the sovereign debt market.

Our subsequent charts compare the strained debt metrics across major developed markets.

Bid-to-cover ratios for recent 30-year auctions have consistently indicated soft demand: the US and Japan have all suffered weak long-end auction results in recent months, as have Germany and Canada (whose auction results for benchmark government debt have recently been added to CEIC's database). Luckily, as our OECD chart shows, there is relatively less debt in total to refinance in the near term.

We've also revisited our fiscal bubble plot for developed countries. It shows how the US, France and the UK particularly stand out for high deficit-to-GDP ratios.

Finally, we have charted some of the stresses facing individual nations.

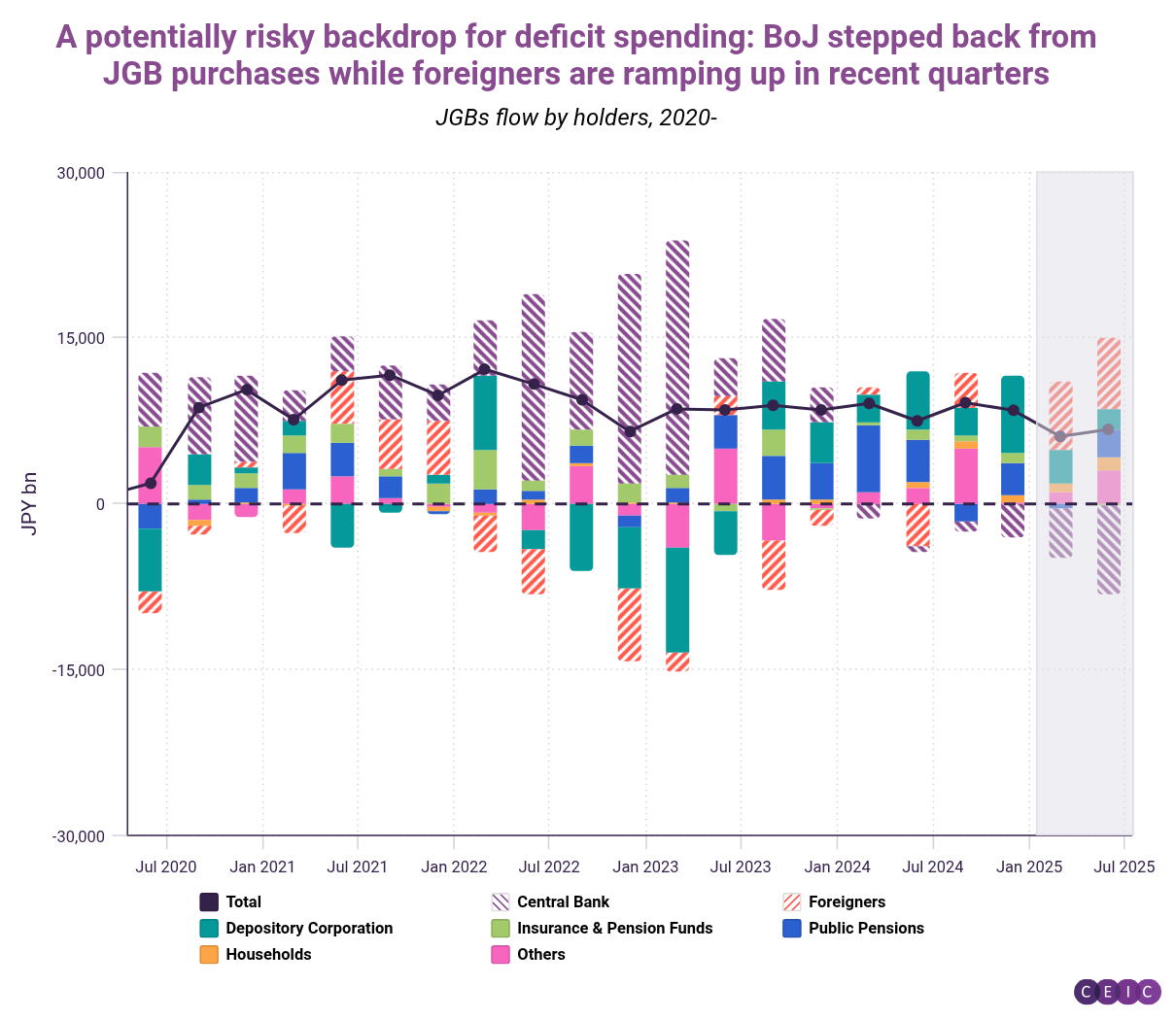

Japan: Ambitious stimulus meets a saturated bond market. Prime Minister Sanae Takaichi unveiled a massive stimulus package, but the lack of clarity on how it would be financed rattled the bond market. As our chart shows, foreigners had been buying the nation's debt as the Bank of Japan stepped back. (Japan already carries the world’s highest public-debt-to-GDP ratio, though most of its liabilities are yen-denominated and mostly owned by domestic creditors.)

