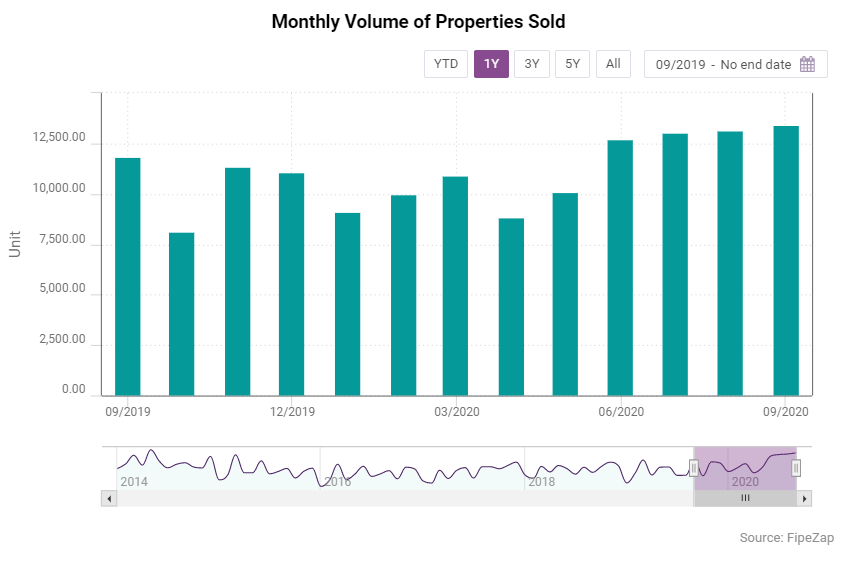

The COVID-19 outbreak is reshaping the real estate market in Brazil. People who were once attracted to big cities are now looking at opportunities far from the busy urban conglomerates. A total of 13,438 properties were sold in Brazil in September 2020, the best monthly sales performance since 2014.

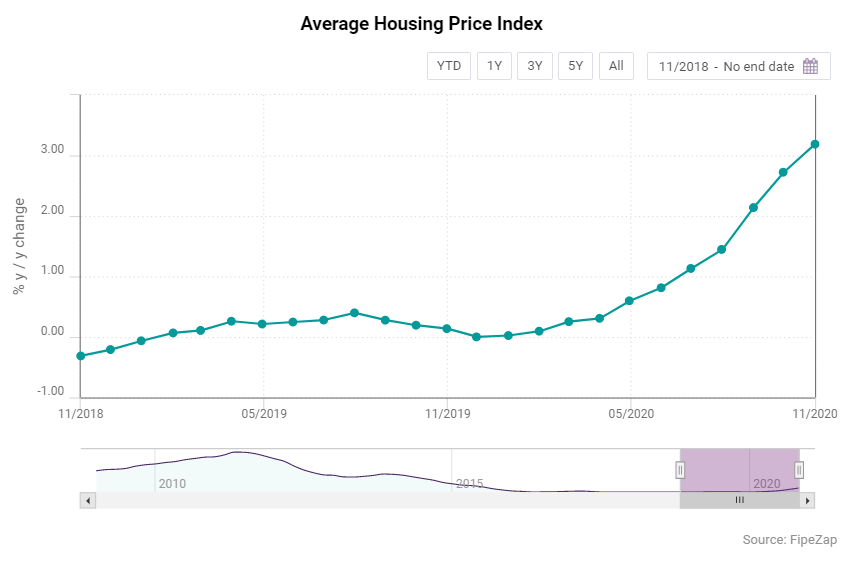

Rising demand translated into growing prices and the Fipe-Zap index posted a 3.2% y / y growth in October 2020 to 133.29 points, the biggest increase since 2008. The Fipe-Zap index is a joint initiative of the Zap Imoveis platform and the University of Sao Paulo's Economic Research Institute Foundation (Fipe).

