The Brazilian economy grew by just 0.45% y/y in Q1 2019, decelerating from 1.12% y/y in the previous quarter.

Seasonally-adjusted q/q values revealed a 0.2% drop from the 0.1% growth in the previous period, marking the first such development since the end of recession-ridden 2016. In 2018, the economy maintained a moderate real growth of 1.12%, slightly improving from 1.06% in 2017.Consumption expenditure

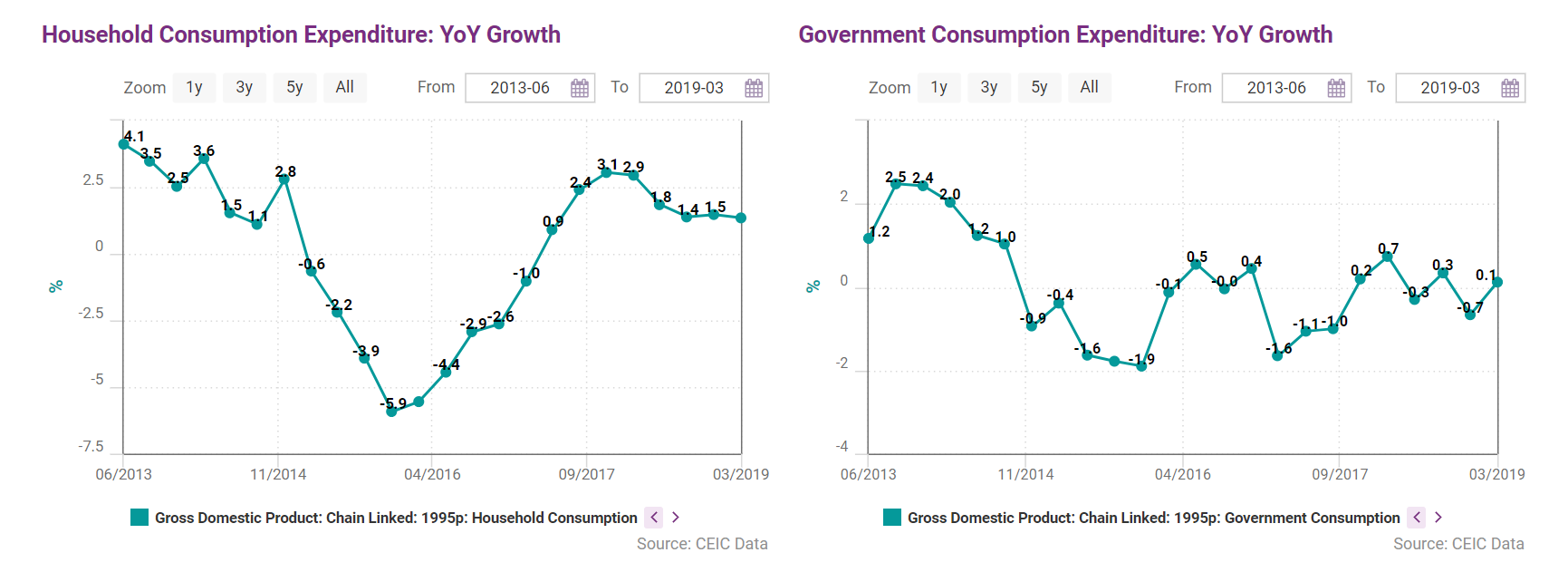

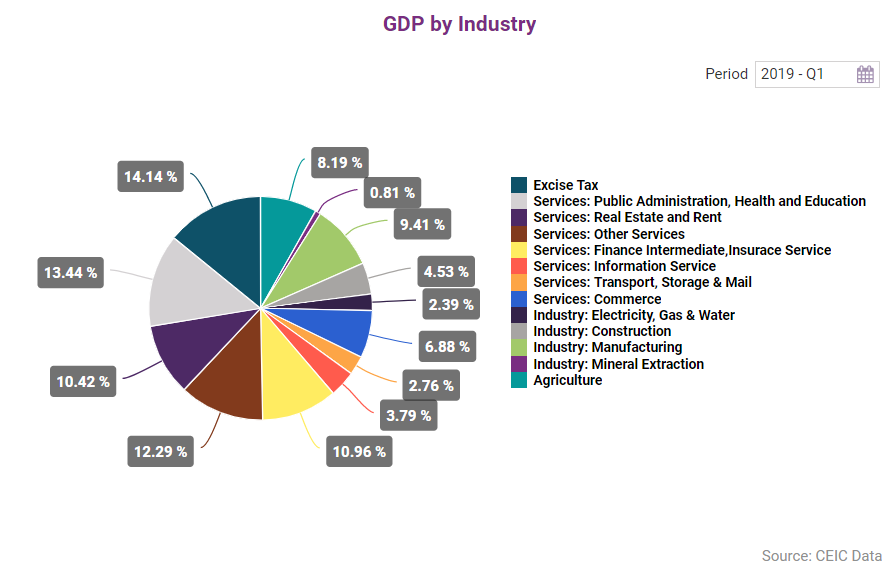

Private consumption, investment and external trade have been the core engines of economic growth in 2018. Household consumption grew by 1.9% in 2018, accelerating from 1.3% in 2017. The first quarter of 2019 began less favourably, however, with these key drivers losing steam q/q, either decreasing or accelerating by less than 1% and essentially mitigating the new administration’s positive expectations for 2019. Economic activity is dominated by the service sector, comprising commercial business, real estate, public administration, and healthcare services. In particular, real estate activities increased by 3.38% y/y in Q4 2018, reaching a record high since 2013. Data for Q1 2019 revealed a 0.7% q/q dip in real estate activities but in y/y terms the sector increased by a further 3%.

