CEICData.com © 2018 Copyright All Rights Reserved

CEICData.com © 2018 Copyright All Rights Reserved

Nvidia chief Jensen Huang's bid to negotiate directly with the White House to preserve his Chinese sales has thrust global semiconductor trade back into the spotlight. In an unusual deal, Nvidia and rival AMD will pay 15% of their revenue from certain artificial-intelligence chip sales in China to the US government, a significant softening of American export controls.

In this context, we are examining China's imports of US chips in an era where American presidents from both parties have increasingly moved to constrain this trade.

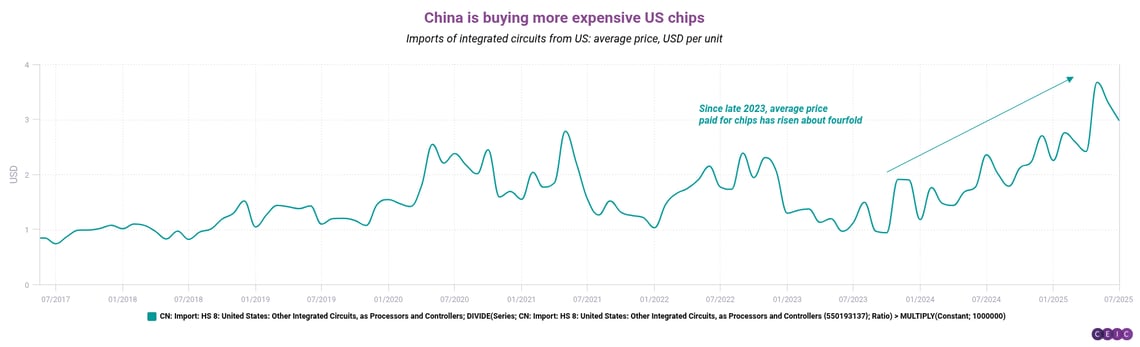

China’s imports of US integrated circuits have undergone a notable shift in both value composition and sourcing share. The first chart shows that the average price per chip imported from the US surged from less than USD 1 in 2017–2018 to nearly USD 4 by early 2025, reflecting a move toward importing high-value semiconductors -- such as AI accelerators and advanced processors.

Even a small number of these high-end chips can significantly lift the overall average, given that they can be priced in the tens of thousands of dollars.