These optimistic figures contrast with the country's bleak economic performance. As of September 2020, the unemployment level reached 14.6%. Further, 50.5% of the total population did not have an occupation in June 2020. In 2019 almost two-thirds of the workers in Brazil were employed in the services sector , whose output dropped by 9.7% y / y in the second quarter of 2020 Moreover, the Focus Survey by the Central Bank of Brazil (BCB) suggests that the GDP will contract by 4.8% in 2020.

However, economic uncertainty did not seem to be a hurdle to changes in consumer preferences. According to real estate start-up Newcore, the demand for properties in the upscale downtown neighborhoods in the city of Sao Paulo dropped by half during the pandemic and accounted for a mere 2.7% of the firm's overall property demand in May 2020. From May until September, the number of people working remotely in Brazil stood at an average of 8.5mn, a lifestyle shift that prompted people to reconsider their living and working space preferences. A joint survey of human resources firm Talenses and business school Fundacao Dom Cabral showed that seven out of 10 professionals considered their productivity “very high” while working remotely and 74% pointed out that the number of activities they are involved in were higher as of August 2020.

Shifting Preferences

As people seek to find a balance between work and personal life under the new remote working scenario, property rental and purchase preferences underwent a significant shift. Larger rooms and an adequate space for setting up a home office became crucial features of the most sought after properties. Consumers started to look for bigger houses and apartments away from the cities, as the prices of properties further from the urban clusters were significantly lower. Quinto Andar, a Brazilian housing start-up, observed a 67% increase in the search for four-bedroom properties between April and May 2020, while demand for apartments with up to three bedrooms rose by 6% during that period. Demand for houses, especially those located in gated communities, also increased by 76%.

Location preferences also changed. Urban conglomerates are a more risky environment during a virus outbreak, so people started looking for countryside properties. According to Zap Imoveis, demand for residences in cities 100 km away from the metropolitan area of Sao Paulo increased by 340% in the first half of 2020. The search for houses in condominiums, villas or farmsteads represented 0.5% of the total on the platform in January, but in May this share rose to 2.2%. Municipalities in the countryside were also favored due to the already visible results of investment in infrastructure and tax incentives.

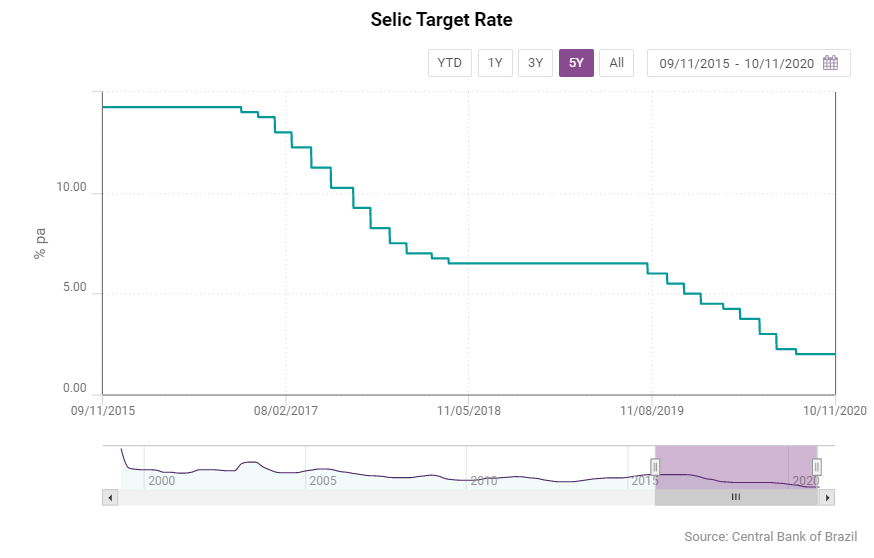

Low interest rates are the best economic explanation for this real estate phenomenon.Brazil used to have very high real interest rate, as the basic rate SELIC peaked at 25.5% in the first quarter of 2002.

The successful management of the inflation targeting program, the accumulation of foreign reserves during the commodities boom, and other institutional developments, allowed the central bank to follow a consistent policy of interest rate reduction. From 2017 on, the Selic rate was reduced by 12.25 pp to reach 2% per year in October 2020, the lowest level ever.

