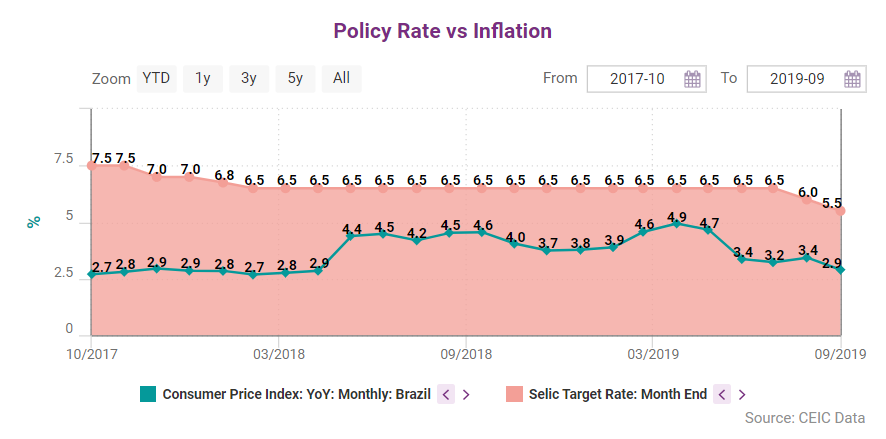

The Brazilian Central Bank's Monetary Policy Committee (Copom) cut the SELIC rate by 50 bp to a record low 6% in September 2019.

Although sharper than expected, the cut comes in harmony with other rate adjustments around the globe - the Fed’s 25-bp cut in July and the Chilean central bank’s 50-bp cut in June among others.

COPOM’s decision reflects the central bank’s confidential stance and many analysts expect a further cut of the SELIC to a historically low 5% by the end of the year.

Inflation by sector

The rate drop comes in an environment of downward trending inflation, which reached a 2019-low of 3.22% in July, decreasing significantly from a high of 4.94% in April. The fall below the 4.25% target for 2019 allowed a more dovish stance on behalf of the central bank and COPOM did not hesitate to explore this window of opportunity.

The plunge in inflation comes as a consequence of the sharp decrease in prices in essential sectors - food & beverage inflation fell to 4.12% in July from 6.73% in March, while the housing price index dropped to 3.49% from 6.11% in the same period. On the supply side, producer price indices trended downwards as well after the mid-2018 hike, down to 0.35% and 1.32% in manufacturing and industry, respectively.

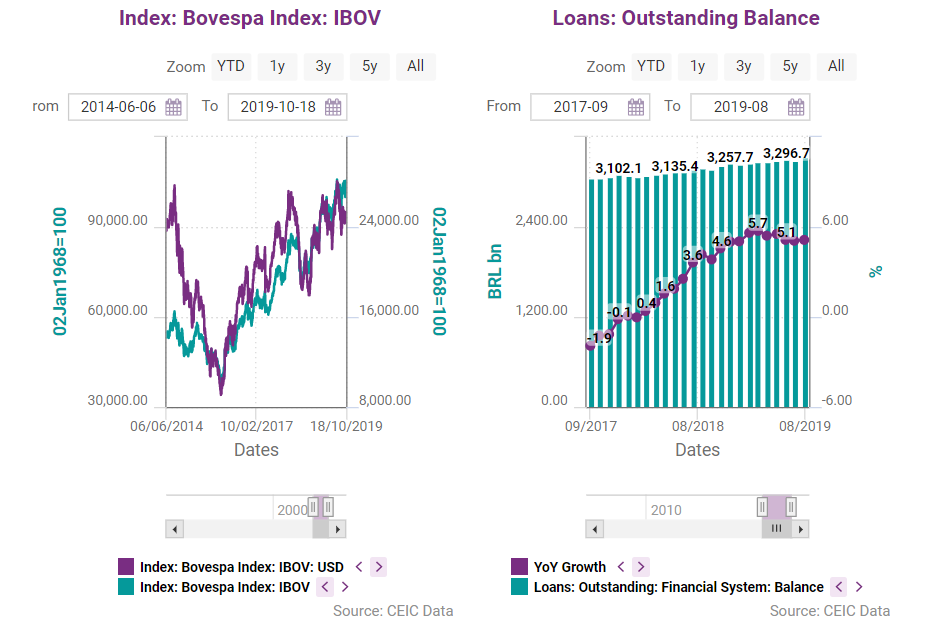

Stock exchange

The Sao Paulo stock exchange benchmark index BOVESPA gained some ground in 2019, up to 101,134.61 in August from 97,393.7 in January 2019. Government securities demand remained robust as the 10-year government bond yield kept trending downwards in 2019 to reach 7.38% at the end of August from 9.26% at the end of 2018.

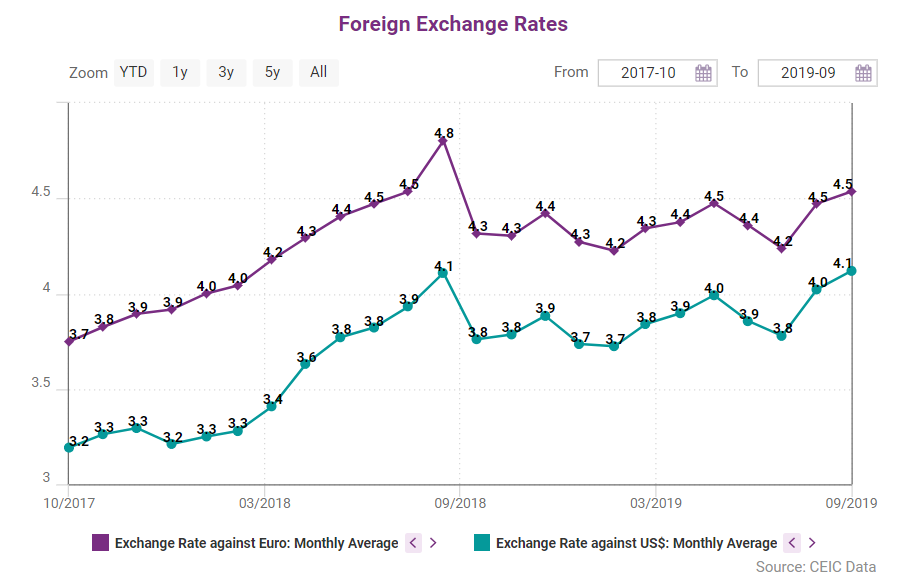

Foreign exchange rates

Although the Brazilian real gained on the US dollar in Q2, it subsequently felt the impact of the SELIC rate cut and depreciated significantly in August, trading at 4.14 USD/BRL at the end of the month. Given the expected additional cuts in the months to come, the real’s further depreciation against the US dollar depends on the outcome of the Fed’s next meeting, where the board will convene under pressure for more cuts on behalf of President Trump.

A similar trend was recorded by the Brazilian real exchange rate against the Euro – the real traded at 4.38 EUR/BRL in the beginning of 2019 and appreciated to 4.22 EUR/BRL at the end of July, though after the rate cut it lost some ground, trading at 4.55 EUR/BRL at the end of August.

The full CEIC Brazil Economy in a Snapshot Q3 2019 can be found in the Q3 CEIC Reports suite.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)

.png)