President Bolsonaro’s government had a positive impact on Brazil’s fiscal sector towards the back end of 2019.

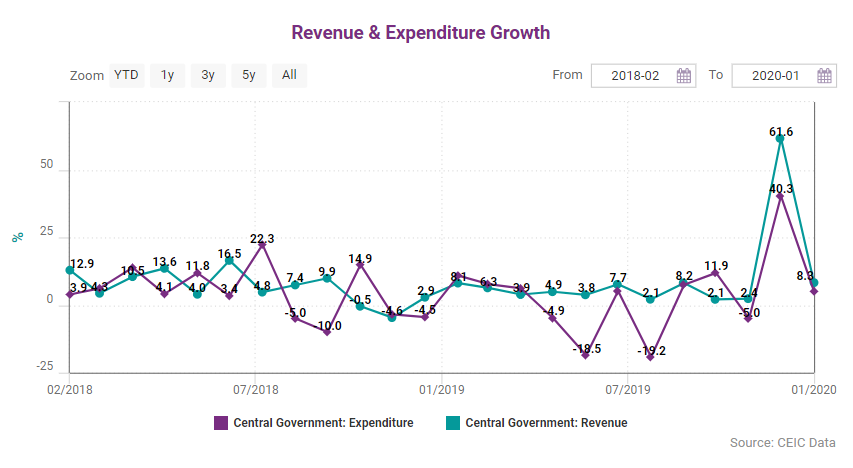

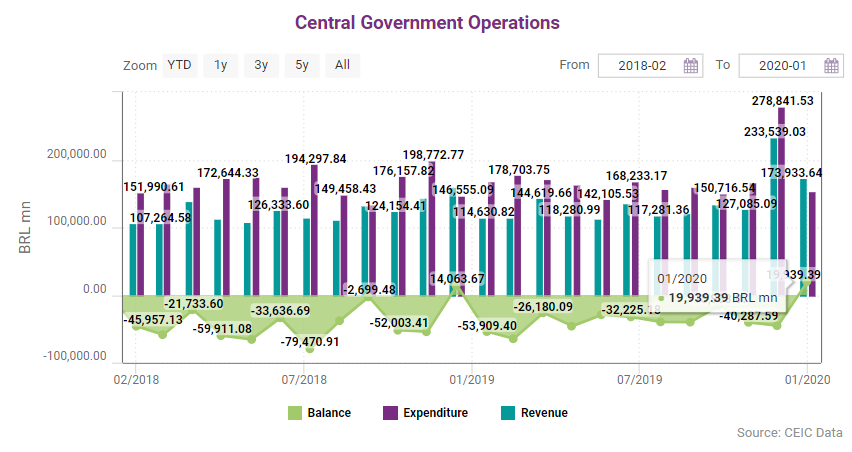

The fiscal deficit narrowed down to 5.96% of GDP in Q3, the lowest figure since Q4 2014. It is a significant improvement from the Q1 and Q2 figures when the deficit stood at 7.35% and 6.61%, respectively. In line with economy minister Paulo Guedes’ liberal agenda, public expenditure growth exceeded that of revenues in only one month out of six months in the period June-November 2019.

Central government revenue rose by 2.36% y/y to BRL 127.1bn in November, whereas public spending contracted by 5.04% y/y to BRL 167.3bn in the same period. Consequently, the central government fiscal deficit stood at BRL 40.2bn.

Fiscal health is expected to further improve as the Congress finally passed the long-awaited pension reform. The pension reform bill is aimed at cutting social security costs, which now stand at 13% of GDP, while other G-20 countries spend just 8% on average. The plan is foreseen to generate savings of around USD 300bn, which could be used to reduce the country’s high government debt. Moreover, its expansionary effect could be strengthened by a tax simplification reform that involves aggregating five different taxes into one VAT. The reform is expected to be approved in 2020.

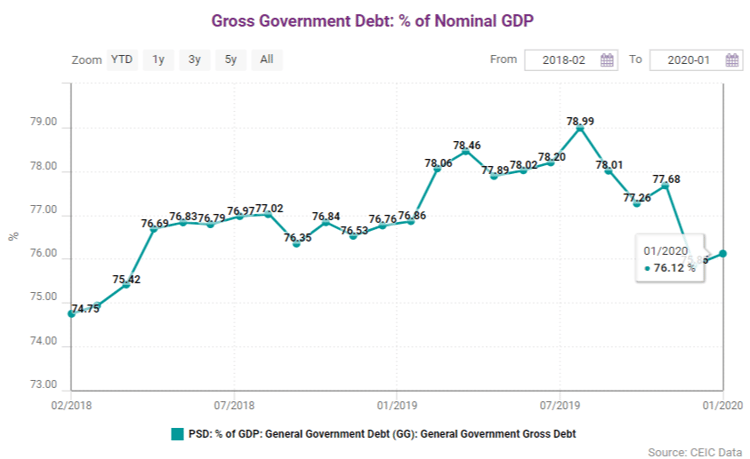

Due to severe fiscal imbalances, gross public debt reached a historic high of 78.99% of GDP in August. During the following months the figure slipped marginally to 77.65% of GDP in November. A significant fraction of the debt comes on the back of increased borrowing to support the activities of an unsustainable amount of state-owned enterprises (134 as of January 2019).

The current governmental policy’s aim is to narrow down the debt to a more sustainable level. The dovish monetary policy will ease the task as the interest on debt repayments decreased with the Selic rate cuts. Recent advancements towards fiscal consolidation motivated the rating agency S&P to revise the outlook on Brazil to positive from stable.

The revision came as a consequence of the pension reform as well as expected progress on fiscal and growth measures. Amid an accommodative monetary policy, the yield on 10-year government bonds has been gradually declining. The rate of return on government securities dropped to a 2019 low of 6.34% in October, but increased to 6.81% in November and remained unchanged in December.

Access our Q4 report suite, including the full CEIC Brazil Economy in a Snapshot Q4 2019 Report here.

.png?width=160&name=ceic-logo-Vector%20logo%20no%20tagline%20(002).png)

.jpg)