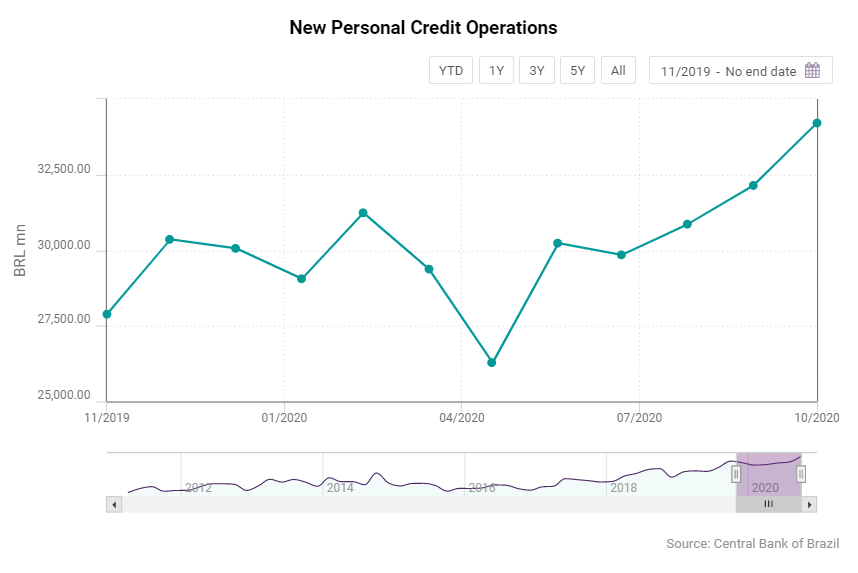

Lower Rates Boosted Demand for Credit

The downward trend in interest rates boosted demand for housing credits and banks viewed the segment as a means to keep lending activity at a reasonable level against the background of an overall contraction in demand. In this sense, the new consumer loans dropped by 10.5% m / m in May to BRL 26.3bn, while the vehicle financing operations reported a 49.9% m / m fall in April. Banks' financial performance was threatened not only by the subdued domestic activity, but also by the fear of increase in default levels, both for consumers and companies. Brazil's largest private banks Bradesco, Itau and Santander announced aggressive capital contingency plans for the year. Itau's balance sheet for the third quarter of 2020 included a BRL 243bn provision for non-performing loans, up 79.5% y/y.

Home loans are historically a safe harbour for banks. Brazil's housing deficit was estimated at 7.7mn units in 2017, mainly concentrated in the metropolitan area of Sao Paulo, where people living in deteriorated premises totalled 1.2mn in that year. A joint survey of the Brazilian Association of Real Estate Developers (ABRAINC) and business school Fundacao Getulio Vargas (FGV) found out that the rental burden over household income reached 42% in 2017 compared to 24.2% in 2008. In the Southeast, at least 1.5mn households were under rental burden stress. The situation will deteriorate for tenants in the short run, since the General Price Index (IGP-M), the main index for updating rental contracts, is expected to end 2020 at 20% higher compared to 2019, FGV estimates. This encourages Brazilians to prioritize mortgage payments, as they want to avoid rental contracts volatility, which ultimately leads to low default rates on home loans. In September 2020, BCB reported an average home equity loan default rate of 3.2.

Santander was the first bank to offer more affordable rates for housing loans. Late in May, the bank started advertising a 30-year loan with a flat rate of 6.99% per year. The rate was closer to those charged by public banks, the historical leaders of the segment. Itau followed suit in July, by offering housing credits at a composite rate of 3.99% per year, supplemented by the variation of savings interest rate, which follows the Selic dynamic. The combination of these actions resulted in a 25.4% y / y growth in housing loans at market rates in September 2020.

Sign in to read the full data analysis here. You may also be interested in downloading our comprehensive analysis of Brazil's economy with the CEIC Brazil Economy in a Snapshot Q3 2020 Report.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)