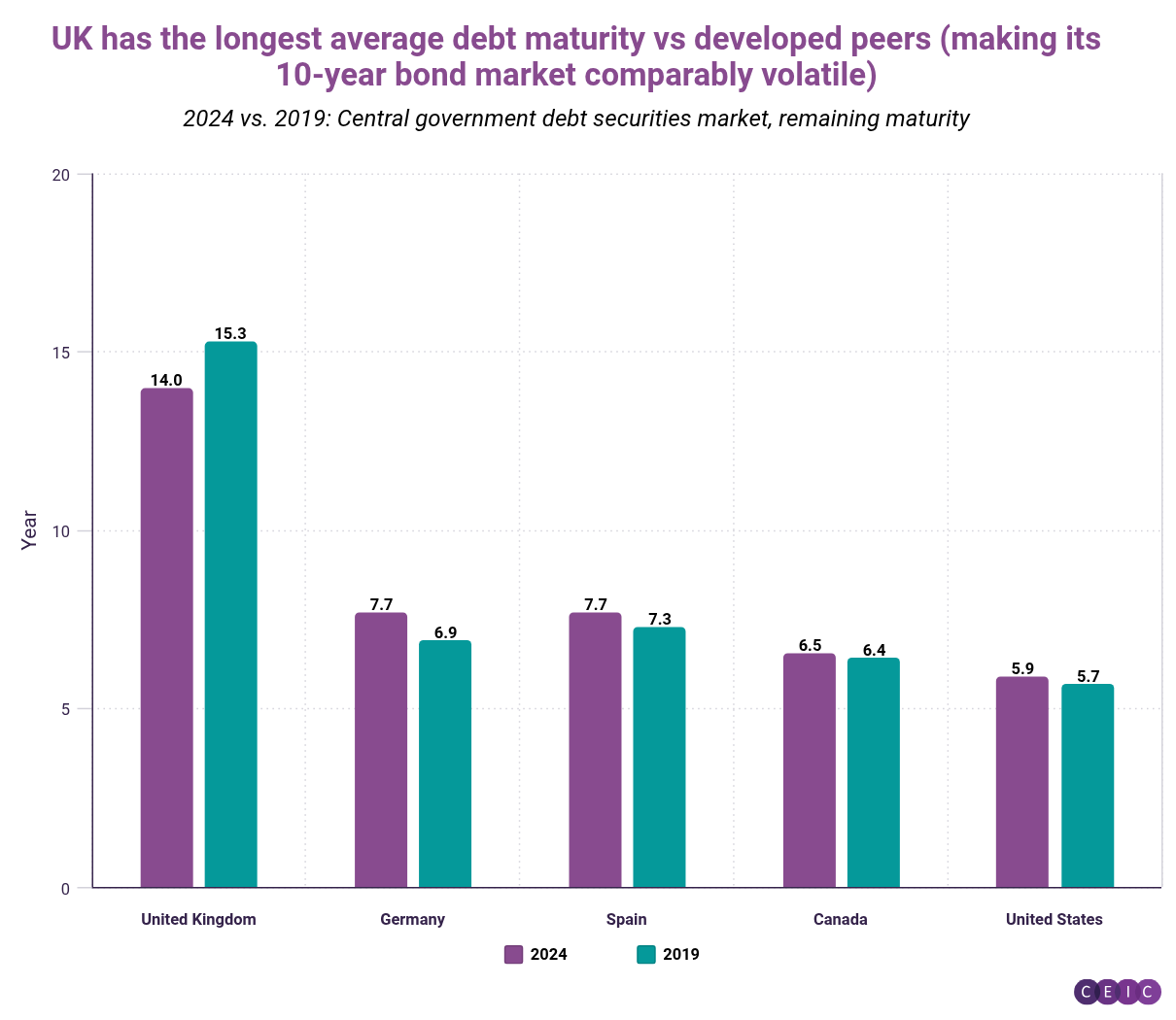

UK: Tax hikes restore bond-market calm. Chancellor Rachel Reeves' budget might have angered taxpayers, but it reassured the markets: investors piled into the pound and gilts, pushing yields down the most since April. (They remain the highest in the G7, however, as our first chart pointed out.) We've visualized a particularity of the British market: it has the longest average maturity of government debt, particularly when compared to the short-maturity focus of the US Treasury of late. This has meant even small shifts in UK sentiment or inflation expectations cause outsized swings in bond prices, i.e. duration sensitivity.

France: The key stress point in the Eurozone. Political gridlock has meant a succession of governments have fallen rather than repaired the nation's structural deficit, eroding investor confidence. The French 10-year yield continues to widen versus its German equivalent and has matched the Italian level.

Germany: Sluggish economy drives cautiously received fiscal pivot. Even with Germany's historic fiscal discipline and larger fiscal room versus peers (as we noted in our third chart), it has not been immune to bond vigilantes given the external environment. Recent 10-year and 30-year Bund auctions have delivered below-average bid-to-cover ratios, highlighting softer demand as investors absorb the prospect of materially higher issuance. (New Chancellor Friedrich Merz succeeded in getting lawmakers to relax the country's "debt brake" in March, enabling a massive ramp-up in defense, infrastructure, and stimulus spending.)

US: The highest debt-servicing costs. The Federal Reserve raised rates faster and higher than global peers, exacerbating the interest bill -- especially given the preponderance of short-term T-bills.

You can find government bond auction results for various markets at these links: US Treasury Securities Auction, Japanese Government Bonds Auction, German Federal Securities Auction, and Canadian Government Securities Auction

*The G7 PPP-weighted policy rate is calculated as the GDP-PPP-weighted average of the policy rates for the US, UK, Japan, the Euro Area and Canada.

If you are a CEIC user, access the story here.

If you are not a CEIC client, explore how we can assist you in generating alpha by registering for a trial of our product: https://hubs.la/Q02f5lQh0

CEICData.com © 2024 Copyright All Rights Reserved