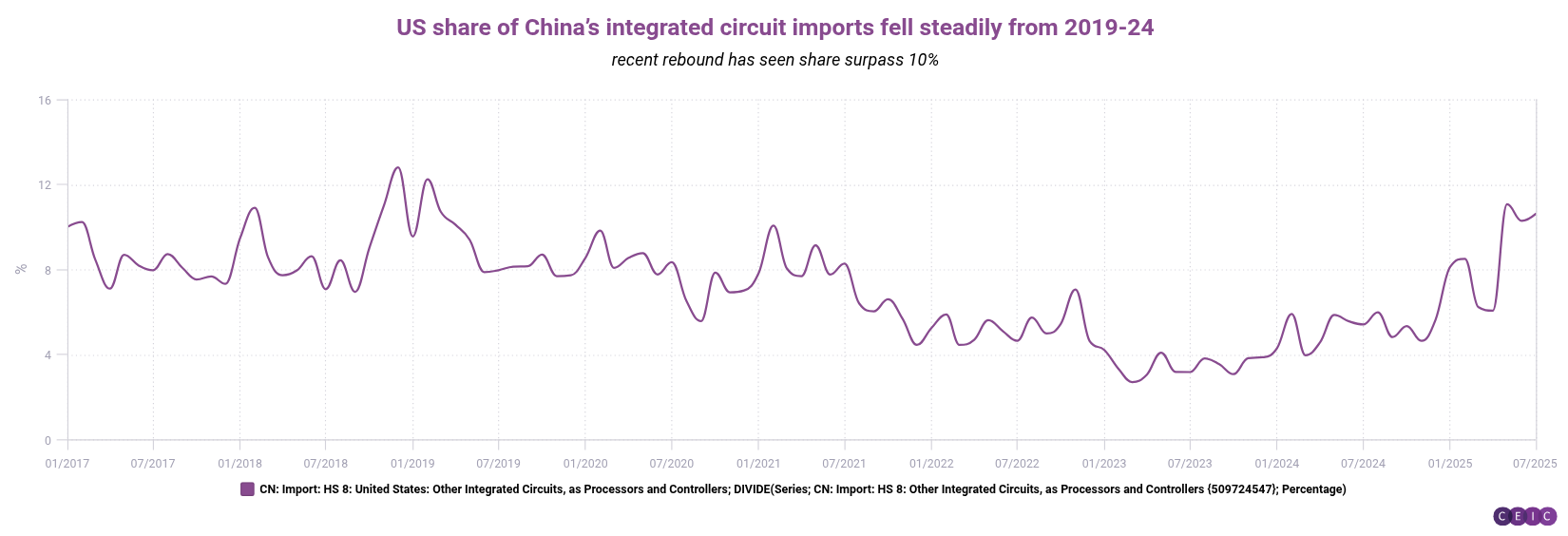

The second chart reveals that the US share of China’s total imports of these chips has generally trended downward since 2017, dropping from around 10–12% to a low of about 4% in 2023, before rebounding to about 10% in early 2025. Taken together, the data suggest that while the US is supplying a smaller portion of China’s total chip imports, the chips that are traded are increasingly concentrated in high-value categories.

For now, the US will still bar sales of the most advanced AI chips to China, citing security concerns; Trump officials have called Nvidia's H20 an "old chip". Nvidia has said it hopes the rules will allow US firms to compete in China and with Chinese companies globally, and had criticized a blanket ban for potentially speeding China's drive to complete independence from the US chip ecosystem.

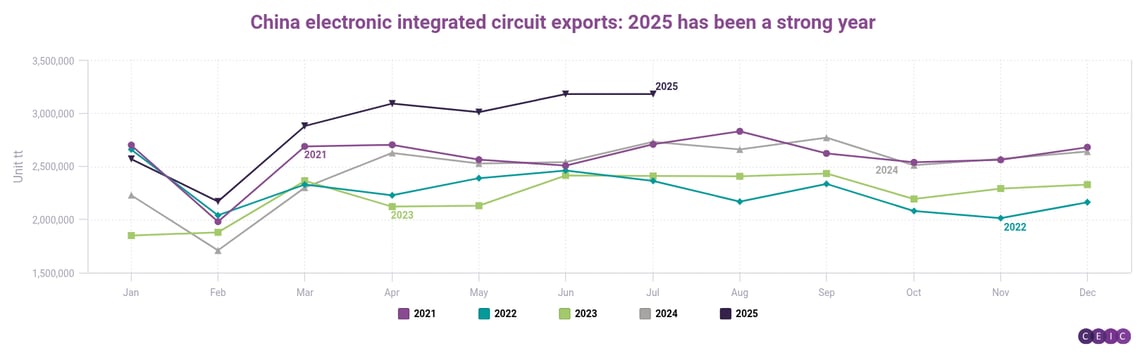

We've also created some charts on the reverse of this trading relationship: China's own semiconductor exports to the US.

Our second chart looks at these exports in absolute value and market-share terms (as measured by the Harmonized System codes for "semiconductor devices," which include components, and "electronic integrated circuits," i.e. chips).

![]()

The first Trump term stands out as an era where shipments in both categories were both much lower than they were in the Obama years. The Biden term (which included the CHIPS act, bolstering onshoring of chips to US manufacturing hubs) saw Chinese exports rise in absolute value terms, though their share of the US market remained much lower than in the pre-Trump years.

![]()

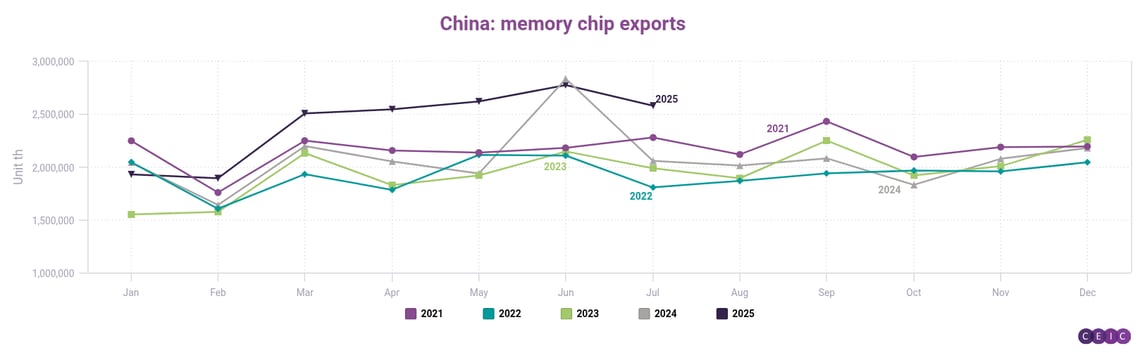

Our further charts explore even more granular measures of China's semiconductor exports, breaking down value, price and categories such as memory chips and processors.

If you are a CEIC user, access the story here.

If you are not a CEIC client, explore how we can assist you in generating alpha by registering for a trial of our product: https://hubs.la/Q02f5lQh0

CEICData.com © 2024 Copyright All Rights Reserved