GDP by Industry

Although manufacturing output showed signs of recovery in late 2018, the January-May 2019 data revealed a renewed deterioration. The shrinking output had been offset by improving mineral extraction until the deadly January collapse of a mining dam owned by Brazilian company Vale. The resulting crisis had a big negative impact on Brazilian mineral production and led to a drop in the purchasing manager indices (PMI) of both manufacturing and services, which had been rising robustly above the breakeven level of 50 points until February. The May values of the headline manufacturing PMI decelerated to 50.2, dangerously close to mid-2018 levels.

Retail sales continued to expand in value terms by 6.21% y/y in Q4 2018 and by 4.76% in the whole of 2018, compared to 2.72% in 2017. The main growth drivers were the sales of food and beverages, personal appliances, and cosmetics and healthcare products. Retail sales value lost some steam in Q1 2019 but continued to be solid, increasing by 5.7% y/y in March.

Labour market and consumer confidence

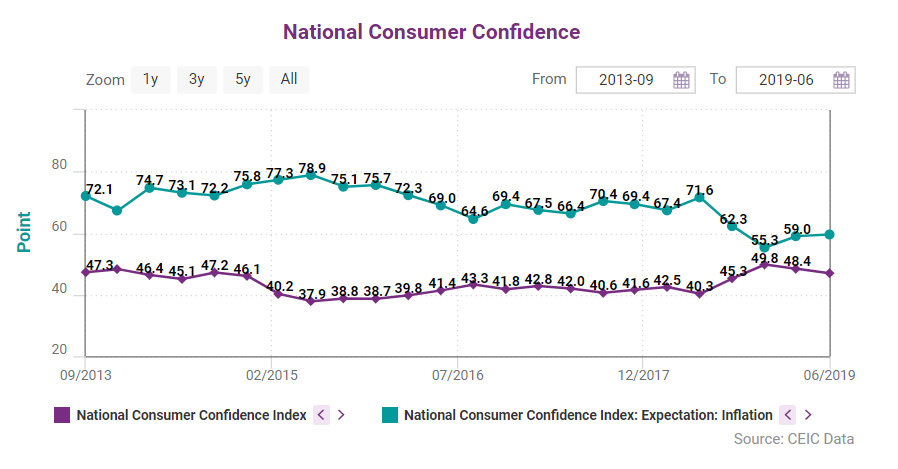

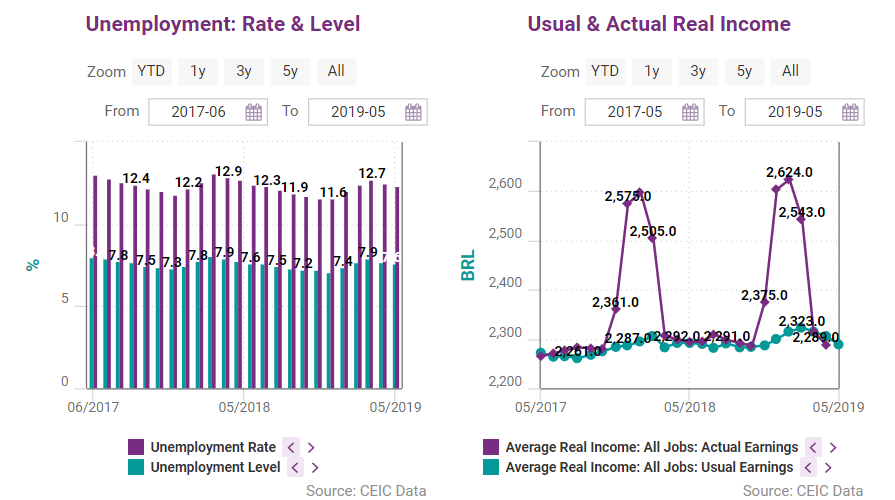

The upbeat retail sales corresponded to a stronger labour market and consumer confidence index. The headline non-seasonally adjusted unemployment rate was at an annual average of 12.26% in 2018, slightly decreasing from 2017. The rate accelerated again at the beginning of 2019 only to start dropping in April, mirroring the standard seasonal dynamics of Brazilian employment. The 12.5% unemployment rate in April can be seen as a small improvement from the 12.9% a year earlier. The consumer confidence index has been accelerating from 40.3 in June 2018 to 49.8 in December 2018, the highest in five years. The first quarter of 2019 revealed a slight drop to 48.4 but consumer confidence still remains strong and would be boosted by a further decrease in unemployment.

You can download the full CEIC Brazil Economy in a Snapshot Q2 2019 report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)